If we follow the logic and evidence presented in these seven points, we are forced to conclude that the fractures in France, Germany and the EU are widening by the day. When is a nation-state no longer a functional state? It’s an interesting question to ask of the European nation-states trapped in the devolving European Union. Longtime correspondent Mark G. recently posed seven indicators of dissolving national...

Read More »Financial watchdog pushes for upgrade of cyber defence

So far, Switzerland’s financial sector has escaped major cyber attacks unscathed according to the watchdog unit. The chief executive of the Swiss financial watchdog, Mark Branson, has called for the creation of a national cyber defence centre. In an interview with the SonntagsZeitung newspaper, Branson reiterated that Switzerland was lagging on safety standards behind other financial centres. Both the awareness and the...

Read More »The Death of a Business Cycle

How do business cycles end? In the US, conventional wisdom is that they are murdered by the Federal Reserve. It is too slow to raise rates and then goes too quickly. This view is espoused by numerous well-respected economists and policymakers. President Trump’s criticism of the Federal Reserve is anchored by such views. America’s ambivalence toward a central bank is around 200-year old. It was the Panic of 1893 that...

Read More »FX Daily, January 16: Markets are Eerily Calm

Swiss Franc The Euro has risen by 0.14% at 1.1286 EUR/CHF and USD/CHF, January 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is an eerie calm over in the capital market through the European morning today despite some ostensibly worrisome developments. While many, like ourselves, expect UK Prime Minister May to survive a vote of confidence, it hardly...

Read More »SNB Grants Fintechs Access to SIC

In a press release the Swiss National Bank explains that it grants access to … [fintechs] that make a significant contribution to the fulfilment of the SNB’s statutory tasks, and whose admission does not pose any major risks. Entities with fintech licences whose business model makes them significant participants in the area of Swiss franc payment transactions will therefore be granted access to the SIC system and to...

Read More »SIHH watch fair opens in Geneva

Time to say good buy? Visitors at the SIHH last year The Salon International de la Haute Horlogerie (SIHH) has opened in Geneva with 35 watch brands showing off their wares. SIHHexternal link will run until Thursday, when it is open to the public, who must register and pay CHF70 ($71.20) in advance. It is the first watch fair of the year and important in terms of setting trends, particularly in the luxury segment. A...

Read More »Cool Video: Brexit–Now What?

Marc Chandler, Wilf Frost, and Sara Eisen on the CNBC - Click to enlarge I joined Wilf Frost, and Sara Eisen on the CNBC set at the NYSE shortly after the House of Commons delivered an unprecedented defeat to UK Prime Minister May. Catherine Mann (Citi) and Christopher Smart (Barings). The guests generally agreed that a delay in Brexit was likely. Here is a distillation of my thoughts. Not all made into the video clip...

Read More »Insight Japan

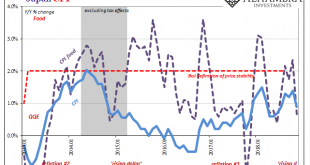

As I wrote yesterday, “In the West, consumer prices overall are pushed around by oil. In the East, by food.” In neither case is inflation buoyed by “money printing.” Central banks both West and East are doing things, of course, but none of them amount to increasing the effective supply of money. Failure of inflation, more so economy, the predictable cost. In yesterday’s article the topic in the East was China. Today,...

Read More »FX Daily, January 15: New Phase Begins with UK Vote

Swiss Franc The Euro has risen by 0.17% at 1.1272 EUR/CHF and USD/CHF, January 15(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Several of the equity benchmarks are flirting with six-week highs, including MSCI Asia Pacific Index and the Emerging Markets Index. The Dow Jones Stoxx 600 is trying to extend its advancing streak for a third week, something not...

Read More »Former US interior secretary lands first job since stepping down

Zinke’s new employer invests in fintech, blockchain, cyber security and energy projects. Former United States interior secretary Ryan Zinke has landed his first job since leaving the Trump administration two weeks ago. Zinke has joined investment company Artillery One as managing director, swissinfo.ch has learned. Zinke ended his nearly two-year stint as US Secretary of the Interior at the beginning of this year...

Read More » SNB & CHF

SNB & CHF