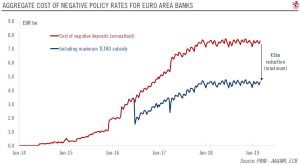

ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves.

Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020.

Despite nearly four years of asset purchases and five years of negative rates, the downside risks to growth and inflation still dominant. Mario Draghi himself ruled out a tiered reserve system in March 2016 “exactly for the purpose of not signalling that we can go as low as we want on this”. We cannot

Articles by Frederik Ducrozet

ECB Forward Guidance: the Devil is in the Detail

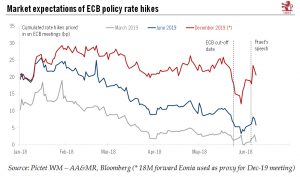

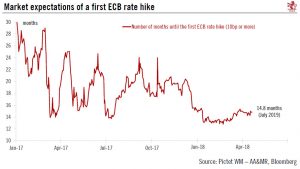

March 14, 2019Following the changes to its forward guidance, we have revised our forecast for ECB policy rates.

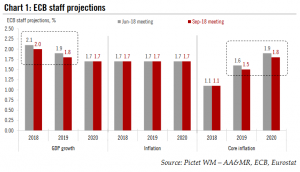

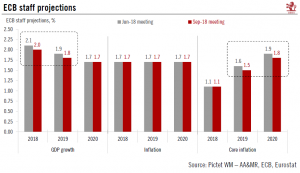

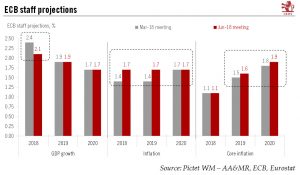

Last week, the European Central Bank (ECB) announced a new long-term refinancing package for banks (called TLTRO-III) and made clear that interest rates would not be raised this year. While these measures were expected, they have come earlier than we thought. We were also taken aback by the extent of the downside revisions to the ECB’s inflation and growth projections and ECB President Draghi‘s overall dovishness.

We have revised our scenario accordingly and now expect a 15bp deposit rate hike in March 2020, followed by a 25bp hike in the deposit and refi rates in September 2020. The former would be a technical rate hike

A successful bank should be boring

September 14, 2018The main risk facing ECB watchers is that the next few meetings of the Governing Council will be increasingly boring and predictable. However, from the central bankers’ perspective, this may considered a sign of success, “like a referee whose success is judged by how little his or her decisions intrude into the game itself”, to quote former BoE Governor Mervyn King.

Back to the economy, downside risks stemming from protectionism, emerging markets and financial volatility are still firmly on the ECB’s radar, having“ gained more prominence recently ”. But, crucially, staff projections were little changed over the medium term and, on balance, risks to economic growth were still assessed as “broadly balanced”, helping

A successful bank should be boring

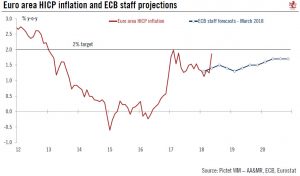

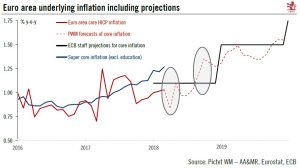

September 13, 2018No changes to the ECB’s monetary stance and policy guidance mean we are holding to our forecasts for quantitative easing and rate hikes.The ECB made no change to its monetary stance and policy guidance at its 13 September meeting. The end of quantitative easing (QE) was confirmed for after December, following a final reduction in the pace of net asset purchases to EUR15bn per month in Q4 2018.Much of the focus was on the updated ECB staff projections. In the end, downward revisions were minimal, leaving the medium-term outlook unchanged, including the all-important 2020 core inflation projection at 1.9%, despite lower oil prices and a stronger currency.Euro area real GDP growth was revised marginally lower, from 2.1% to 2.0% in 2018, and from 1.9% to 1.8% in 2018. This is lower than the

Read More »Peak headline inflation for the euro area?

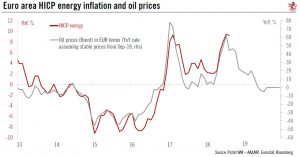

August 31, 2018Latest inflation report came in on the softer side of expectations, but changes in headline inflation are likely to gain importance as we move closer to policy normalisation.Although the European Central Bank’s (ECB) mandate is defined in terms of headline inflation (targeting an annual rate of “below, but close to 2%” over the medium-term), over the past few years, the central bank has been mainly focused on underlying consumer price dynamics, including core inflation. Looking forward, there are reasons to believe that changes in headline inflation will gain importance as we move closer to policy normalisation. In particular, there is evidence that the pick-up in wage growth, which is fuelling the ECB’s optimism over the medium-term outlook for price stability, has been driven by higher

Read More »Euro area PMIs: still little good news below the surface

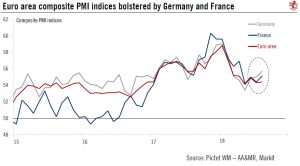

August 24, 2018We see little evidence of a rebound in business taking shape, reinforcing our revised 2018 GDP growth forecast.Although euro area flash PMI indices were roughly in line with expectations in August, some details were less positive than the headline numbers, suggesting that downside risks have not yet disappeared. True, at face value, the small rise in the euro area composite PMI index, from 54.3 in July to 54.4 in August, is consistent with resilient real GDP growth, close to the 0.4% q-o-q pace recorded in Q2. But, the change in PMI sub-components across countries and sectors was less encouraging.First, the relatively larger rebound in French and German indices (+0.7 point on average in August) implied renewed weakness in the periphery, with Markit indicating that future business

Read More »Euro Area PMIs: Still Little Good News Below the Surface

August 24, 2018We see little evidence of a rebound in business taking shape, reinforcing our revised 2018 GDP growth forecast.

Although euro area flash PMI indices were roughly in line with expectations in August, some details were less positive than the headline numbers, suggesting that downside risks have not yet disappeared. True, at face value, the small rise in the euro area composite PMI index, from 54.3 in July to 54.4 in August, is consistent with resilient real GDP growth, close to the 0.4% q-o-q pace recorded in Q2. But, the change in PMI sub-components across countries and sectors was less encouraging.

First, the relatively larger rebound in French and German indices (+0.7 point on average in August) implied renewed

Europe chart of the week – Turkey

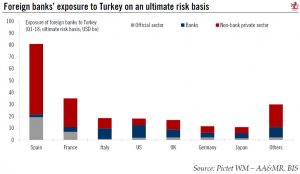

August 10, 2018European banks’ exposure to Turkey looks non-systemic and manageable overall, although a number of indirect effects could amplify the eventual losses.The rapid depreciation of the Turkish Lira is raising concerns at the European Central Bank over European banks’ exposure to Turkey, according to recent press reports. Data from the Bank of International Settlements (BIS) show that the total exposure of foreign banks to Turkish assets was USD223 bn in Q1 2018, on an ultimate risk basis (net of risk transfers). European banks excluding the UK accounted for USD150 bn, or two-thirds of total foreign exposure, largely attributable to Spanish, Italian and French stakes in various subsidiary banks in Turkey.Banks’ exposure represents the most obvious risk of contagion to Europe. In absolute terms,

Read More »Europe chart of the week – UK households

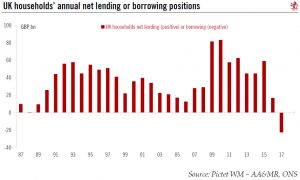

August 3, 2018ONS data suggest that UK households lived beyond their means in 2017 as they became net borrowers for the first time in nearly 30 years.The latest UK sectoral accounts from the Office for National Statistics (ONS) has received considerable attention over the past few days as it shows UK households’ outgoings surpassed their income in 2017 for the first time in nearly 30 years. The ONS noted that, on average, each UK household spent or invested around GBP 900 more than it received in income in 2017, or GBP 23 bn for the country as a whole. Detailed financial accounts revealed that to fund this shortfall, UK households borrowed more, including around GBP 80 bn in bank loans last year (the highest amount in ten years) and saved less, depositing just GBP 37 bn with UK banks (the lowest amount

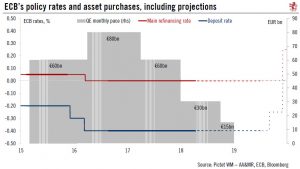

Read More »ECB: the end of constructive ambiguity

June 14, 2018The ECB provides a pretty clear signal that quantitative easing will be wound up at the end of this year, with a first rate hike coming in 2H 19.Based on its upgraded assessment of the inflation outlook, the ECB delivered the QE tapering that the market expected, signalling the end of net asset purchases in December 2018 following a final three-month extension of EUR15bn per month. Importantly, today’s decision is flexible and conditional, “subject to incoming data” confirming the inflation outlook. Still, the bar for change looks very high. Economic data would need to deteriorate materially between now and September for the ECB to reverse its tapering decision.The most surprising element of today’s decision was that the ECB effectively ruled out a rate hike in H1 2019 using an ‘Odyssean’

Read More »ECB gets ready to make the leap

June 12, 2018The ECB has had essentially two options going into the June meeting: either a dovish decision but a hawkish communication (hinting at an imminent QE tapering), or a hawkish decision but a dovish communication (counterb alancing a tapering announcement with dovish sweeteners).

Ever since economic indicators have started to deteriorate this year and risks to global trade have accumulated, ECB rhetoric has been overwhelmingly consistent with the first option including a postponement of a QE decision to the 26 July meeting. This would have allowed the ECB to reassess the situation on the basis of additional data releases, including two PMI reports.

This week’s speech by the ECB’s chief economist, Peter Praet, was a game

Europe chart of the week-German new orders

June 11, 2018This is not what we ordered!

German factory orders collapsed in April, suggesting that the economic slowdown could extend into Q2.

The underlying pace of domestic demand expansion looks more resilient. The main downside risks relate to net exports, in our view.

Still, the most recent data releases have not been fully consistent with the ECB’s “hawkish moderation” scenario. A rebound in soft and hard data will be needed over the next few months for the ECB ’s exit strategy to remain on track.

German new orders were weak across the board in April, contracting for a fourth consecutive month and by a larger-than-expected 2.5% m-o-m following a downwardly-revised 1.1% drop in March. As a result, total manufacturing

Read More »Europe chart of the week—German new orders

June 8, 2018This is not what we ordered!German new orders were weak across the board in April, contracting for a fourth consecutive month and by a larger-than-expected 2.5% m-o-m following a downwardly-revised 1.1% drop in March. As a result, total manufacturing orders are off to an extremely weak start in Q2 (-3.3% q-o-q after -2.2% q-o-q in Q1). What is more, the decline in demand for German goods in April was fairly broad-based across countries and sectors.Beneath the surface of horrible headline numbers, however, some details looked more resilient, especially core domestic orders of capital and durable goods (excluding big-ticket items). Intermediate goods orders were weakest of all, possibly linked to the accumulation of large inventories in 2017. Moreover, the choice of the seasonal adjustment

Read More »ECB gets ready to make the leap

June 8, 2018An announcement on quantitative easing is looking likely as early as next week. But the jury is out on what the central bank will actually say.Peter Praet’s hawkish comments on inflation this week did not surprise us in terms of substance but did in terms of timing. The view of the (usually dovish) ECB chief economist carries significant weight, and therefore an announcement on QE is now likely at the 14 June meeting.We expect the staff projections to be revised lower in terms of GDP growth, albeit not dramatically so, but higher in terms of headline inflation, thanks to oil. Headline inflation that is rising towards 1.8% by 2020 would provide the Governing Council with the necessary ammunition to make a tapering announcement.However, it remains to be seen how far the ECB will go. We do

Read More »Euro area inflation close to ECB target in May

June 3, 2018Euro Area HICP

Today’s release of euro area flash HICP surprised to the upside both in terms of headline inflation (which surged from 1.2% to 1.9% y-o-y in May, above consensus expectations of 1.6%) and, crucially, in terms of core inflation (HICP excluding energy, food, alcohol and tobacco rose from 0.7% to 1.1%).

This sharp rebound in inflation will provide the ECB with a critical input for its looming decision on QE (which we still expect to be delayed to July). First, although the May HICP report cannot yet be described as a genuinely clean picture of underlying inflation, it is reasonable to assume that a large part of the volatility induced by transitory factors and the timing of Easter has faded. At 1.1%

Euro area inflation close to ECB target in May

May 31, 2018Latest figures may increase the ECB’s confidence that inflation will get to 2% in the medium term, but its gradualist approach to policy normalisation should continue.At 1.9% in May, euro area headline inflation is back close to the ECB’s target of 2%. Importantly, it was not only energy and food prices that pushed inflation higher, but also core consumer prices (up 1.1% y-o-y).Looking ahead, headline inflation is likely to remain close to 2% for most of the rest of the year. Core inflation is expected to hover around 1% before stronger base effects and a narrowing of the output gap provide another push higher in Q4 2018, to around 1.3-1.4%. On a forward-looking basis, the ECB is likely to conclude that we are getting closer to a sustained adjustment in inflation that is a necessary

Read More »Europe chart of the week – wage growth

May 25, 2018Euro area wage growth rose in the first quarter of the year, reinforcing our view that the ECB will end QE in December.For all the noise about Italian politics and the loss of economic momentum in the euro area, this week also brought some reassuring news that underlying inflationary pressure is gradually building. The ECB’s data series of euro area negotiated wages rose to a five-year high of 1.9% y-o-y in Q1 2018. The compensation per employee series, which the ECB staff is using as their benchmark for wage growth in their projections, is not yet available for Q1 but at 1.8% y-o-y in Q4 2017, it has risen to multi-year highs as well.These developments are all the more encouraging as they pre-date the latest German wage deals which for the most part will start showing up in wage growth

Read More »ECB: contingency plans

May 25, 2018A look at different scenarios for the ECB’s exit from quantitative easing and its expected rate hiking cycle.

Our baseline scenario for ECB normalisation still holds. We expect QE to end in December 2018 and a first rate hike in September 2019. The ECB is likely to wait until its 26 July meeting to make its decisions on QE and forward guidance.

Still, downside risks have risen to the point where another open-ended QE extension can no longer be ruled out, albeit at a slower pace, in order to postpone rate hike expectations.

If those risks were to materialise, we would expect the ECB to announce a six-month QE extension at a EUR15bn pace, using the programme’s flexibility in order to reduce the share of central

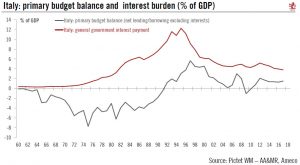

Europe chart of the week – Italy’s fiscal buffers

May 18, 2018The incoming government’s fiscal plans could result in a sharp deterioration of Italy’s public finances. However, broader fiscal metrics are better than they were during the euro sovereign crisis.

The M5S-League coalition has committed to a significant degree of fiscal easing and to the reversal of some structural reforms. Such policies will put Italy on course for confrontation with Brussels over deficit reduction targets, although at this stage we still expect negotiations to result in compromises.

For all the political and economic risks facing Italy, the difference in macro fundamentals between the situation today and the 2011 sovereign debt crisis cannot be stressed often enough. Italy has managed to run a

Europe chart of the week – Italy’s fiscal buffers

May 18, 2018The incoming government’s fiscal plans could result in a sharp deterioration of Italy’s public finances. However, broader fiscal metrics are better than they were during the euro sovereign crisis.The M5S-League coalition has committed to a significant degree of fiscal easing and to the reversal of some structural reforms. Such policies will put Italy on course for confrontation with Brussels over deficit reduction targets, although at this stage we still expect negotiations to result in compromises.For all the political and economic risks facing Italy, the difference in macro fundamentals between the situation today and the 2011 sovereign debt crisis cannot be stressed often enough. Italy has managed to run a primary surplus in 24 of the past 26 years, estimated at +1.5% of GDP in 2017.

Read More »Europe chart of the week – Corporate Sector Soft Patch

May 6, 2018Next week’s detailed breakdown of ECB QE monthly data will reveal a marked slowdown in the pace of corporate bonds purchases in April (Corporate Sector Purchase Programme, or CSPP). Indeed, weekly holdings data have been consistent with gross purchases of around EUR3bn in April, down from EUR5.8bn on average in Q1. There are several possible explanations for the drop in gross purchases, but redemptions are not one of them, as they amounted to just EUR87m in April.

At first sight, this drop contrasts with our view that the relative size of CSPP would rise after QE was recalibrated from EUR60bn to EUR30bn in 2018, as a way to mitigate the scarcity of core sovereign bonds. As a matter of fact, the share of CSPP in total

Europe chart of the week – Corporate Sector Soft Patch

May 4, 2018The ECB is adjusting its corporate bond purchases to take account of market conditions, including the recent fall in issuance.Next week’s detailed breakdown of ECB QE monthly data will reveal a marked slowdown in the pace of corporate bond purchases in April (Corporate Sector Purchase Programme, or CSPP). Indeed, weekly holdings data have been consistent with gross purchases of around EUR3bn in April, down from EUR5.8bn on average in Q1. There are several possible explanations for the drop in gross purchases, but redemptions are not one of them, as they amounted to just EUR87m in April.At first sight, this drop contrasts with our view that the relative size of CSPP would rise after QE was recalibrated from EUR60bn to EUR30bn in 2018, as a way to mitigate the scarcity of core sovereign

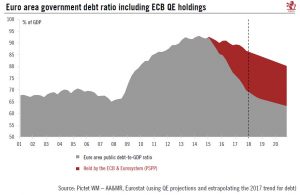

Read More »Europe chart of the week – public debt

May 3, 2018This week’s Eurostat releases revealed that public finances continue to improve in most euro area member states. As a result of falling deficits, low interest rates and stronger nominal growth, the ratio of euro area government debt to GDP fell to a six-year low of 86.7% in Q4 2017.

Although sovereign debt sustainability remains shaky in countries like Italy, it is fair to say that we have moved from self-defeating austerity to a more stable equilibrium where debt dynamics have become less sensitive to fluctuations in interest rates. ECB QE has provided a massive boost through various transmission channels, including a quasi-fiscal effect on interest expenditure in core and peripheral countries alike.

Looking at the

The ECB’s steady hand

April 28, 2018Another ECB meeting, another balanced message of confidence and prudence. Unsurprisingly, the statement mentioned the deterioration in the data flow since March, but our impression is that the ECB is largely brushing off concerns about a soft patch in the economy for the moment.

Indeed, Mario Draghi described the recent “moderation” in growth as the result of a pullback in sentiment from elevated levels, with economic expansion expected to remain solid and broad-based across countries and sectors. Moreover, “temporary factors” were said to go a long way in explaining the extent of the loss in momentum, including weather conditions, strikes, or the timing of Easter, all of which are expected to reverse. External risks

Europe chart of the week – public debt

April 27, 2018Changes in quantitative easing will have profound implications for euro area debt dynamics.This week’s Eurostat releases revealed that public finances continue to improve in most euro area member states. As a result of falling deficits, low interest rates and stronger nominal growth, the ratio of euro area government debt to GDP fell to a six-year low of 86.7% in Q4 2017.Although sovereign debt sustainability remains shaky in countries like Italy, it is fair to say that we have moved from self-defeating austerity to a more stable equilibrium where debt dynamics have become less sensitive to fluctuations in interest rates. ECB QE has provided a massive boost through various transmission channels, including a quasi-fiscal effect on interest expenditure in core and peripheral countries

Read More »The ECB’s steady hand

April 26, 2018The ECB Governing Council acknowledges “moderation” in the pace of the euro area’s recovery. It may wait until July before announcing its next policy decision.Another ECB meeting, another balanced message of confidence and prudence. Unsurprisingly, the statement today mentioned the deterioration in the data flow since March, but our impression is that the ECB is largely brushing off concerns about a soft patch in the economy for the moment.ECB president Mario Draghi said that the Governing Council did not discuss monetary policy “per se”, waiting for more hard evidence before they update their assessment of the situation. He may have lied – it happened before – but the bottom line is that upcoming data releases will therefore receive greater scrutiny. We see downside risks to April

Read More »Euro area core inflation to rise again after Easter

April 22, 2018The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a potentially larger FX pass-through. We are not too worried, as weakness in non-energy industrial goods in March was largely driven by volatile HICP components including clothing and footwear, but the ECB will be waiting for more evidence to be sure.

The release of euro area flash HICP estimate on 3 May will have the potential to shape market expectations ahead of the important June meeting.

ECB policy: Stop Worrying and Love the Soft Patch

April 21, 2018For all the talk about weaker economic momentum and low inflation in the euro area, we would not jump to conclusions in terms of ECB policy. True, downside risks have re-emerged over the past couple of months, generating understandable concerns and frustration in Frankfurt. However, the ECB is unlikely to respond unless those risks materialise, which is not our central case. If anything, the soft patch should only strengthen the case for gradualism which ECB officials have been building since the start of the year.

Although the recent data flow has helped the doves, it remains to be seen to which extent the ECB can continue to influence market expectations through communication changes. Anyone remotely following the

Euro area core inflation to rise again after Easter

April 20, 2018Euro area core inflation has been affected by a series of transitory factors in recent months, resulting in higher volatility in a number of HICP sub-components.The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a potentially larger FX pass-through. We are not too worried, as weakness in non-energy industrial goods in March was largely driven by volatile HICP components including clothing and footwear, but the ECB will be waiting for more evidence to be sure.The release of euro area flash HICP estimate on 3 May

Read More »ECB policy: Stop Worrying and Love the Soft Patch

April 20, 2018Weaker economic momentum and low inflation in the euro area is unlikely to affect ECB monetary stance.We see little incentive for the ECB to change its broad assessment of the economic situation at the 26 April meeting. The normalisation of the monetary stance will continue to be dictated by the ECB’s guiding principles of confidence, patience, persistence, prudence, and gradualism.Talk is cheap, and Mario Draghi could still put more emphasis on those contingencies that would force the ECB to respond (including trade tensions and a stronger EUR) by delaying the first rate hikes. A more explicit dovish shift would see the Governing Council endorse market pricing of a delayed lift-off.Either way, the ECB will closely monitor the upcoming data, with a special focus on core inflation and PMI

Read More »