Euro area core inflation has been affected by a series of transitory factors in recent months, resulting in higher volatility in a number of HICP sub-components.The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a potentially larger FX pass-through. We are not too worried, as weakness in non-energy industrial goods in March was largely driven by volatile HICP components including clothing and footwear, but the ECB will be waiting for more evidence to be sure.The release of euro area flash HICP estimate on 3 May

Topics:

Frederik Ducrozet considers the following as important: ECB policy normalisation, euro area core inflation, Euro area inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Euro area core inflation has been affected by a series of transitory factors in recent months, resulting in higher volatility in a number of HICP sub-components.

The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a potentially larger FX pass-through. We are not too worried, as weakness in non-energy industrial goods in March was largely driven by volatile HICP components including clothing and footwear, but the ECB will be waiting for more evidence to be sure.

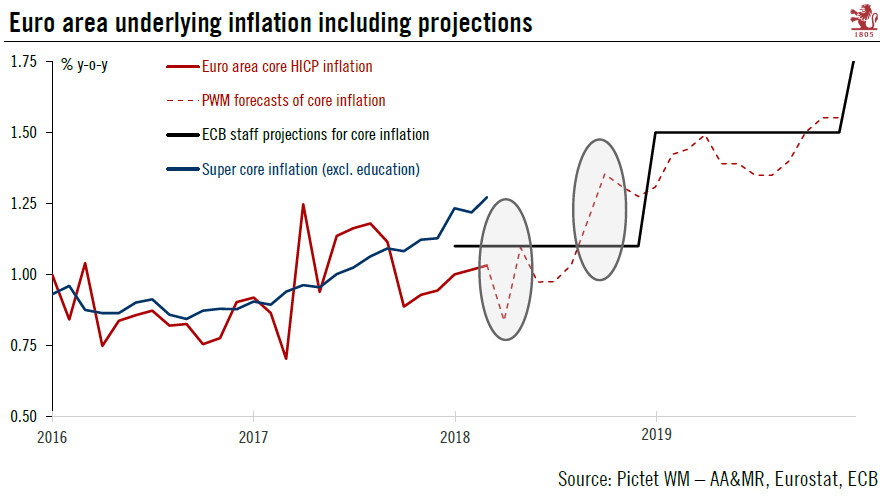

The release of euro area flash HICP estimate on 3 May will have the potential to shape market expectations ahead of the important June meeting. Standard seasonal patterns point to a fairly large setback in core inflation, to 0.7-0.8% y-o-y in April, before the upward trend can resume in the months ahead. Our forecast is at the upper end of this range assuming that a rebound in core goods inflation will help offset part of the weakness in services. Super core inflation is already trending higher, but this has not been reflected in official metrics for now (HICP excluding energy, food, alcohol and tobacco).

As a result, we see a tactical case for renewed ECB dovishness over the coming weeks as the upward adjustment in core inflation would be delayed into H2 2018. To be sure, core inflation looks set to rise more quickly from October and we remain cautiously bullish over the medium-term. We continue to expect the ECB to taper QE purchases in Q4 2018 and to start hiking rates in Q3 2019. But the recent data flow is playing into the doves’ hands and the next policy announcements could well be delayed until the 26 July meeting, especially if business sentiment fails to fully recover.