An announcement on quantitative easing is looking likely as early as next week. But the jury is out on what the central bank will actually say.Peter Praet’s hawkish comments on inflation this week did not surprise us in terms of substance but did in terms of timing. The view of the (usually dovish) ECB chief economist carries significant weight, and therefore an announcement on QE is now likely at the 14 June meeting.We expect the staff projections to be revised lower in terms of GDP growth, albeit not dramatically so, but higher in terms of headline inflation, thanks to oil. Headline inflation that is rising towards 1.8% by 2020 would provide the Governing Council with the necessary ammunition to make a tapering announcement.However, it remains to be seen how far the ECB will go. We do

Topics:

Frederik Ducrozet considers the following as important: ECB preview, ECB quantitative easing, ECB tapering, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

An announcement on quantitative easing is looking likely as early as next week. But the jury is out on what the central bank will actually say.

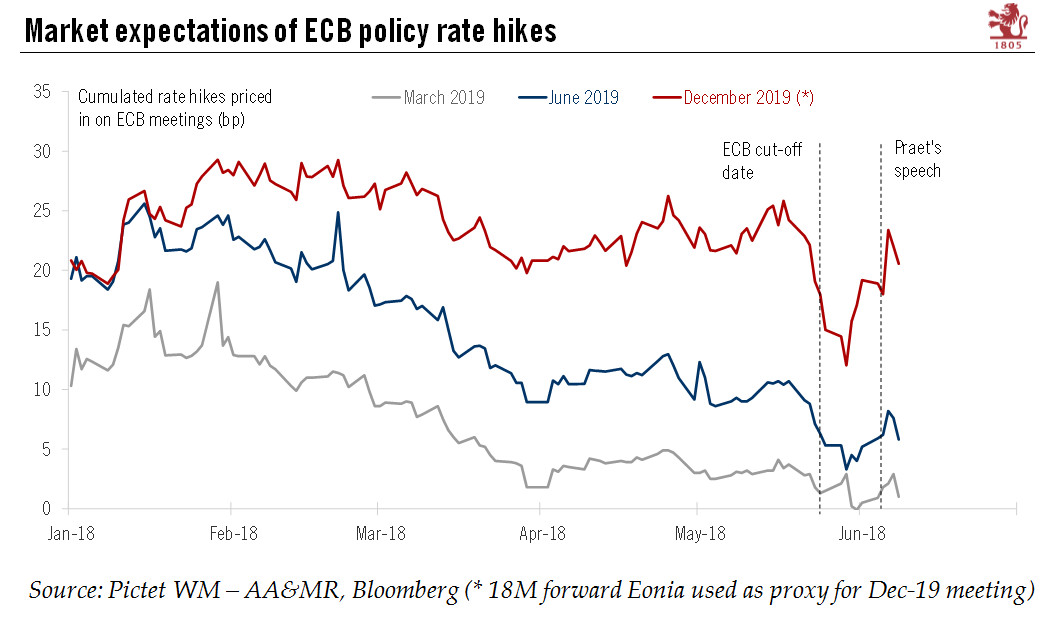

Peter Praet’s hawkish comments on inflation this week did not surprise us in terms of substance but did in terms of timing. The view of the (usually dovish) ECB chief economist carries significant weight, and therefore an announcement on QE is now likely at the 14 June meeting.

We expect the staff projections to be revised lower in terms of GDP growth, albeit not dramatically so, but higher in terms of headline inflation, thanks to oil. Headline inflation that is rising towards 1.8% by 2020 would provide the Governing Council with the necessary ammunition to make a tapering announcement.

However, it remains to be seen how far the ECB will go. We do not expect an iron-clad commitment to end QE in December but a ‘flexible tapering’ announcement based on a positive assessment of inflation criteria. We think the ECB is more likely to either introduce conditionality (based on rate hike expectations), or to retain some degree of optionality (by announcing that the modalities of tapering will be unveiled at a later stage).

Timing is not everything. Regardless of the June vs. July communication trade-off, our scenario remains unchanged beyond the summer. We expect net asset purchases to end in December 2018 and the ECB’s deposit rate to be raised by 15bp in September 2019.