This is not what we ordered! German factory orders collapsed in April, suggesting that the economic slowdown could extend into Q2. The underlying pace of domestic demand expansion looks more resilient. The main downside risks relate to net exports, in our view. Still, the most recent data releases have not been fully consistent with the ECB’s “hawkish moderation” scenario. A rebound in soft and hard data will be needed over the next few months for the ECB ’s exit strategy to remain on track. German new orders were weak across the board in April, contracting for a fourth consecutive month and by a larger-than-expected 2.5% m-o-m following a downwardly-revised 1.1% drop in March. As a result, total manufacturing

Topics:

Frederik Ducrozet considers the following as important: 2) Swiss and European Macro, European forward indicators, European soft patch, Featured, German new orders, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

This is not what we ordered!

- German factory orders collapsed in April, suggesting that the economic slowdown could extend into Q2.

-

The underlying pace of domestic demand expansion looks more resilient. The main downside risks relate to net exports, in our view.

-

Still, the most recent data releases have not been fully consistent with the ECB’s “hawkish moderation” scenario. A rebound in soft and hard data will be needed over the next few months for the ECB ’s exit strategy to remain on track.

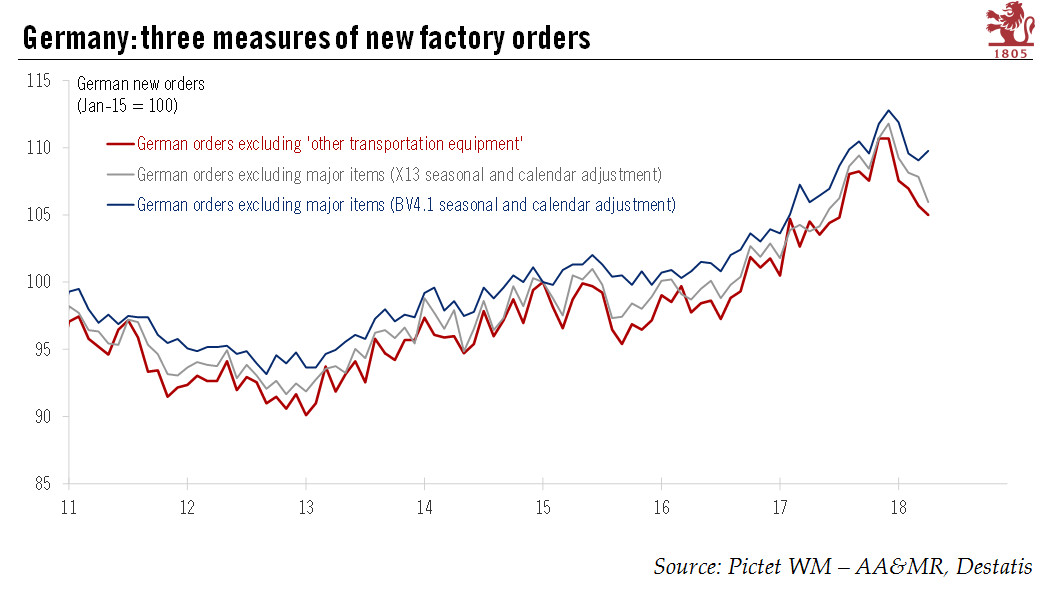

| German new orders were weak across the board in April, contracting for a fourth consecutive month and by a larger-than-expected 2.5% m-o-m following a downwardly-revised 1.1% drop in March. As a result, total manufacturing orders are off to an extremely weak start in Q2 (-3.3% q-o-q after -2.2% q-o-q in Q1). What is more, the decline in demand for German goods in April was fairly broad-based across countries and sectors.

Beneath the surface of horrible headline numbers, however, some details looked more resilient, especially core domestic orders of capital and durable goods (excluding big-ticket items). Intermediate goods orders were weakest of all, possibly linked to the accumulation of large inventories in 2017. Moreover, the choice of the seasonal adjustment methodology appeared to make a large difference, with no explanations that we are aware of. To be clear, we are not implying that the underlying economic trend is positive – it remains consistent with a sharper slowdown in the German economy than we envisaged at the beginning of the year. But it is still unclear to what extent weak activity data reflects a genuine deterioration in domestic demand in Germany or in other euro area countries. Whether the slowing of economic momentum is being driven by transitory factors, by external or domestic demand, or by supply-side constraints, is of critical importance for the ECB’s exit strategy. The ECB’s chief economist, Peter Praet, recently described the situation as the result of a “hawkish moderation”, suggesting that he thinks supply constraints are at work. This would buttress the argument for a gradual improvement in the inflation outlook underpinning a broad exit announcement next week. |

Germany: three measures of new factory orders 2011-2018 |

Tags: European forward indicators,European soft patch,Featured,German new orders,Macroview,newsletter