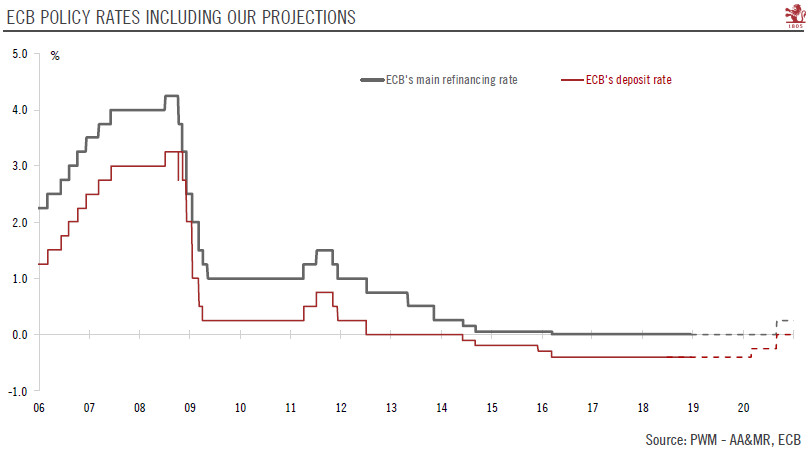

Following the changes to its forward guidance, we have revised our forecast for ECB policy rates. Last week, the European Central Bank (ECB) announced a new long-term refinancing package for banks (called TLTRO-III) and made clear that interest rates would not be raised this year. While these measures were expected, they have come earlier than we thought. We were also taken aback by the extent of the downside revisions to the ECB’s inflation and growth projections and ECB President Draghi‘s overall dovishness. We have revised our scenario accordingly and now expect a 15bp deposit rate hike in March 2020, followed by a 25bp hike in the deposit and refi rates in September 2020. The former would be a technical rate hike

Topics:

Frederik Ducrozet considers the following as important: 2) Swiss and European Macro, ECB monetary policy, euro area, Featured, Macroview, newsletter, Pictet Macro Analysis, TLTRO III

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Following the changes to its forward guidance, we have revised our forecast for ECB policy rates.

| Last week, the European Central Bank (ECB) announced a new long-term refinancing package for banks (called TLTRO-III) and made clear that interest rates would not be raised this year. While these measures were expected, they have come earlier than we thought. We were also taken aback by the extent of the downside revisions to the ECB’s inflation and growth projections and ECB President Draghi‘s overall dovishness.

We have revised our scenario accordingly and now expect a 15bp deposit rate hike in March 2020, followed by a 25bp hike in the deposit and refi rates in September 2020. The former would be a technical rate hike rather than the start of a full-blown normalisation cycle. As for TLTRO-III, what matters above all, is what governments and other European institutions make of this opportunity to lock in cheap funding for longer. While the OECD’s call for a coordinated programme of fiscal stimulus and structural reforms looks overambitious and politically difficult to realise, the ECB’s response appears as if it believes that the euro area might be facing a form of ‘Japanisation’, for better or worse. |

ECB Policy Rates, 2006 - 2019(see more posts on ECB policy, ) |

Tags: ECB monetary policy,Euro area,Featured,Macroview,newsletter,TLTRO III