ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves. Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020. Despite nearly four years of asset purchases and five years of negative rates, the downside risks to growth and inflation still dominant. Mario Draghi himself ruled out a tiered reserve system in March 2016 “exactly for the purpose of not signalling that we can go as low as we want on this”. We cannot

Topics:

Frederik Ducrozet considers the following as important: 2) Swiss and European Macro, ECB, euro area monetary policy, Featured, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves.

Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020.

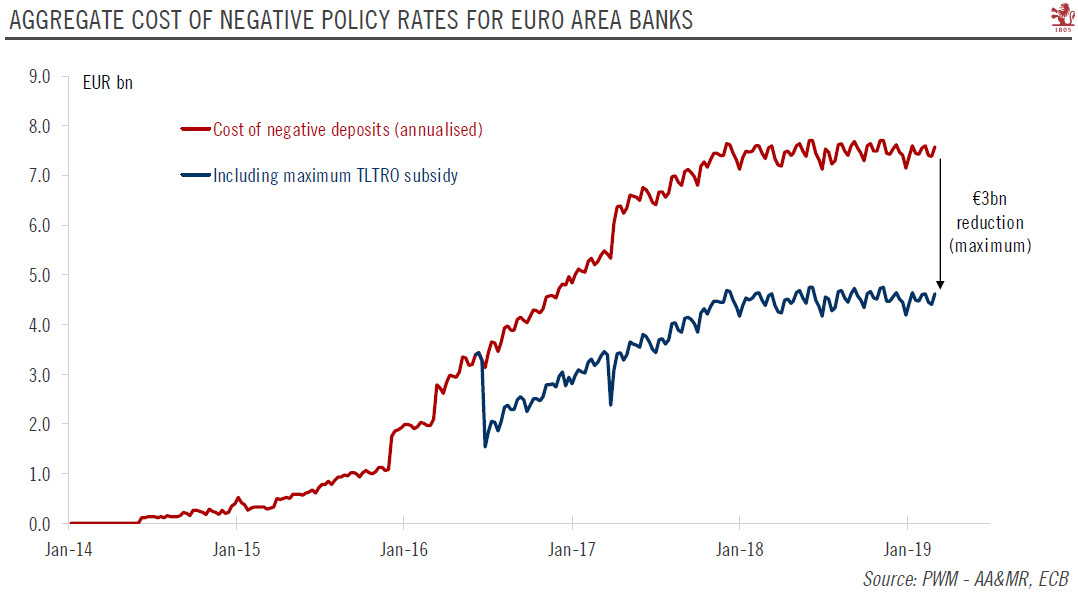

Despite nearly four years of asset purchases and five years of negative rates, the downside risks to growth and inflation still dominant. Mario Draghi himself ruled out a tiered reserve system in March 2016 “exactly for the purpose of not signalling that we can go as low as we want on this”. We cannot emphasise enough how important the recent shift in conditions is from that perspective. If another shock led to a more protracted slowdown, rate cuts could be back on the agenda, if only by default because all other options would face higher hurdles. In that case, a tiering system may be the only option available to reduce the cost for banks in the core.

| In the end, tiering is all about the credibility of forward guidance and the ECB signalling its ability to cut rates again in the next downturn.

Tiering would come with technical complications and non-trivial effects on the distribution of excess liquidity across euro area countries. Our best guess is that the ECB would opt for a simple exemption system equivalent to an increase in minimum reserve requirements. For example, in a two-tiered system similar to the one adopted by the Swiss National Bank, exemptions could be set at 10x the required reserves, reducing the share of bank reserves subject to negative rates from 94% to 40% and the annual cost of negative rates by EUR 4bn, to EUR 3.5bn. We expect the ECB to use its policy meeting on Thursday to reaffirm its assessment of the downside risks to the economic outlook, while taking solace in the resilience of domestic demand. June still looks like the best time to announce pricing for its new Targeted Longer-Term Refinancing Operations programme (TLTRO-III), while tiering could come in September if, and only if, macro and credit conditions deteriorate further. |

Aggregate Cost of Negative Policy Rates for Euro Area Banks, 2014-2019 |

Tags: ECB,euro area monetary policy,Featured,Macroview,newsletter