Weaker economic momentum and low inflation in the euro area is unlikely to affect ECB monetary stance.We see little incentive for the ECB to change its broad assessment of the economic situation at the 26 April meeting. The normalisation of the monetary stance will continue to be dictated by the ECB’s guiding principles of confidence, patience, persistence, prudence, and gradualism.Talk is cheap, and Mario Draghi could still put more emphasis on those contingencies that would force the ECB to respond (including trade tensions and a stronger EUR) by delaying the first rate hikes. A more explicit dovish shift would see the Governing Council endorse market pricing of a delayed lift-off.Either way, the ECB will closely monitor the upcoming data, with a special focus on core inflation and PMI

Topics:

Frederik Ducrozet considers the following as important: ECB asset purchases, ECB monetary policy, ECB staff projections, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Weaker economic momentum and low inflation in the euro area is unlikely to affect ECB monetary stance.

We see little incentive for the ECB to change its broad assessment of the economic situation at the 26 April meeting. The normalisation of the monetary stance will continue to be dictated by the ECB’s guiding principles of confidence, patience, persistence, prudence, and gradualism.

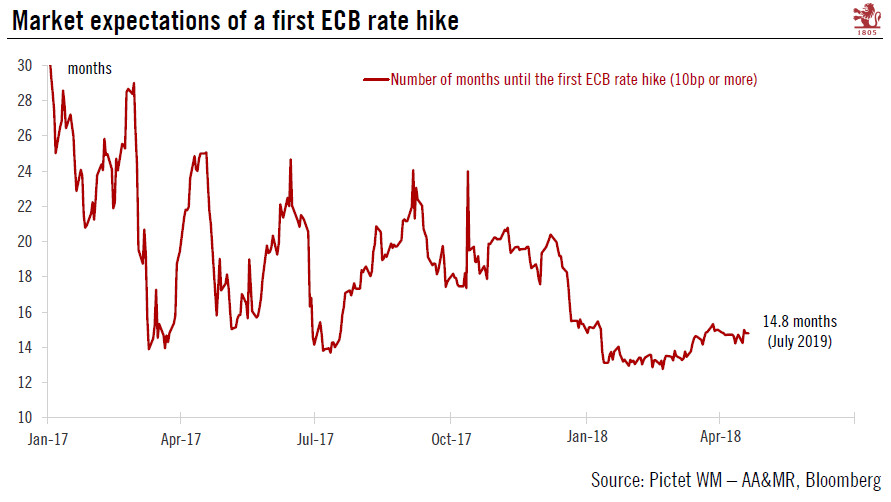

Talk is cheap, and Mario Draghi could still put more emphasis on those contingencies that would force the ECB to respond (including trade tensions and a stronger EUR) by delaying the first rate hikes. A more explicit dovish shift would see the Governing Council endorse market pricing of a delayed lift-off.

Either way, the ECB will closely monitor the upcoming data, with a special focus on core inflation and PMI surveys ahead of the more important 14 June meeting. Despite higher oil prices, risks remain tilted toward modest downward revisions to ECB staff projections.