Latest figures may increase the ECB’s confidence that inflation will get to 2% in the medium term, but its gradualist approach to policy normalisation should continue.At 1.9% in May, euro area headline inflation is back close to the ECB’s target of 2%. Importantly, it was not only energy and food prices that pushed inflation higher, but also core consumer prices (up 1.1% y-o-y).Looking ahead, headline inflation is likely to remain close to 2% for most of the rest of the year. Core inflation is expected to hover around 1% before stronger base effects and a narrowing of the output gap provide another push higher in Q4 2018, to around 1.3-1.4%. On a forward-looking basis, the ECB is likely to conclude that we are getting closer to a sustained adjustment in inflation that is a necessary

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

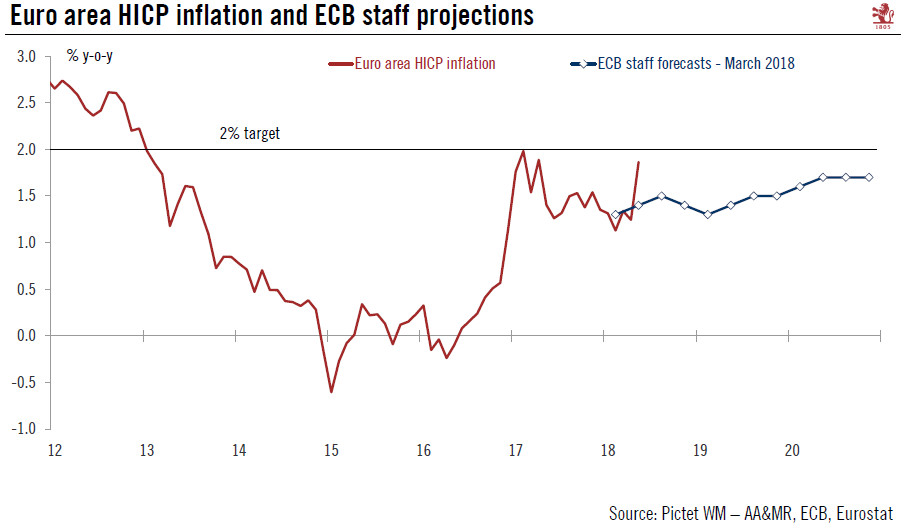

Latest figures may increase the ECB’s confidence that inflation will get to 2% in the medium term, but its gradualist approach to policy normalisation should continue.

At 1.9% in May, euro area headline inflation is back close to the ECB’s target of 2%. Importantly, it was not only energy and food prices that pushed inflation higher, but also core consumer prices (up 1.1% y-o-y).

Looking ahead, headline inflation is likely to remain close to 2% for most of the rest of the year. Core inflation is expected to hover around 1% before stronger base effects and a narrowing of the output gap provide another push higher in Q4 2018, to around 1.3-1.4%. On a forward-looking basis, the ECB is likely to conclude that we are getting closer to a sustained adjustment in inflation that is a necessary condition for ending QE this year.

On balance, the ECB is still likely to wait until the 26 July meeting to announce its looming decisions on QE and forward guidance. We continue to expect QE to end in December 2018 and a first rate hike to be delivered in September 2019.