The ECB Governing Council acknowledges “moderation” in the pace of the euro area's recovery. It may wait until July before announcing its next policy decision.Another ECB meeting, another balanced message of confidence and prudence. Unsurprisingly, the statement today mentioned the deterioration in the data flow since March, but our impression is that the ECB is largely brushing off concerns about a soft patch in the economy for the moment.ECB president Mario Draghi said that the Governing Council did not discuss monetary policy “per se”, waiting for more hard evidence before they update their assessment of the situation. He may have lied – it happened before – but the bottom line is that upcoming data releases will therefore receive greater scrutiny. We see downside risks to April

Topics:

Frederik Ducrozet considers the following as important: ECB policy, ECB projections, ECB staff forecasts, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The ECB Governing Council acknowledges “moderation” in the pace of the euro area's recovery. It may wait until July before announcing its next policy decision.

Another ECB meeting, another balanced message of confidence and prudence. Unsurprisingly, the statement today mentioned the deterioration in the data flow since March, but our impression is that the ECB is largely brushing off concerns about a soft patch in the economy for the moment.

ECB president Mario Draghi said that the Governing Council did not discuss monetary policy “per se”, waiting for more hard evidence before they update their assessment of the situation. He may have lied – it happened before – but the bottom line is that upcoming data releases will therefore receive greater scrutiny. We see downside risks to April inflation and May PMI indices, which may well be enough for the ECB to delay its next decision until the July meeting.

However, we expect the data to prove the ECB right eventually, and our scenario remains unchanged. We continue to expect the ECB to taper its asset purchases in Q4 2018 and to start hiking rates in Q3 2019.

Here are the most important deadlines in the coming weeks:

- April flash HICP inflation (3 May): we expect euro area core inflation to drop from 1.0% to 0.8% y-o-y in April. Looking ahead, we forecast core inflation to rebound to above 1% before a large base effect pushes it higher in October.

- Q1 GDP first estimate (15 May): weak hard data look consistent with a sharp slowdown in Q1 GDP growth to around 0.1-0.2% q-o-q, while soft data still point to around 0.6% growth. We expect Q1 GDP to come in somewhere in between those estimates.

- May PMI indices (23 May): our forecasts are consistent with business survey stabilising at around current levels, but forward-looking PMI components point to downside risks in the near term.

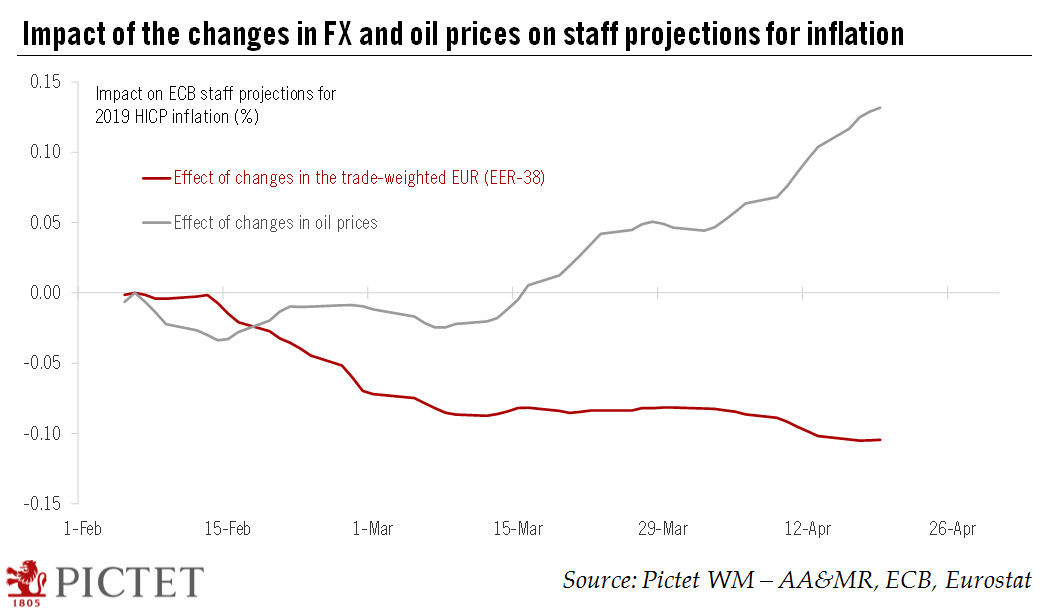

- ECB staff projections: ahead of the 14 June meeting, the ECB staff will extract technical assumptions from market prices and expectations. At this stage, the effect of higher oil prices on inflation has more than offset the drag from a slightly stronger currency in trade-weighted terms (see Chart above).

- EU summit (28-29 June): the topics to be discussed will be of critical importance to the medium-term outlook, including banking union. The risk of a disappointing outcome has increased, which in turn could put more pressure on the ECB to be even more gradual.