Latest inflation report came in on the softer side of expectations, but changes in headline inflation are likely to gain importance as we move closer to policy normalisation.Although the European Central Bank’s (ECB) mandate is defined in terms of headline inflation (targeting an annual rate of “below, but close to 2%” over the medium-term), over the past few years, the central bank has been mainly focused on underlying consumer price dynamics, including core inflation. Looking forward, there are reasons to believe that changes in headline inflation will gain importance as we move closer to policy normalisation. In particular, there is evidence that the pick-up in wage growth, which is fuelling the ECB’s optimism over the medium-term outlook for price stability, has been driven by higher

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Latest inflation report came in on the softer side of expectations, but changes in headline inflation are likely to gain importance as we move closer to policy normalisation.

Although the European Central Bank’s (ECB) mandate is defined in terms of headline inflation (targeting an annual rate of “below, but close to 2%” over the medium-term), over the past few years, the central bank has been mainly focused on underlying consumer price dynamics, including core inflation. Looking forward, there are reasons to believe that changes in headline inflation will gain importance as we move closer to policy normalisation. In particular, there is evidence that the pick-up in wage growth, which is fuelling the ECB’s optimism over the medium-term outlook for price stability, has been driven by higher inflation based on backward-looking expectations.

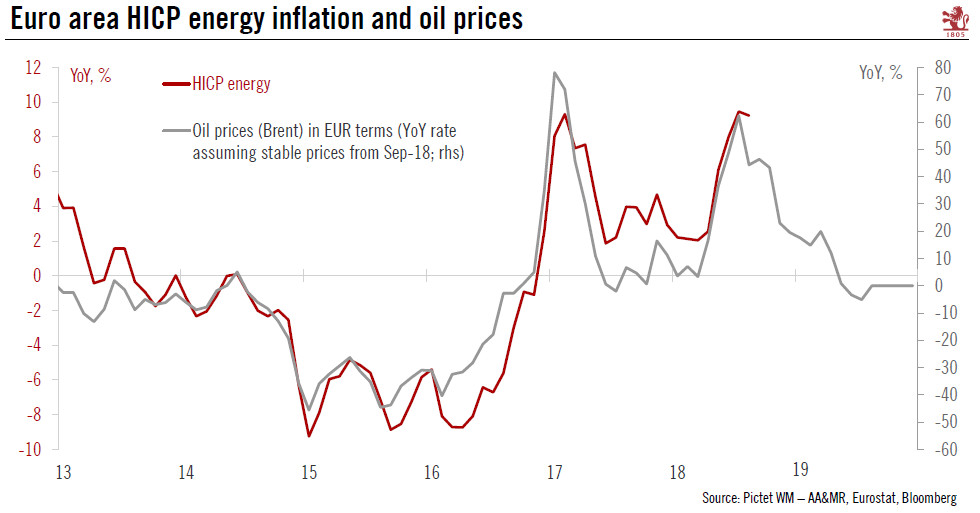

Unfortunately, it looks like the support from higher energy prices could be fading again. Our chart below suggests that Harmonised Index of Consumer Prices (HICP) energy inflation is likely to have peaked in July (at 9.5% year on year(YoY)) unless oil prices rebound and/or the EUR/USD exchange rate depreciates more substantially. Meanwhile, food inflation has eased somewhat in recent months.

This leaves the burden on core prices for services and non-energy goods to sustain higher inflation rates close to 2% over the medium-term. We estimate that ECB staff projections are consistent with core HICP rising from 1% today to about 1.3% in Q4 2018, before accelerating to above 1.5% over the course of 2019. However, following today’s soft core HICP print of 0.96% YoY in August, the risk is that the ECB staff will need to revise their projections for core inflation lower at the September meeting, especially the 2019 median projection, which currently stands at an elevated 1.6%. While this should not prevent the ECB from ending quantitative easing (QE) net asset purchases in December 2018, it may increase the risk of a delayed normalisation process in 2019.