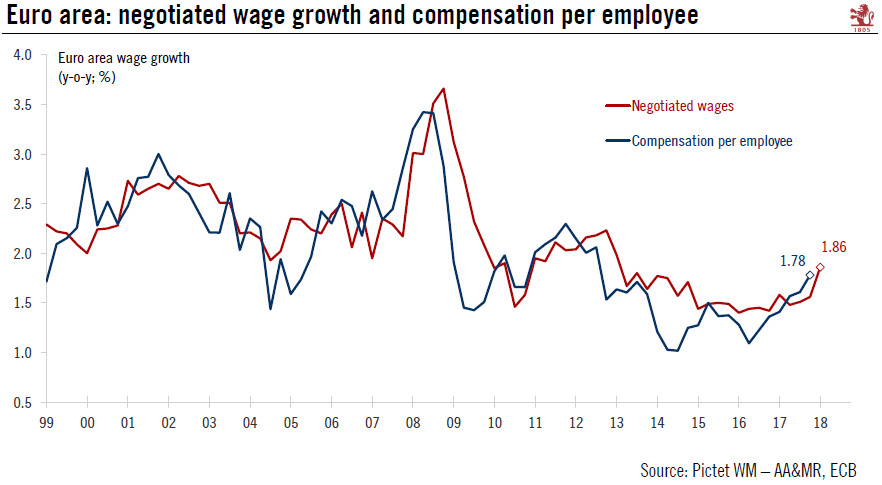

Euro area wage growth rose in the first quarter of the year, reinforcing our view that the ECB will end QE in December.For all the noise about Italian politics and the loss of economic momentum in the euro area, this week also brought some reassuring news that underlying inflationary pressure is gradually building. The ECB’s data series of euro area negotiated wages rose to a five-year high of 1.9% y-o-y in Q1 2018. The compensation per employee series, which the ECB staff is using as their benchmark for wage growth in their projections, is not yet available for Q1 but at 1.8% y-o-y in Q4 2017, it has risen to multi-year highs as well.These developments are all the more encouraging as they pre-date the latest German wage deals which for the most part will start showing up in wage growth

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Euro area wage growth rose in the first quarter of the year, reinforcing our view that the ECB will end QE in December.

For all the noise about Italian politics and the loss of economic momentum in the euro area, this week also brought some reassuring news that underlying inflationary pressure is gradually building. The ECB’s data series of euro area negotiated wages rose to a five-year high of 1.9% y-o-y in Q1 2018. The compensation per employee series, which the ECB staff is using as their benchmark for wage growth in their projections, is not yet available for Q1 but at 1.8% y-o-y in Q4 2017, it has risen to multi-year highs as well.

These developments are all the more encouraging as they pre-date the latest German wage deals which for the most part will start showing up in wage growth figures from Q2 on. Unless the soft patch turns into a much sharper slowdown in economic growth (an unlikely outcome, in our view), we expect the ongoing decline in unemployment (including the broader ‘U6’ measures) to feed into stronger wage growth in most euro area member states. In Germany, where the Phillips curve is among the flattest in the region due to a number of structural factors, our analysis suggests that an inflection point has been reached beyond which wage growth can be expected to respond more strongly to the decline in unemployment and the shortage of labour.

Wage growth is an essential part of the ECB’s assessment of the inflation outlook, including its so-called SAPI criteria (Sustained Adjustment in the Path of Inflation). These define the conditions for QE tapering based on convergence of inflation to the ECB’s 2% target over the medium term, confidence in the convergence process, and its resilience to the withdrawal of monetary support. The pick-up in wage growth is one of the reasons why we still expect the ECB to announce in July that QE will end in December 2018.