The main risk facing ECB watchers is that the next few meetings of the Governing Council will be increasingly boring and predictable. However, from the central bankers’ perspective, this may considered a sign of success, “like a referee whose success is judged by how little his or her decisions intrude into the game itself”, to quote former BoE Governor Mervyn King. Back to the economy, downside risks stemming from protectionism, emerging markets and financial volatility are still firmly on the ECB’s radar, having“ gained more prominence recently ”. But, crucially, staff projections were little changed over the medium term and, on balance, risks to economic growth were still assessed as “broadly balanced”, helping

Topics:

Frederik Ducrozet considers the following as important: 2) Swiss and European Macro, ECB staff forecasts, European Central Bank, European inflation, Featured, Macroview, Mervyn King, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The main risk facing ECB watchers is that the next few meetings of the Governing Council will be increasingly boring and predictable. However, from the central bankers’ perspective, this may considered a sign of success, “like a referee whose success is judged by how little his or her decisions intrude into the game itself”, to quote former BoE Governor Mervyn King.

Back to the economy, downside risks stemming from protectionism, emerging markets and financial volatility are still firmly on the ECB’s radar, having“ gained more prominence recently ”. But, crucially, staff projections were little changed over the medium term and, on balance, risks to economic growth were still assessed as “broadly balanced”, helping ECB President Mario Draghi to convey a message of confidence. A boring ECB is also good news for markets, reducing uncertainty and further compressing volatility. QE tapering was confirmed, with the ECB still “anticipating” to end net asset purchases after December, following a final reduction from EUR30bn to EUR15bn per month in Q4 2018. On paper, the ECB retains some degree of optionality with tapering still “subject to incoming data”, but in our view, the bar for change in this pre-defined policy path is still very high, if only because QE has to end for technical and political reasons. More fundamentally, the ECB’s optimism in the face of elevated downside risks to growth remains predicated on the view that the euro area economy is still growing above potential, with enough accumulated speed to fuel inflationary pressure– a concept dubbed ‘reverse hysteresis’ explaining why uncertainty around the inflation outlook is perceived as “receding”. |

ECB staff projections |

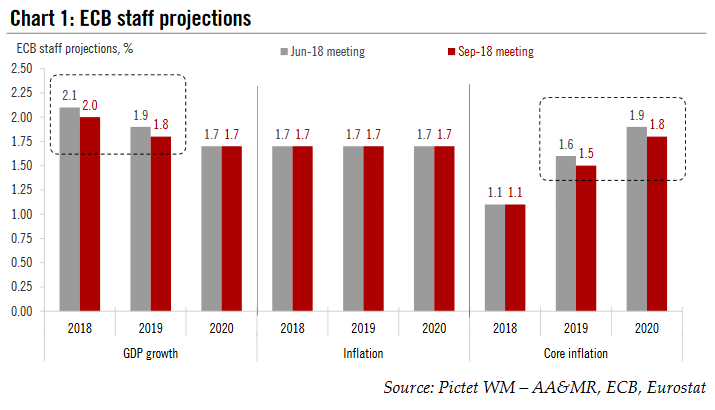

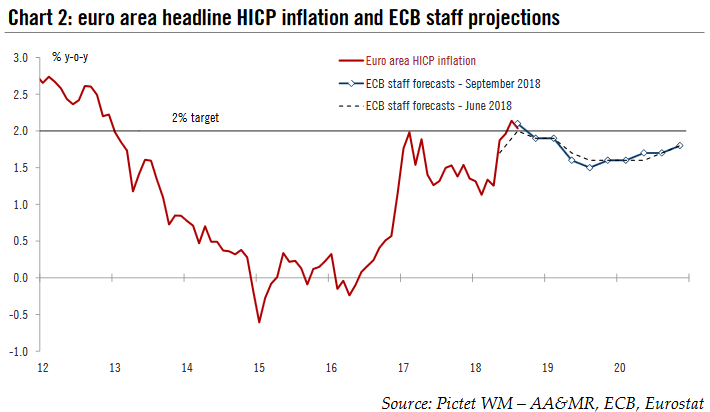

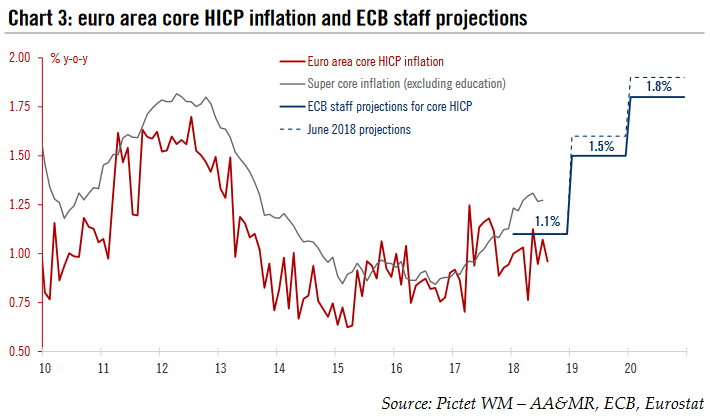

Staff projections: minimal changesMuch of the focus at today’s meeting was on ECB staff projections, but in the end the revisions were very small and broadly in line with expectations. Euro area real GDP growth was revised marginally lower, from 2.1% to 2.0% in 2018 and from 1.9% to 1.8% in 2019, reflecting the deterioration in both hard and soft data of late. True, the 2018 projection was still 2.4% six months ago, but part of the revision has reflected the shift from euphoria to more normal, yet still above-potential growth rates. Meanwhile, the 2020 GDP growth projection was unchanged at 1.7%. The main surprise came from the lack of revision to the inflation outlook, with median staff projections unchanged at 1.7% over the 2018-20 horizon and “uncertainty around the inflation outlook receding”, according to the Governing Council. Moreover, the quarterly staff projections remained consistent with headline HICP inflation edging higher to 1.8% by Q4 2020, very close to the ECB’s definition of price stability. All else equal, a 2% decline in oil prices, a 1.5 % stronger trade-weighted EUR and a slightly weaker growth trajectory should have triggered a downward revision to headline HICP inflation of at least 10bp over the forecast horizon. Core HICP inflation was indeed revised lower by 10bp, to 1.5% in 2019 and 1.8% in 2020, yet headline inflation wasn’t affected. Moreover, the unemployment rate was revised marginally higher, from 7.3% to 7.4% in 2020 while wage growth was little changed, rising to 2.7% by 2020. |

euro area headline HICP inflation and ECB staff projections |

| We don’t want to overplay the importance of 10bp fluctuations in ECB staff projections which could be related to rounding issues. More fundamentally, we view the resilience of the inflation outlook to external shocks as reflecting the idea that the euro area economy in aggregate has reached high enough escape velocity for the output gap to continue shrinking at a broadly steady pace. As long as the euro area is growing above potential, there is sufficient “underlying strength” in the economy, according to Draghi, for a sustained adjustment in inflation to continue. This constructive view was likely strengthened by the recent acceleration in negotiated wages, to 2.2% y-o-y in Q2.

Last but not least, Draghi mentioned a number of upside risks, including more supportive fiscal policies (in the US and in some euro area member states), which are expected to mitigate external risks to some extent. |

euro area core HICP inflation and ECB staff projections |

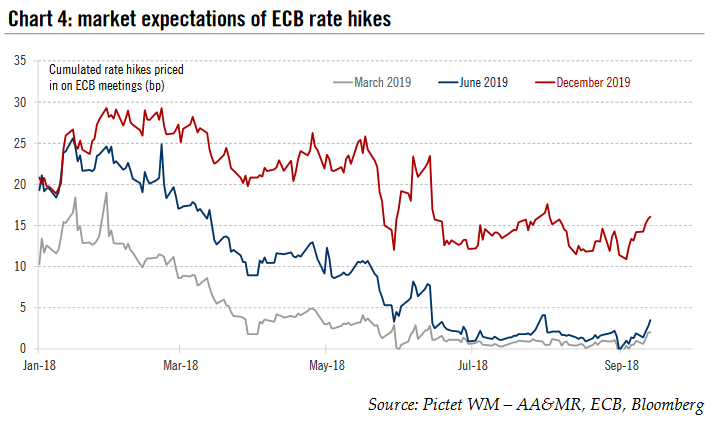

No change to our ECB forecastsIn the end, we continue to forecast a first 15bp hike in the ECB’s deposit rate in September 2019, followed by a 25bp hike in all policy rates in December 2019. For now, our view remains that the ECB is satisfied with (very) dovish market pricing of roughly 10bp hike by October 2019, and 20bp by March 2020. Meanwhile Mario Draghi said that the Governing Council did not discuss QE reinvestment policy, nor did they discuss when they would discuss it… Still, we continue to expect reinvestment modalities to be adjusted in a flexible way in 2019, including via an increase in the reinvestment period up to 6 months, with an announcement possible in December. |

market expectations of ECB rate hikes |

Tags: ECB staff forecasts,European central bank,European inflation,Featured,Macroview,Mervyn King,newsletter