The ECB is adjusting its corporate bond purchases to take account of market conditions, including the recent fall in issuance.Next week’s detailed breakdown of ECB QE monthly data will reveal a marked slowdown in the pace of corporate bond purchases in April (Corporate Sector Purchase Programme, or CSPP). Indeed, weekly holdings data have been consistent with gross purchases of around EUR3bn in April, down from EUR5.8bn on average in Q1. There are several possible explanations for the drop in gross purchases, but redemptions are not one of them, as they amounted to just EUR87m in April.At first sight, this drop contrasts with our view that the relative size of CSPP would rise after QE was recalibrated from EUR60bn to EUR30bn in 2018, as a way to mitigate the scarcity of core sovereign

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The ECB is adjusting its corporate bond purchases to take account of market conditions, including the recent fall in issuance.

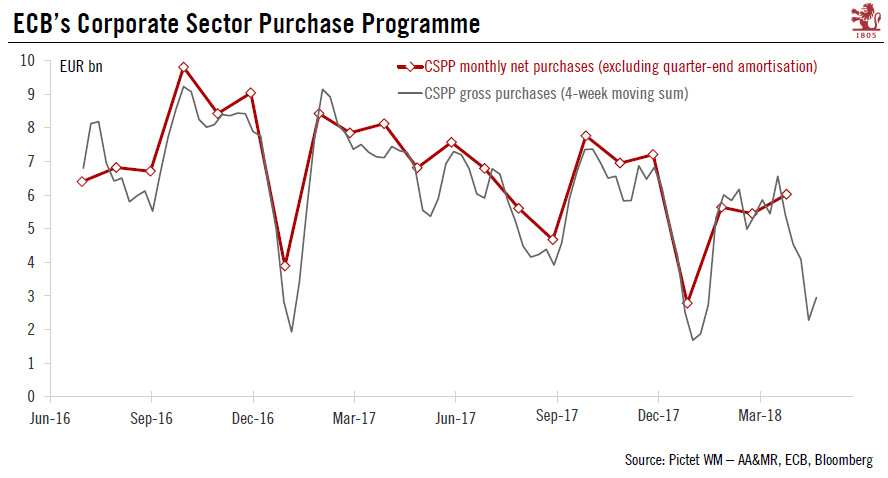

Next week’s detailed breakdown of ECB QE monthly data will reveal a marked slowdown in the pace of corporate bond purchases in April (Corporate Sector Purchase Programme, or CSPP). Indeed, weekly holdings data have been consistent with gross purchases of around EUR3bn in April, down from EUR5.8bn on average in Q1. There are several possible explanations for the drop in gross purchases, but redemptions are not one of them, as they amounted to just EUR87m in April.

At first sight, this drop contrasts with our view that the relative size of CSPP would rise after QE was recalibrated from EUR60bn to EUR30bn in 2018, as a way to mitigate the scarcity of core sovereign bonds. As a matter of fact, the share of CSPP in total purchases increased to 19% in Q1, from 10% in 2017.

The recent deceleration in CSPP purchases might have been amplified by a number of technical factors, with the ECB adjusting its strategy in a flexible way depending on liquidity conditions. The simple and most convincing explanation is that after a surge in net issuance in Q1, which the ECB took advantage of via some limited frontloading, net CSPP purchases dipped in April as the result of lower issuance activity. At the ECB’s last press conference, after reiterating the central bank’s flexible approach to QE implementation, Mario Draghi said “we had higher seasonal amount of purchases and therefore we kind of averaged down with lower purchases”.

Similarly to the soft patch in the economy, we would not read too much into the noise in QE data at this stage. The big picture is unchanged. Should the ECB need to extent QE in the future, CSPP would be no silver bullet.