European banks’ exposure to Turkey looks non-systemic and manageable overall, although a number of indirect effects could amplify the eventual losses.The rapid depreciation of the Turkish Lira is raising concerns at the European Central Bank over European banks’ exposure to Turkey, according to recent press reports. Data from the Bank of International Settlements (BIS) show that the total exposure of foreign banks to Turkish assets was USD223 bn in Q1 2018, on an ultimate risk basis (net of risk transfers). European banks excluding the UK accounted for USD150 bn, or two-thirds of total foreign exposure, largely attributable to Spanish, Italian and French stakes in various subsidiary banks in Turkey.Banks’ exposure represents the most obvious risk of contagion to Europe. In absolute terms,

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

European banks’ exposure to Turkey looks non-systemic and manageable overall, although a number of indirect effects could amplify the eventual losses.

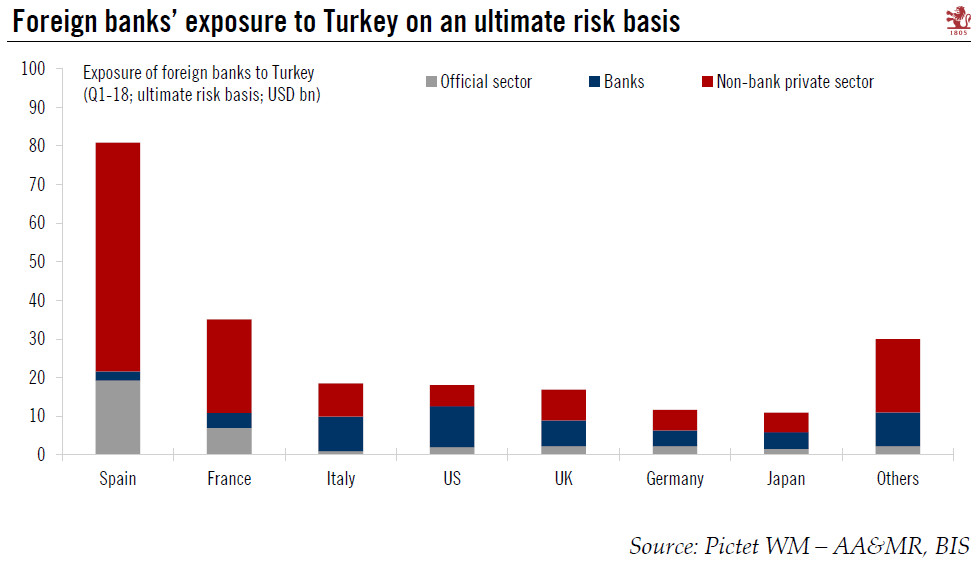

The rapid depreciation of the Turkish Lira is raising concerns at the European Central Bank over European banks’ exposure to Turkey, according to recent press reports. Data from the Bank of International Settlements (BIS) show that the total exposure of foreign banks to Turkish assets was USD223 bn in Q1 2018, on an ultimate risk basis (net of risk transfers). European banks excluding the UK accounted for USD150 bn, or two-thirds of total foreign exposure, largely attributable to Spanish, Italian and French stakes in various subsidiary banks in Turkey.

Banks’ exposure represents the most obvious risk of contagion to Europe. In absolute terms, it looks manageable, representing roughly about 2.5% of total banking assets in Spain and less than 0.5% in France and in Italy, notwithstanding the issue of currency mismatch in some of the underlying investments and loans. While there could be various indirect effects that amplify the eventual losses, they are unlikely to prove systemic for any of the related financial systems.

The BIS provides a breakdown of banks’ exposure to the public, financial and non-financial private sectors. Except for Spain, the exposure to the Turkish public sector looks small. The risk is that the Turkish economy suffers from the combination of currency depreciation, rising bond yields and a potential contraction in the financial operations of European banks in the banking and corporate sectors. This, in turn, could lead to second-round economic effects on the European economy, including via a drop in exports to Turkey which represent about 3% of total (extra-EU) euro area exports.