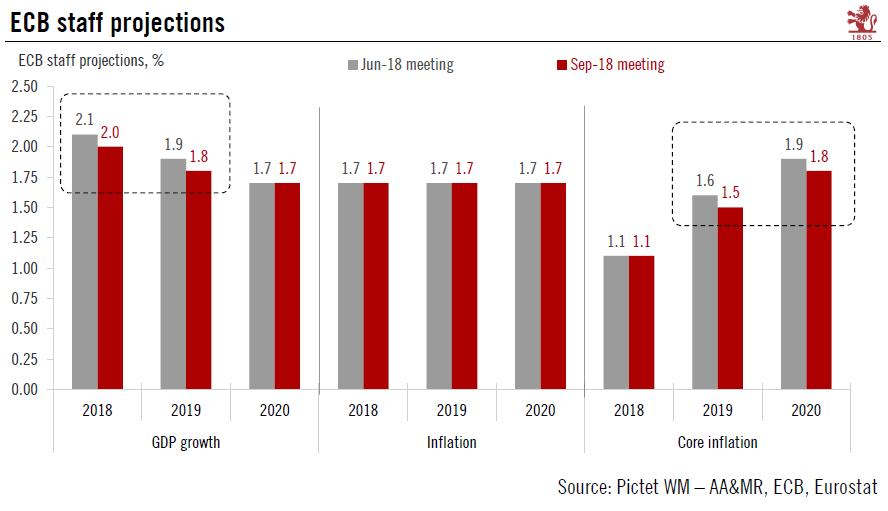

No changes to the ECB’s monetary stance and policy guidance mean we are holding to our forecasts for quantitative easing and rate hikes.The ECB made no change to its monetary stance and policy guidance at its 13 September meeting. The end of quantitative easing (QE) was confirmed for after December, following a final reduction in the pace of net asset purchases to EUR15bn per month in Q4 2018.Much of the focus was on the updated ECB staff projections. In the end, downward revisions were minimal, leaving the medium-term outlook unchanged, including the all-important 2020 core inflation projection at 1.9%, despite lower oil prices and a stronger currency.Euro area real GDP growth was revised marginally lower, from 2.1% to 2.0% in 2018, and from 1.9% to 1.8% in 2018. This is lower than the

Topics:

Frederik Ducrozet considers the following as important: ECB staff forecasts, European Central Bank, European inflation, Macroview

This could be interesting, too:

Dirk Niepelt writes Panel on “Will the digital euro take off?,” CEPR, 2023

Dirk Niepelt writes Conference on “The Macroeconomic Implications of Central Bank Digital Currencies,” CEPR/ECB, 2023

Dirk Niepelt writes “A Macroeconomic Perspective on Retail CBDC and the Digital Euro,” EIZ, 2023

Dirk Niepelt writes “Why the Digital Euro Might be Dead on Arrival,” VoxEU, 2023

No changes to the ECB’s monetary stance and policy guidance mean we are holding to our forecasts for quantitative easing and rate hikes.

The ECB made no change to its monetary stance and policy guidance at its 13 September meeting. The end of quantitative easing (QE) was confirmed for after December, following a final reduction in the pace of net asset purchases to EUR15bn per month in Q4 2018.

Much of the focus was on the updated ECB staff projections. In the end, downward revisions were minimal, leaving the medium-term outlook unchanged, including the all-important 2020 core inflation projection at 1.9%, despite lower oil prices and a stronger currency.

Euro area real GDP growth was revised marginally lower, from 2.1% to 2.0% in 2018, and from 1.9% to 1.8% in 2018. This is lower than the six-month old projection of a 2.4% rate, but part of the revision has reflected the shift from euphoria to more normal, yet still above-potential, growth rates.

The main surprise was the lack of revision to the inflation outlook, with median staff projections unchanged at 1.7% over the 2018-2020 horizon and “uncertainty around the inflation outlook receding”, according to the Government Council. Moreover, the quarterly staff projections remained consistent with headline HICP inflation to 1.8% by Q4 2020, very close to the ECB’s definition of price stability.

We continue to forecast a first 15bp hike in the ECB’s deposit rate in September 2019, followed by a 25bp hike in all policy rates in December 2019. Meanwhile, QE reinvestment modalities are likely to be adjusted in a flexible way in 2019, including via an increase in the reinvestment period up to six months, with an announcement possible in December.