Changes in quantitative easing will have profound implications for euro area debt dynamics.This week’s Eurostat releases revealed that public finances continue to improve in most euro area member states. As a result of falling deficits, low interest rates and stronger nominal growth, the ratio of euro area government debt to GDP fell to a six-year low of 86.7% in Q4 2017.Although sovereign debt sustainability remains shaky in countries like Italy, it is fair to say that we have moved from self-defeating austerity to a more stable equilibrium where debt dynamics have become less sensitive to fluctuations in interest rates. ECB QE has provided a massive boost through various transmission channels, including a quasi-fiscal effect on interest expenditure in core and peripheral countries

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Changes in quantitative easing will have profound implications for euro area debt dynamics.

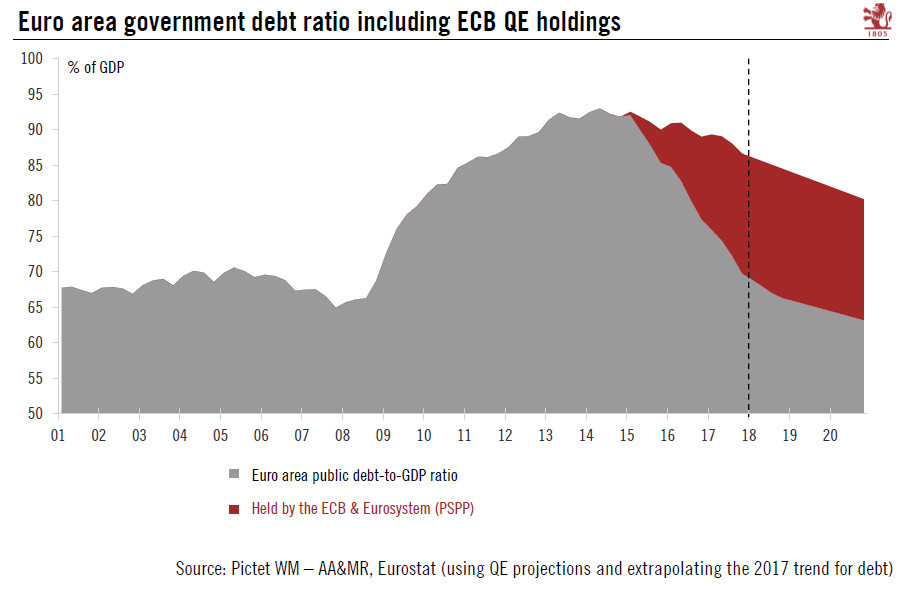

This week’s Eurostat releases revealed that public finances continue to improve in most euro area member states. As a result of falling deficits, low interest rates and stronger nominal growth, the ratio of euro area government debt to GDP fell to a six-year low of 86.7% in Q4 2017.

Although sovereign debt sustainability remains shaky in countries like Italy, it is fair to say that we have moved from self-defeating austerity to a more stable equilibrium where debt dynamics have become less sensitive to fluctuations in interest rates. ECB QE has provided a massive boost through various transmission channels, including a quasi-fiscal effect on interest expenditure in core and peripheral countries alike.

Looking at the stock effect of QE, the ECB and European System of Central Banks (ESCB) held around 20% of total marketable sovereign debt securities in Q4, equivalent to 17% of euro area GDP. This share will continue to increase in 2018, to about 22% and 18%, respectively, as QE proceeds and nominal GDP is expected to rise faster than government debt. We expect asset purchases to be tapered in Q4 2018, and the ECB’s reinvestment policy to continue beyond 2019. As a result, the share of government debt held by the ESCB is likely to stabilise from 2019 on, depending on the pace of public sector deleveraging (at least until the next recession hits).

All this will have profound implications for euro area debt dynamics, echoing Benoît Coeuré’s point about a shrinking free-float of core sovereign debt as QE displaced private investors. The ECB should remain confident that tapering will not lead to an “unwarranted decompression of the term premium” as long as its forward guidance on policy rates remains credible.