While recent data has been encouraging, we still expect the UK economy to weaken in 2017. Short-term support for sterling may be undermined by Brexit talks and twin deficits. At its 15 September meeting, the Bank of England (BoE) left its main policy rate unchanged at 0.25% and maintained its Asset Purchase Facility (APF) target at GBP435 bn. The BoE’s assessment of economic conditions was broadly similar to its August projections despite some “slight upside” in the data. Nevertheless, the BoE provided enough hints to suggest that it will cut its main policy rate from 0.25% to 0.10% before the end of this year, most likely in November. At the same time, we acknowledge that the likelihood of the BoE delaying such a policy response has increased, not only because of better-than-expected economic data but also because of the impact of its August easing package on UK asset prices.Recent UK economic indicators have generally been resilient, mechanically pushing our 2016 GDP growth forecast up to 1.8% from the 1.3% level we predicted immediately after the Brexit vote. However, we have left our 2017 growth forecast unchanged at 0.9%, given our belief that the UK will perform well below potential.We remain reluctant to revise our medium-term UK growth projections higher for two main reasons.

Read More »Articles by Frederik Ducrozet and Luc Luyet

UK: To Brexit, or not to Brexit?

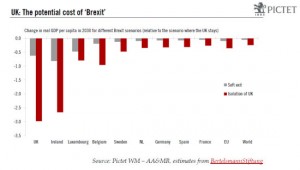

February 22, 2016We expect the UK to remain in the EU, but the risks are high. Opinion polls suggest a close result, and unless the gap widens markedly between the “Ins” and “Outs”, a prolonged period of uncertainty beckons. Moreover, in the event of Brexit, negotiations could go on for years.

Having secured a deal at the European Council meeting on 19 February, PM David Cameron announced that the referendum on UK EU membership will be held on 23 June. Based on the reactions on both sides, it looks like there might be something for everyone in Cameron’s deal, with some terms giving room for interpretation. The two most politically-sensitive issues revolve around an ‘emergency brake’ for foreign workers’ and child benefits, for which Cameron secured some tailor-made concessions. In particular, social benefits for newly arriving EU workers in the UK can be limited for up to four years, with a gradual phase-out period. This emergency brake will disappear after seven years, whereas Cameron had asked for it to be permanent.

In terms of broader sovereignty, the agreement specifies that references to ever closer union do not apply to the UK—but this was pretty much a given anyway. Things are slightly more complicated when it comes to financial issues, as usual.

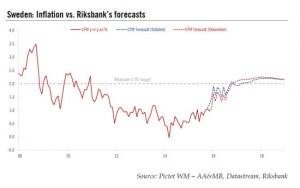

Swedish monetary policy: on hold but still under pressure to ease in 2016

December 15, 2015Today, the Riksbank left both the repo rate (-0.35%) and its QE programme unchanged (for a total of SEK200bn in bond purchases by June 2016), as expected.

The Swedish central bank’s forward guidance was strengthened somewhat as its Executive Board said that “policy rates will not be raised until CPIF inflation has stabilised around 2% during the first half of 2017”.

Meanwhile, the Board stated that is was “highly prepared” to ease policy, “even between the ordinary policy meetings”, although the wording did not change much from the previous meeting. In particular, the statement repeated that the repo rate can be cut further (although the repo rate path was largely unchanged), asset purchases can be increased, FX interventions are possible and therefore a lending programme to companies.

We believe that the Riksbank opted to stay put for more tactical reasons – the Fed is about to hike rates while the ECB delivered a package of measures that fell short of (inflated) market expectations. More fundamentally, some of the downside risks highlighted after the summer did not materialise, including in China where the most recent data point to some tentative signs of stabilisation.