Today, the Riksbank left both the repo rate (-0.35%) and its QE programme unchanged (for a total of SEK200bn in bond purchases by June 2016), as expected. The Swedish central bank's forward guidance was strengthened somewhat as its Executive Board said that “policy rates will not be raised until CPIF inflation has stabilised around 2% during the first half of 2017”. Meanwhile, the Board stated that is was “highly prepared” to ease policy, “even between the ordinary policy meetings”, although the wording did not change much from the previous meeting. In particular, the statement repeated that the repo rate can be cut further (although the repo rate path was largely unchanged), asset purchases can be increased, FX interventions are possible and therefore a lending programme to companies. We believe that the Riksbank opted to stay put for more tactical reasons – the Fed is about to hike rates while the ECB delivered a package of measures that fell short of (inflated) market expectations. More fundamentally, some of the downside risks highlighted after the summer did not materialise, including in China where the most recent data point to some tentative signs of stabilisation.

Topics:

Frederik Ducrozet and Luc Luyet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Today, the Riksbank left both the repo rate (-0.35%) and its QE programme unchanged (for a total of SEK200bn in bond purchases by June 2016), as expected.

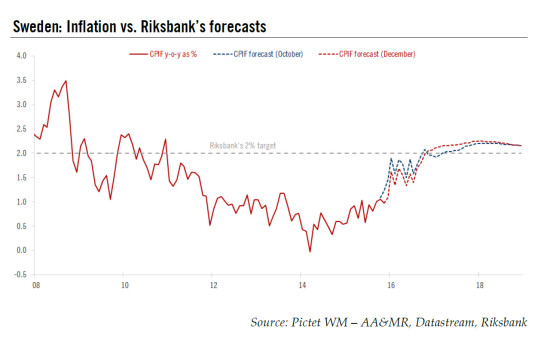

The Swedish central bank's forward guidance was strengthened somewhat as its Executive Board said that “policy rates will not be raised until CPIF inflation has stabilised around 2% during the first half of 2017”.

Meanwhile, the Board stated that is was “highly prepared” to ease policy, “even between the ordinary policy meetings”, although the wording did not change much from the previous meeting. In particular, the statement repeated that the repo rate can be cut further (although the repo rate path was largely unchanged), asset purchases can be increased, FX interventions are possible and therefore a lending programme to companies.

We believe that the Riksbank opted to stay put for more tactical reasons – the Fed is about to hike rates while the ECB delivered a package of measures that fell short of (inflated) market expectations. More fundamentally, some of the downside risks highlighted after the summer did not materialise, including in China where the most recent data point to some tentative signs of stabilisation. Lastly, despite subdued inflation (see below), the case for caution remains from a domestic perspective as strong economic growth, tight labour markets and elevated house prices do not require significant monetary stimulus. Indeed the Riksbank described economic activity as “stronger” while noting that the refugee crisis is also likely to lead a modest fiscal stimulus in 2016.

Since the last policy meeting, macroeconomic news has been mixed. On the one hand, GDP growth surprised significantly to the upside in Q3 (+0.8% q-o-q, after +1.0% in Q2) and looks on course to exceed consensus expectations of around 3% for this year and possibly next. Meanwhile, domestic demand has been the main driver of economic expansion so far, export growth has started to pick up as a result of stronger growth in the euro area in particular.

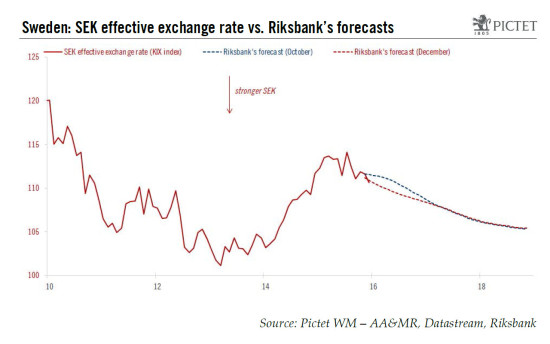

On the other hand, inflation undershot expectations in November, with headline CPI stable at 0.1% y-o-y in November, CPIF inflation (CPI with a fixed interest rate) down from 1.1% to 1.0% y-o-y and CPIF excluding energy, one of Riksbank’s preferred measures, down from 1.6% to 1.4% y-o-y. The Riksbank described the upturn in inflation as “volatile” and “not yet on a firm footing” based on November data, resulting in a modest downward revision to inflation projections for 2016 (but not beyond). The renewed fall in commodity prices is only likely to amplify the deviation from the Riksbank’s target although, if anything, inflation is still likely to rise in the next few months due to base effects. Meanwhile, the SEK is only slightly stronger than was forecast by the Riksbank in October.

To what extent the Riksbank remains under pressure to do more in 2016 will (again) depend on future decisions by the ECB and their collateral effects on the SEK. There is a risk that the ECB has to cut its deposit rate further into negative territory (if EUR appreciation lowers the inflation projections again) or to increase the pace of QE purchases (for instance, if inflation expectations continue to drift lower despite ECB action). Either way, a repo rate cut, to ‑0.45% or even below, could be the Riksbank’s first port of call. Further QE expansion before June 2016 looks less likely but may be on the cards if Swedish inflation disappoints in coming months.

Gradual SEK appreciation to continue

The Riksbank’s inflation outlook is particularly ambitious, especially given the global disinflationary pressures stemming from commodity prices. Furthermore, the recent disappointing inflation data and currency strength confirm that this outlook will be hard to reach. As a result, the Swedish central bank is likely to keep a tight leash on its currency in the coming months to avoid it appreciating too strongly. Nevertheless, given the fundamental undervaluation of the Swedish krona and the robust growth outlook, even the Riksbank expects its currency to appreciate over time. Furthermore, the overheating Swedish housing market and the strong labour market suggest that the risks associated with further easing measures are increasing significantly.

Therefore, the Swedish krona remains attractive in the medium term, although every short-term excess in appreciation is likely to prompt a dovish response from the Riksbank.