We expect the UK to remain in the EU, but the risks are high. Opinion polls suggest a close result, and unless the gap widens markedly between the “Ins” and “Outs”, a prolonged period of uncertainty beckons. Moreover, in the event of Brexit, negotiations could go on for years. Having secured a deal at the European Council meeting on 19 February, PM David Cameron announced that the referendum on UK EU membership will be held on 23 June. Based on the reactions on both sides, it looks like there might be something for everyone in Cameron’s deal, with some terms giving room for interpretation. The two most politically-sensitive issues revolve around an ‘emergency brake’ for foreign workers’ and child benefits, for which Cameron secured some tailor-made concessions. In particular, social benefits for newly arriving EU workers in the UK can be limited for up to four years, with a gradual phase-out period. This emergency brake will disappear after seven years, whereas Cameron had asked for it to be permanent. In terms of broader sovereignty, the agreement specifies that references to ever closer union do not apply to the UK—but this was pretty much a given anyway. Things are slightly more complicated when it comes to financial issues, as usual.

Topics:

Frederik Ducrozet and Luc Luyet considers the following as important: Brexit, Cameron, EU, Macroview, UK

This could be interesting, too:

Marc Chandler writes Will the PCE Deflator Really Contain New Information?

Marc Chandler writes Euro Sold After EU Parliament Elections and Macron’s Gambit

Marc Chandler writes Dollar Slips but Dip may Offer New Opportunity

Marc Chandler writes BOJ Speculation Unwound, Taking the Yen Lower

We expect the UK to remain in the EU, but the risks are high. Opinion polls suggest a close result, and unless the gap widens markedly between the “Ins” and “Outs”, a prolonged period of uncertainty beckons. Moreover, in the event of Brexit, negotiations could go on for years.

Having secured a deal at the European Council meeting on 19 February, PM David Cameron announced that the referendum on UK EU membership will be held on 23 June. Based on the reactions on both sides, it looks like there might be something for everyone in Cameron’s deal, with some terms giving room for interpretation. The two most politically-sensitive issues revolve around an ‘emergency brake’ for foreign workers’ and child benefits, for which Cameron secured some tailor-made concessions. In particular, social benefits for newly arriving EU workers in the UK can be limited for up to four years, with a gradual phase-out period. This emergency brake will disappear after seven years, whereas Cameron had asked for it to be permanent.

In terms of broader sovereignty, the agreement specifies that references to ever closer union do not apply to the UK—but this was pretty much a given anyway. Things are slightly more complicated when it comes to financial issues, as usual. In that area, any EU initiative seen as a potential threat to UK interests may be delayed by the UK government (or by any other non-euro EU country), forcing a debate at the Council level.

Key factors

Not only do opinion polls point to a close outcome, but they cannot be trusted to accurately reflect the state of play. Polls ahead of the 2015 UK general election uniformly showed the Conservatives and Labour roughly level—but the result was actually a win for the Conservatives by a sizeable 6.3 percentage points of the vote. The problem, broadly, was that polling companies’ methods overrepresented younger voters and underrepresented older voters. This could be significant, since younger voters are considerably more likely to favour remaining in the EU, and older voters to favour exit. Recent changes to voter registration rules, which have resulted in large numbers of young people dropping off the electoral register, are also significant. All this suggests that risks of Brexit might be underestimated.

Boris Johnson, the Mayor of London, will provide the out campaign with a recognisable and popular figurehead, helping its appeal. However, the fact that the ‘remain’ campaign will benefit from the active support of the prime minister, most other leading political figures and major employers is likely to prove more decisive.

Immigration is currently the top concern for the UK public, according to opinion polls. Any major worsening of the EU’s refugee crisis ahead of 23 June—such as a further surge in refugee arrivals, or incidents such as the mass sexual assaults involving migrants in Cologne on New Year’s Eve—could help to swing undecided voters towards Brexit.

However, the key factor in favour of ‘remain’ result is likely to be that the economic impact of exit is highly uncertain and the risks are high. Another concern will be that a vote to leave could lead to a break-up of the UK, as Scotland is firmly pro-EU and Brexit would likely prompt a fresh referendum on Scotland leaving the UK. These risks will likely persuade a balance of undecided voters (and some lukewarm Brexit supporters) to opt for the status quo.

What happens next in either case?

If the UK stays, we would expect a strong rebound in risk markets, not only in the UK but also in the euro area, as a sign of relief. Rates market expectations in particular already reflect extremely pessimistic assumptions. The first BoE rate hike is not priced in until end-2019, while the likelihood of a rate cut this year has jumped to around 30%. Such expectations would likely be adjusted sharply if the UK stayed, with a positive effect on the UK currency and sovereign bond yields.

Meanwhile, the significant decline in GBP following Johnson’s announcement confirms that sterling has not yet fully discounted the risk of a potential UK exit. As a result, GBP is likely to weaken further against USD ahead of 23 June. A “Brexit discount“ should also be applied to the euro, as Brexit would put into question the whole European project, including fuelling scepticism about the viability of the euro area.

If the UK leaves, a prolonged period of uncertainty would follow and risk sentiment would likely deteriorate further, leading most observers to downgrade their GDP growth forecasts. There does not seem to be even the beginning of an agreement on a framework for subsequent negotiations on relations with the EU. Our biggest concern is that investors would panic because the new rules will not be known for some time (the fear of the unknown).

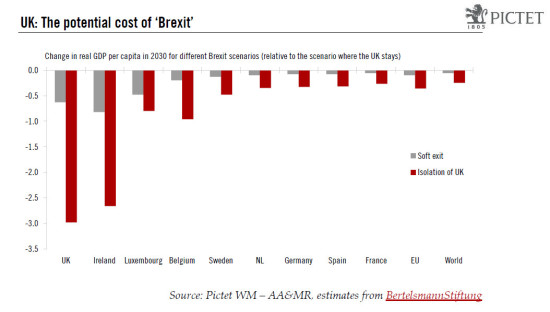

Depending on the form that a Brexit would take, the macro consequences would range from ‘modestly negative’ to ‘potentially disastrous’. The EU accounts for almost 50% of UK exports. Financial links are even more important, including in terms of the banking sector, broader financial services or Foreign Direct Investment (FDI). The UK’s relatively vulnerable external position, including a 4.5-5.0% current account deficit, would be likely to make things worse. Some mitigating effects should be factored in as well, included looser monetary policy for longer, but on balance they are unlikely to compensate for the damage to business confidence and activity in the short-run.

Finally, the risks for other EU countries, especially euro area members, are likely to be significant as well. Direct links may be asymmetric (the UK represents ‘only’ 13% of euro area exports), but other channels would come into play, including politics. Some countries might use the opportunity to ask for special treatment themselves, including in the area of migration and social benefits; others might use the UK as a precedent to show that it is feasible to leave the Union under some conditions. Every situation is different, but Catalonia is a case in point (although in that case the issue would be to re-enter the EU after leaving the euro area), while other countries would likely have heated debate (e.g., France’s far-right Front National is already arguing in favour of a UK-like ‘Frexit’).

Finally, the risks for other EU countries, especially euro area members, are likely to be significant as well. Direct links may be asymmetric (the UK represents ‘only’ 13% of euro area exports), but other channels would come into play, including politics. Some countries might use the opportunity to ask for special treatment themselves, including in the area of migration and social benefits; others might use the UK as a precedent to show that it is feasible to leave the Union under some conditions. Every situation is different, but Catalonia is a case in point (although in that case the issue would be to re-enter the EU after leaving the euro area), while other countries would likely have heated debate (e.g., France’s far-right Front National is already arguing in favour of a UK-like ‘Frexit’).