While recent data has been encouraging, we still expect the UK economy to weaken in 2017. Short-term support for sterling may be undermined by Brexit talks and twin deficits. At its 15 September meeting, the Bank of England (BoE) left its main policy rate unchanged at 0.25% and maintained its Asset Purchase Facility (APF) target at GBP435 bn. The BoE’s assessment of economic conditions was broadly similar to its August projections despite some “slight upside” in the data. Nevertheless, the BoE provided enough hints to suggest that it will cut its main policy rate from 0.25% to 0.10% before the end of this year, most likely in November. At the same time, we acknowledge that the likelihood of the BoE delaying such a policy response has increased, not only because of better-than-expected economic data but also because of the impact of its August easing package on UK asset prices.Recent UK economic indicators have generally been resilient, mechanically pushing our 2016 GDP growth forecast up to 1.8% from the 1.3% level we predicted immediately after the Brexit vote. However, we have left our 2017 growth forecast unchanged at 0.9%, given our belief that the UK will perform well below potential.We remain reluctant to revise our medium-term UK growth projections higher for two main reasons.

Topics:

Frederik Ducrozet and Luc Luyet considers the following as important: Bank of England, Macroview, Sterling exchange rate, UK growth, UK monetary policy

This could be interesting, too:

Marc Chandler writes The Dollar Remains Bid, While the Euro and Swiss Franc are Sold Through Last Week’s Lows

Marc Chandler writes Searching for Direction

Marc Chandler writes Serenity Now

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

While recent data has been encouraging, we still expect the UK economy to weaken in 2017. Short-term support for sterling may be undermined by Brexit talks and twin deficits.

At its 15 September meeting, the Bank of England (BoE) left its main policy rate unchanged at 0.25% and maintained its Asset Purchase Facility (APF) target at GBP435 bn. The BoE’s assessment of economic conditions was broadly similar to its August projections despite some “slight upside” in the data. Nevertheless, the BoE provided enough hints to suggest that it will cut its main policy rate from 0.25% to 0.10% before the end of this year, most likely in November. At the same time, we acknowledge that the likelihood of the BoE delaying such a policy response has increased, not only because of better-than-expected economic data but also because of the impact of its August easing package on UK asset prices.

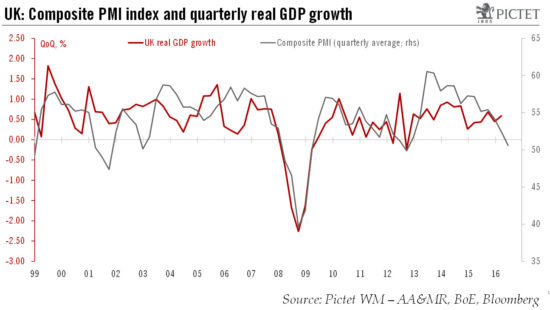

Recent UK economic indicators have generally been resilient, mechanically pushing our 2016 GDP growth forecast up to 1.8% from the 1.3% level we predicted immediately after the Brexit vote. However, we have left our 2017 growth forecast unchanged at 0.9%, given our belief that the UK will perform well below potential.

We remain reluctant to revise our medium-term UK growth projections higher for two main reasons. First, with formal Brexit negotiations yet to start and the UK government’s position still unclear, we believe that the macroeconomic consequences of political uncertainty will continue to be felt over time. Our baseline forecast remains that Article 50 (which will start formal Brexit negotiations) will be triggered in H1 2017, but further delays are very possible given a heavy agenda of general elections in the Netherlands, France and Germany next year. Second, we expect to see a progressive weakening of private-sector investment spending as companies adjust their hiring and expansion plans.

Sterling is likely to remain broadly stable in the next few months. However, despite its attractive short-term valuation, political uncertainty concerning the nature of an eventual Brexit deal with the EU and the UK’s twin deficits favour a negative bias to the GBP over the longer term. The prospect of a ‘hard Brexit’ deal would likely justify a rate closer to USD1.20 to 1 British pound, compared with the USD1.28-1.38 range we forecast for the near future.