Having faltered this year, predictions of prices above USD60/b in 2017 appear premature.The market was highly optimistic about oil price at the beginning of this year, with oil analysts expecting that prices would have recovered to USD60-65 by now. These hopes have clearly been dashed, as WTI prices have fluctuated in a range of USD45-55 since January 1.We have been much less optimistic than the market, based on our own modelling of the equilibrium oil price, which has proved a reliable indicator of oil price trends in the past. The equilibrium oil price has informed our forecast over the past two years that spot oil prices would remain close to USD50 per barrel. In addition, the current price (USD48.6/b for the spot WTI on 16 May) is very close to the equilibrium price of USD44/b Taking into account our economic scenario (world GDP growth of 3.3% in 2017 and 3.6% in 2018, US inflation of 2.4% in 2017), the oil price equilibrium may shift only slightly higher, to USD51/b over the next 12 months, assuming the trade-weighted US dollar rate remains unchanged.For the price to go higher, we would need much stronger economic growth or a weaker US dollar. If the US dollar were to weaken by 10% in real trade-weighted terms over the coming 12 months (not our core scenario), then equilibrium oil prices could rise to USD59/b.

Topics:

Jean-Pierre Durante considers the following as important: Macroview, oil price equilibrium, oil prices, oil prices forecast, oil supply-demand

This could be interesting, too:

Jeffrey P. Snider writes I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

Jeffrey P. Snider writes Houston, We Have An Oil (and inventory) Problem

Cesar Perez Ruiz writes Weekly View – Big Splits

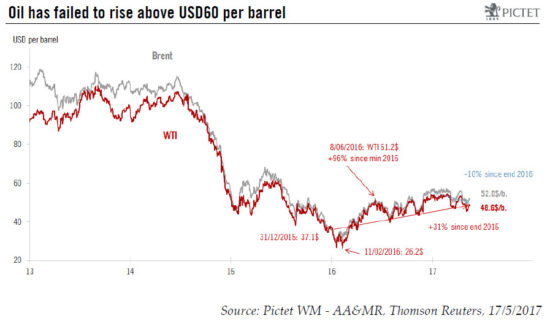

Having faltered this year, predictions of prices above USD60/b in 2017 appear premature.

The market was highly optimistic about oil price at the beginning of this year, with oil analysts expecting that prices would have recovered to USD60-65 by now. These hopes have clearly been dashed, as WTI prices have fluctuated in a range of USD45-55 since January 1.

We have been much less optimistic than the market, based on our own modelling of the equilibrium oil price, which has proved a reliable indicator of oil price trends in the past. The equilibrium oil price has informed our forecast over the past two years that spot oil prices would remain close to USD50 per barrel. In addition, the current price (USD48.6/b for the spot WTI on 16 May) is very close to the equilibrium price of USD44/b Taking into account our economic scenario (world GDP growth of 3.3% in 2017 and 3.6% in 2018, US inflation of 2.4% in 2017), the oil price equilibrium may shift only slightly higher, to USD51/b over the next 12 months, assuming the trade-weighted US dollar rate remains unchanged.

For the price to go higher, we would need much stronger economic growth or a weaker US dollar. If the US dollar were to weaken by 10% in real trade-weighted terms over the coming 12 months (not our core scenario), then equilibrium oil prices could rise to USD59/b. By contrast, should the US dollar strengthen by 10%, then the equilibrium oil price would be USD46/b, just USD2 above the current equilibrium level

The May 15 announcement to extend the OPEC-Russia supply cut agreement is unlikely to change fundamentally the current supply/ demand balance, just as last year’s agreement failed to enable oil to break the USD60/b ceiling. In addition, in spite of short-term declines, US shale oil supplies are high and price dynamics point to more production from this source.

Two on-going technological shocks explain why the market is struggling to balance the accumulated oversupply of the last three years: the faster-than-expected transition towards alternative sources of energy and the adaptability of North American shale oil producers, which means the break-even price for shale production has fallen to about USD35/b.

All in all, we believe the upside potential for oil prices remains limited. Only in quite extreme scenarios (much stronger growth or a collapse in the US dollar) can one envisage an equilibrium oil price above USD60/b.