Summary:

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around 5. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week. Rising oil prices, in particular, have been a regular feature of past recessions and while the US may be better suited to handle this shock than Europe and some other countries, that doesn’t mean it won’t have an impact. We own commodities – including gold – in our portfolios for exactly these types of situations and that has been helpful to our returns this year.

But at some

Topics:

Joseph Y. Calhoun considers the following as important:

5.) Alhambra Investments,

Alhambra Portfolios,

Alhambra Research,

Australia,

Australian Dollar,

bonds,

Brazil,

Brazilian real,

Canada,

Canadian Dollar,

commodities,

commodity prices,

Copper,

credit spreads,

currencies,

economic growth,

emerging markets,

energy stocks,

Featured,

healthcare stocks,

Interest rates,

Markets,

NASDAQ,

natural gas,

newsletter,

oil prices,

Real estate,

REITs,

stocks,

strong dollar,

Ukraine,

US dollar,

US Dollar Index,

value stocks

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week. Rising oil prices, in particular, have been a regular feature of past recessions and while the US may be better suited to handle this shock than Europe and some other countries, that doesn’t mean it won’t have an impact. We own commodities – including gold – in our portfolios for exactly these types of situations and that has been helpful to our returns this year.

But at some point the rise in prices is self correcting due to demand destruction. If we get further confirmation of impending recession – inverted yield curve or rising credit spreads – we will have to consider whether and how much that could reduce commodity prices.

While there are significant differences between today and the 2008 crisis, the rise in oil prices is giving me deja vu all over again. The first half of 2008 saw crude oil rise from under $96 to $147 on July 11th, a 53% rise. After that peak, crude fell in a near straight line, closing the year around $45. Assuming the price of futures tonight holds into tomorrow – and I see no reason to think it won’t considering what is going on – the rise this year is even steeper, up 64%. In both cases too, the rise in commodity prices was not confined to crude oil. Natural gas was up nearly 80% in 2008 – much higher than today – and copper was up 30%. Overall, the CRB commodity index was up 32% from January to July of 2008 and, like crude, fell precipitously as the US economy entered recession, down 52% from the peak by year end. This year, the CRB is up 29%, the Bloomberg Commodity index is up 28% and the S&P GSCI is up 46% so the change is similar to 2008. The levels of these commodity indexes today are still well below 2008 levels but the cause of the rise seems unlikely to end soon. In 2008 the rise was driven by a weak dollar and as soon as the dollar rose, commodity prices fell. This time the rise is driven by the Ukraine war and we have no way of knowing how that will be resolved or when.

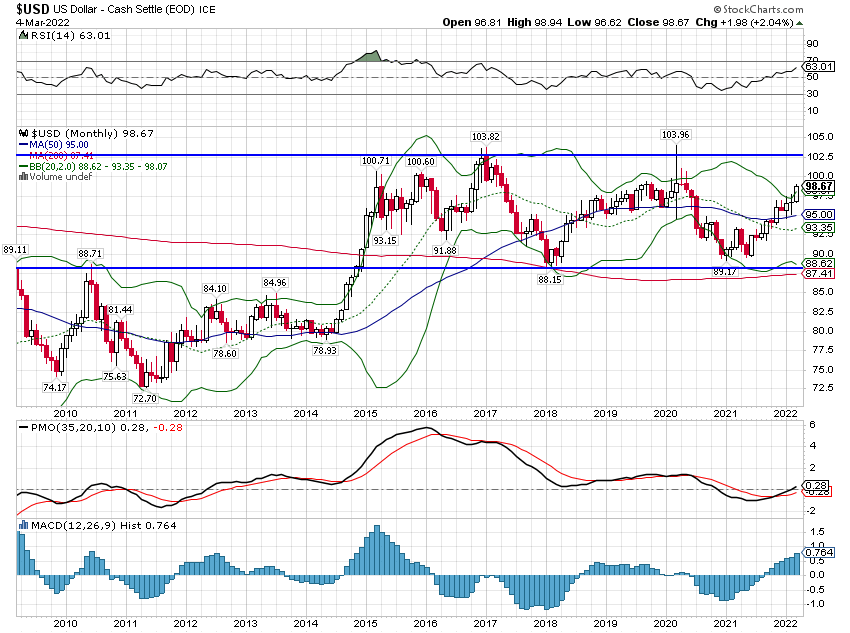

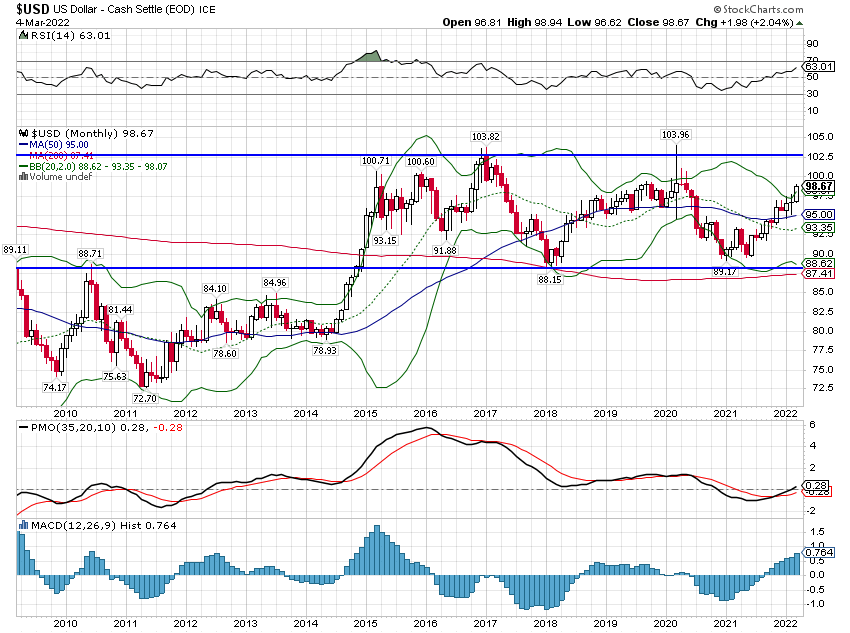

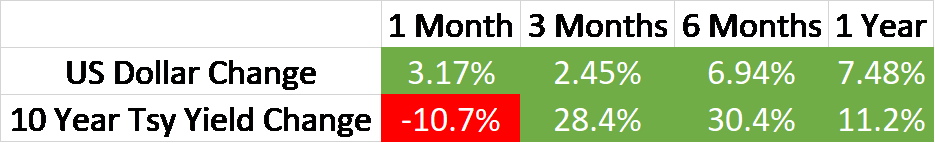

| The major difference between the two periods is the action of the dollar. In the case of 2008, the dollar had been in a downtrend since 2003 and accelerated to the downside after 2006, falling nearly 22%. The dollar hit its nadir in April and rallied 21% by the end of the year. A rapidly rising dollar causes problems in the global economy due to the large amount of outstanding dollar debt and we all know what happened in 2008. The situation is quite different this year although obviously we don’t know what the dollar will do from here. The dollar index is up about 7.5% over the last year and has been in a fairly narrow trading range for the last 7 years:

Note: The dollar index is trading at 99 as I write this. |

|

| A strong dollar is not something we generally think of as a negative for the US economy but a rapidly rising one can create problems for countries and companies with outstanding dollar debts. The world has, however, had quite a long time to adjust to the dollar at these levels so it may not cause any serious issues right now but if it keeps rising it certainly could. One item to note too is that almost all of the rise in the dollar is related to the Euro where the impact of Ukraine is likely to be greatest. The Brazilian Real, Canadian and Australian dollars (commodity producers) were all up last week versus the dollar. The Yen is also up slightly for the year and I don’t see any significant moves in a variety of EM currencies I reviewed over the weekend.

The rise in crude oil prices and other commodities has mostly been driven by fear to date. |

|

| Russian oil is theoretically available to the market even though there are few buyers at this point. That will get resolved over time even if the US and its allies impose an embargo on Russian oil. Just as with Iranian crude, it will get to the market, likely through China. The fear of future shortages is driving an extraordinary demand for crude today which we can observe in the futures market where April futures are trading at a nearly 19% premium to September futures. That doesn’t mean the market believes crude prices will fall by September just that there is extraordinarily high demand today. At some point that will end and the premium for front month futures will subside. Whether that is because the Ukraine situation is resolved or the market finds a way around any supply disruptions or non Russian companies find a way to pump more oil (they certainly have the incentive) or because we have a global recession I can’t say.

We could still avoid recession even if oil and commodity prices remain high. The US economy isn’t as sensitive to energy costs as it once was and we have had recent periods where the economy continued to grow with prices well over $100. From 2011 to 2014 prices oscillated around the $100 level and got as high as $114. It wasn’t a great period for growth with 3 quarters of mild contraction but we were also still dealing with the after effects of 2008 at the time. Recession isn’t a foregone conclusion even if the odds have risen. But high commodity prices may be the reality we have to deal with for some time since a quick resolution does not look likely at this point.

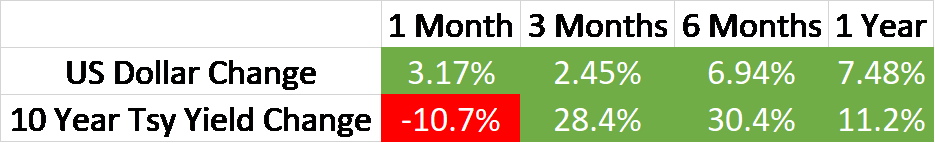

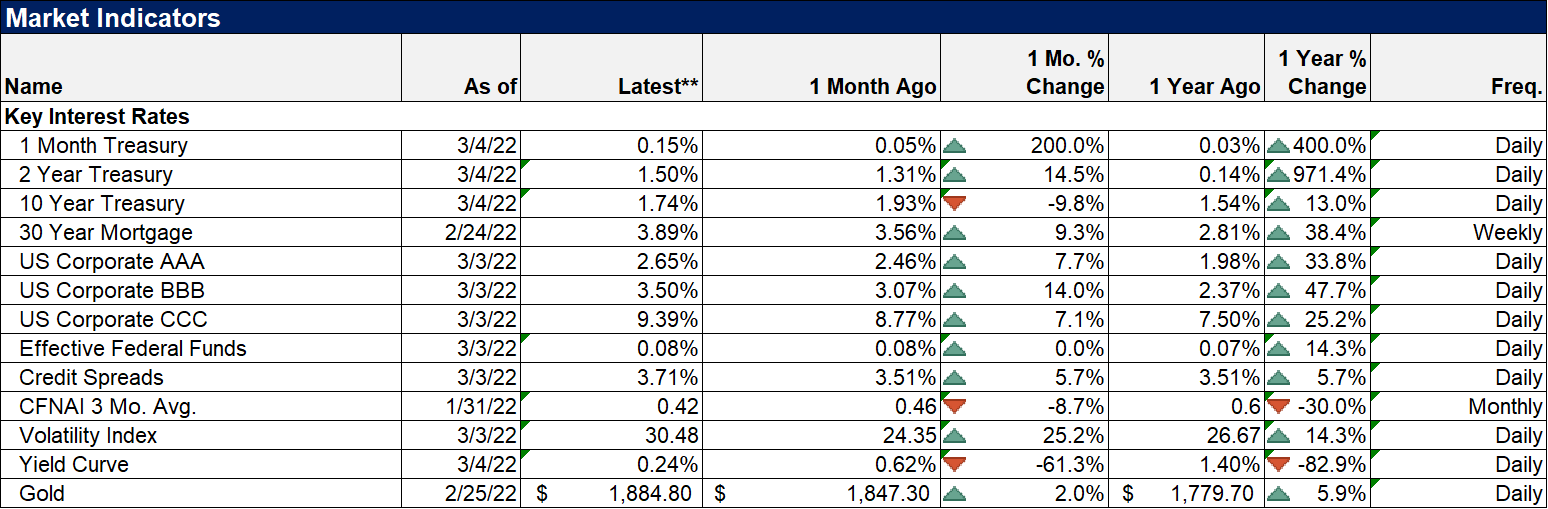

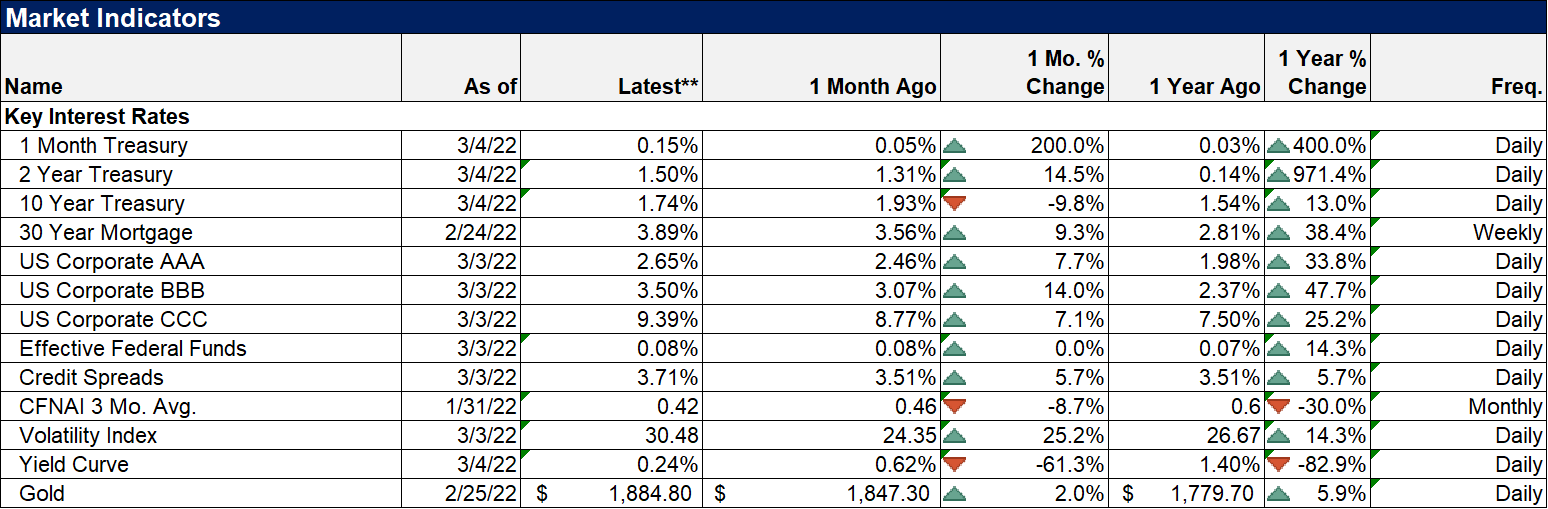

The economic environment changed pretty significantly last week with the dollar rallying a little over 2% and the 10 year Treasury yield falling 26 basis points. That puts the dollar in a full fledged uptrend and means we will likely be forced – barring a quick reversal – to reduce or eliminate our international, non-dollar exposure. Our exposure was minimal in any case but it certainly hurt us last week. Our portfolios still managed to be flat to up a bit last week depending on risk tolerance, but it would have been a lot better without the foreign exposure. Our portfolios still outperformed the standard 60/40 moderate benchmark which fell by 0.75%. Our process requires us to minimize foreign exposure when the dollar is in a full uptrend and we’ll stick to it. Having said that, I am more than a little surprised the dollar isn’t up more than it is. In fact, despite the Ukraine war, the dollar rally last week came almost all on Thursday and Friday. Until then, the dollar index was up less than 1% on the week. It seems the bombing of the nuclear facility triggered a rally that, prior to that, was quite mild. I’m not sure exactly why that is but it does bother me.

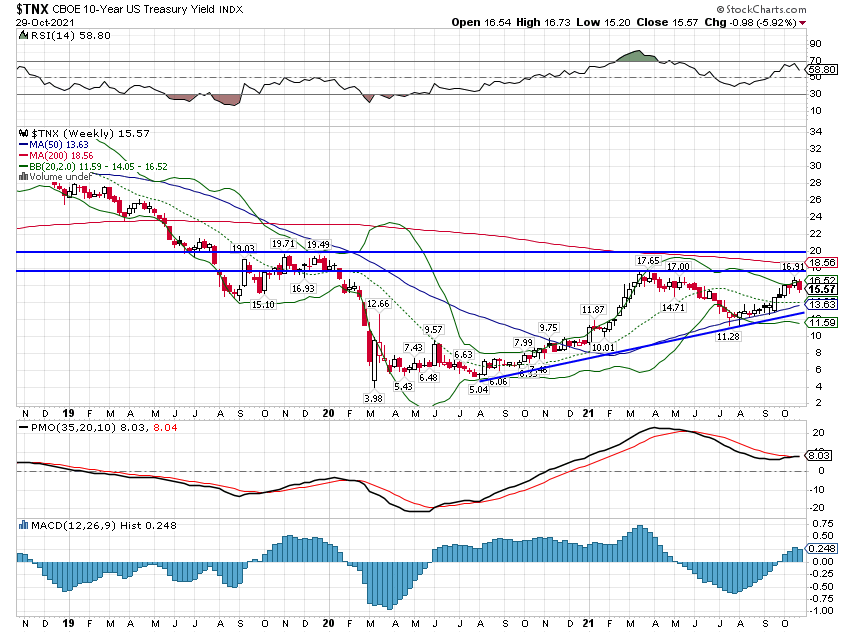

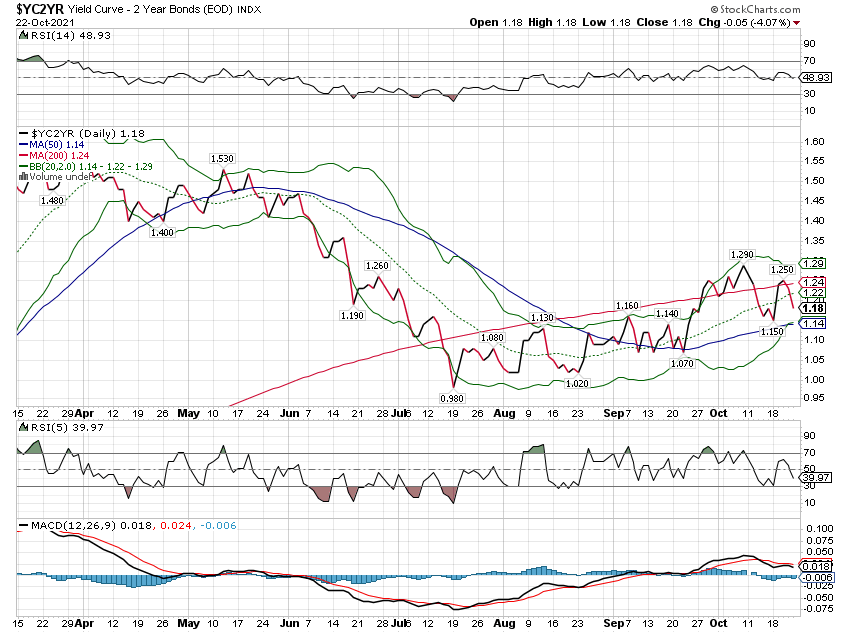

The 10 year Treasury yield is down over the last month but is still in a longer term uptrend. The yield curve also flattened considerably last week and the 10/2 now sits at just 24 basis points. That and a host of other markets we follow are getting uncomfortably near conditions we associate with recession so we are watching them quite closely (obviously). For now it is a warning sign but doesn’t trigger a change in our strategic allocation. |

|

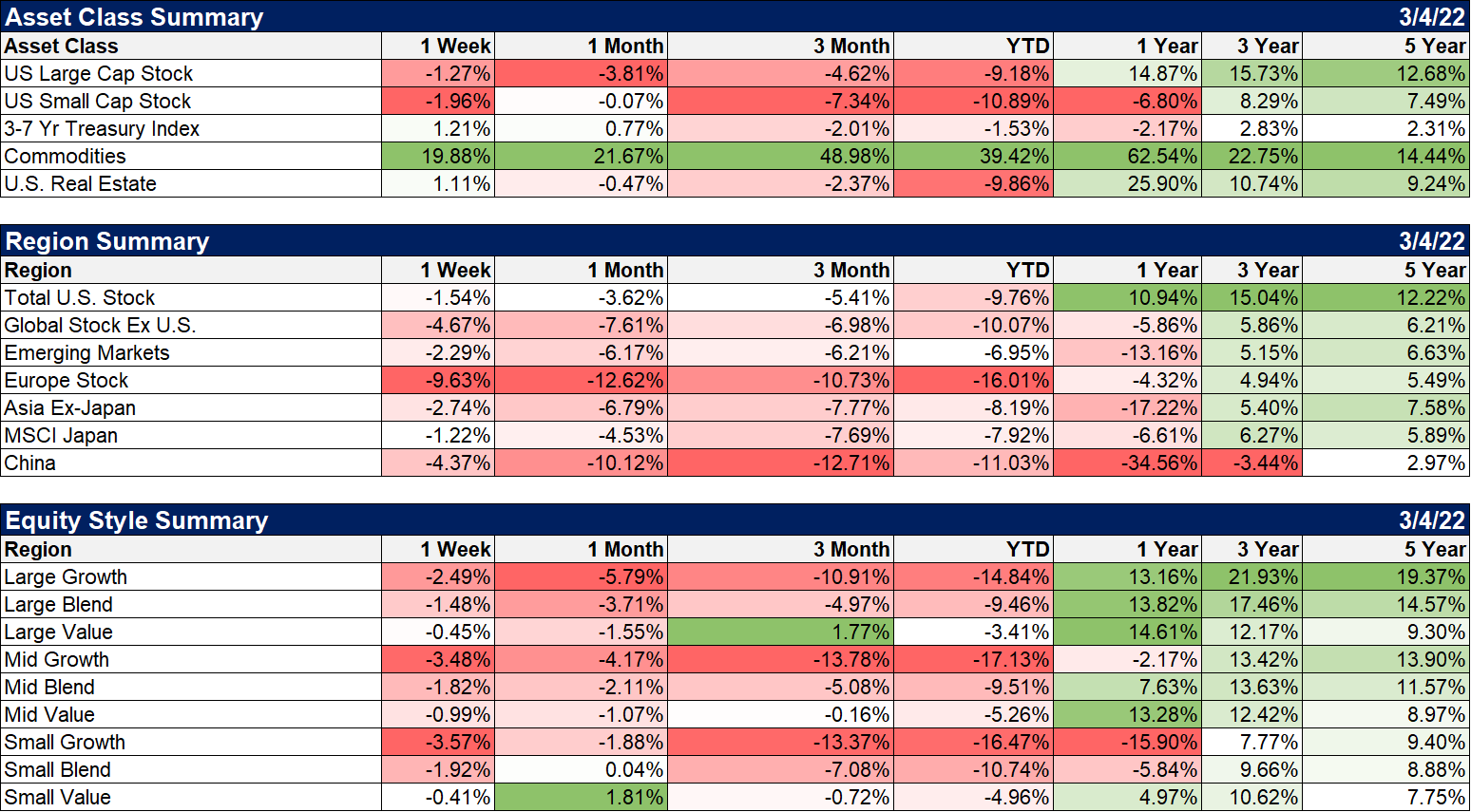

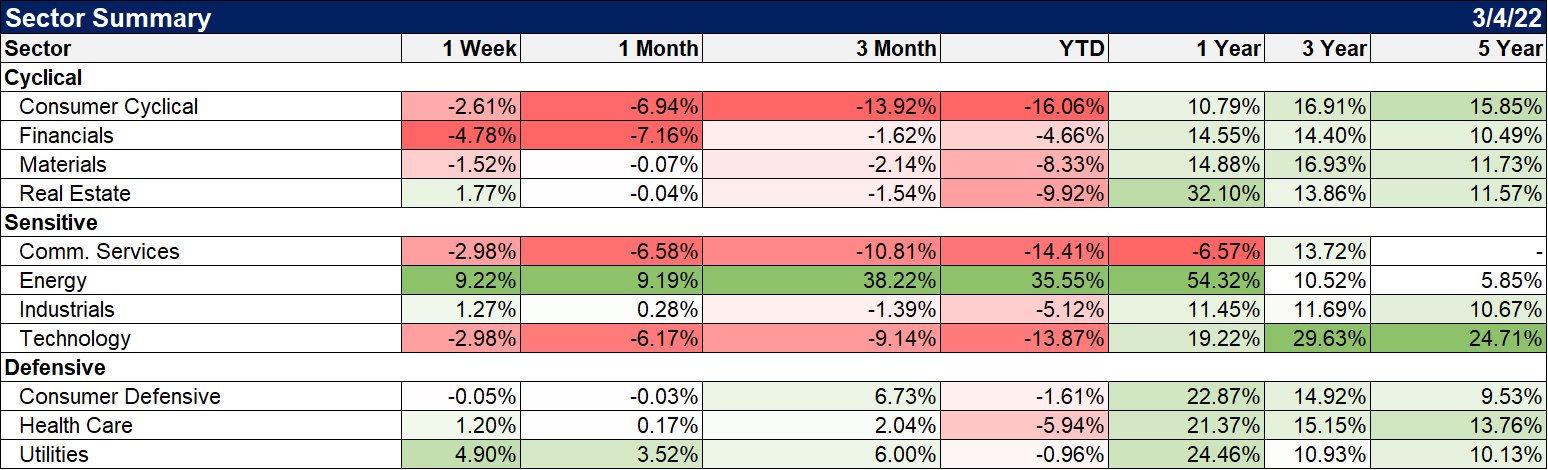

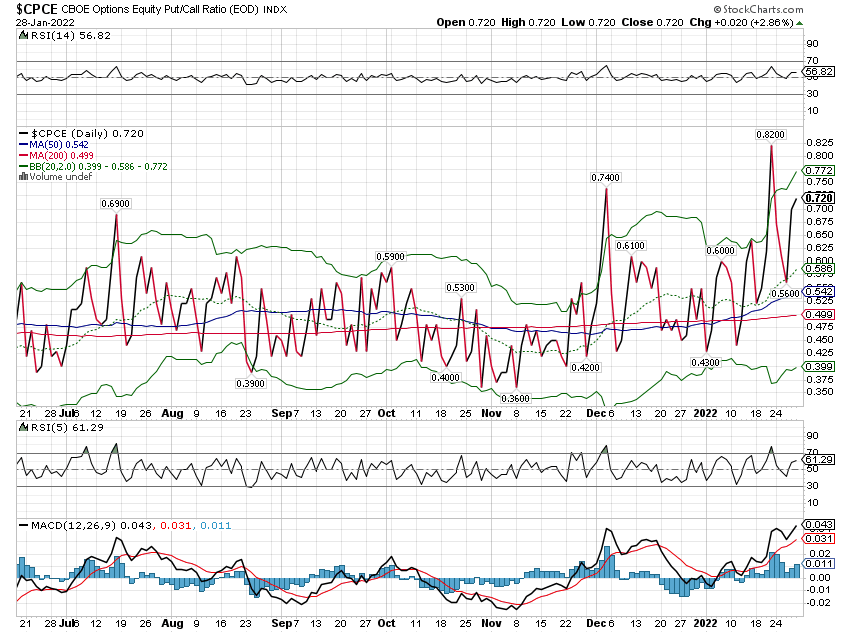

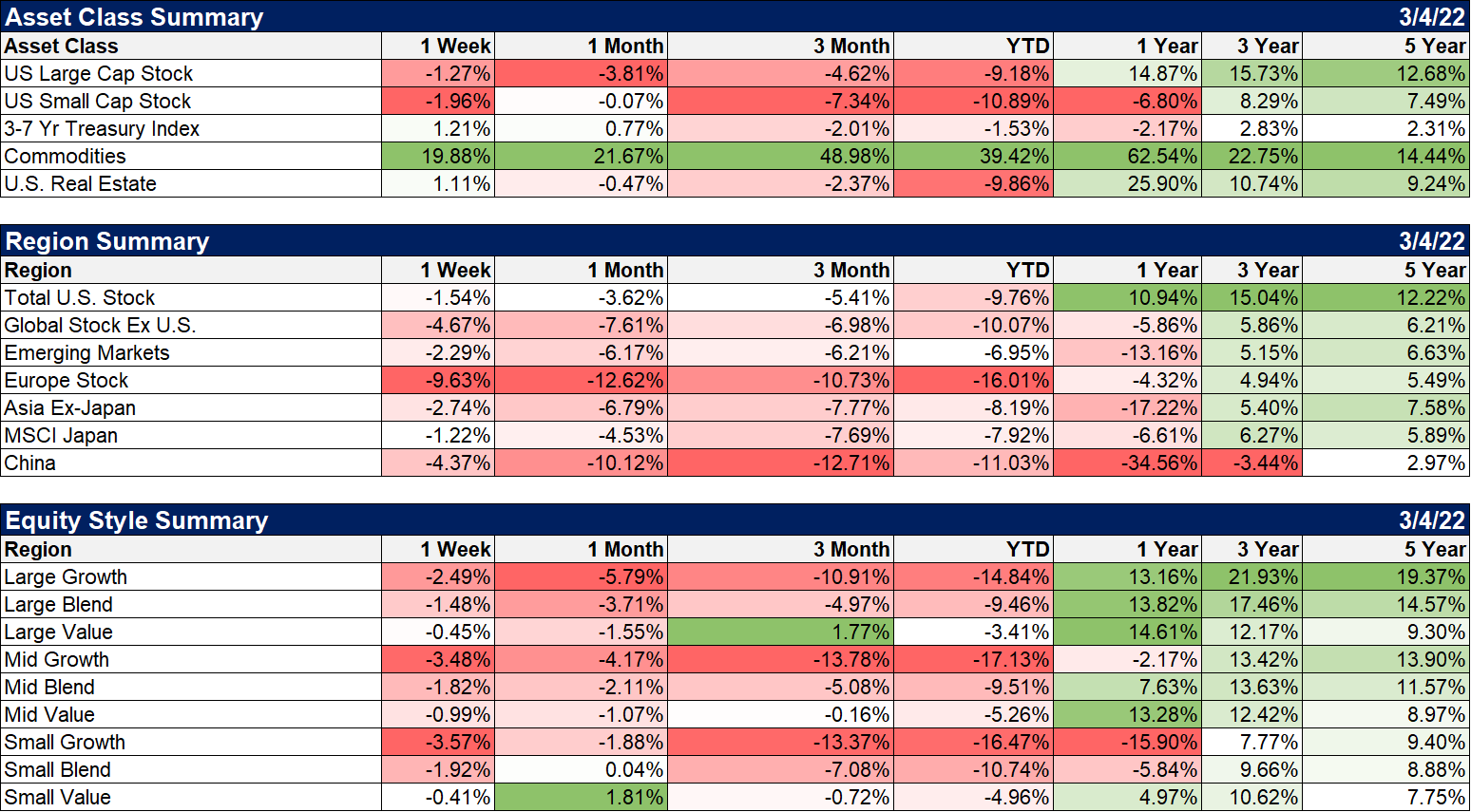

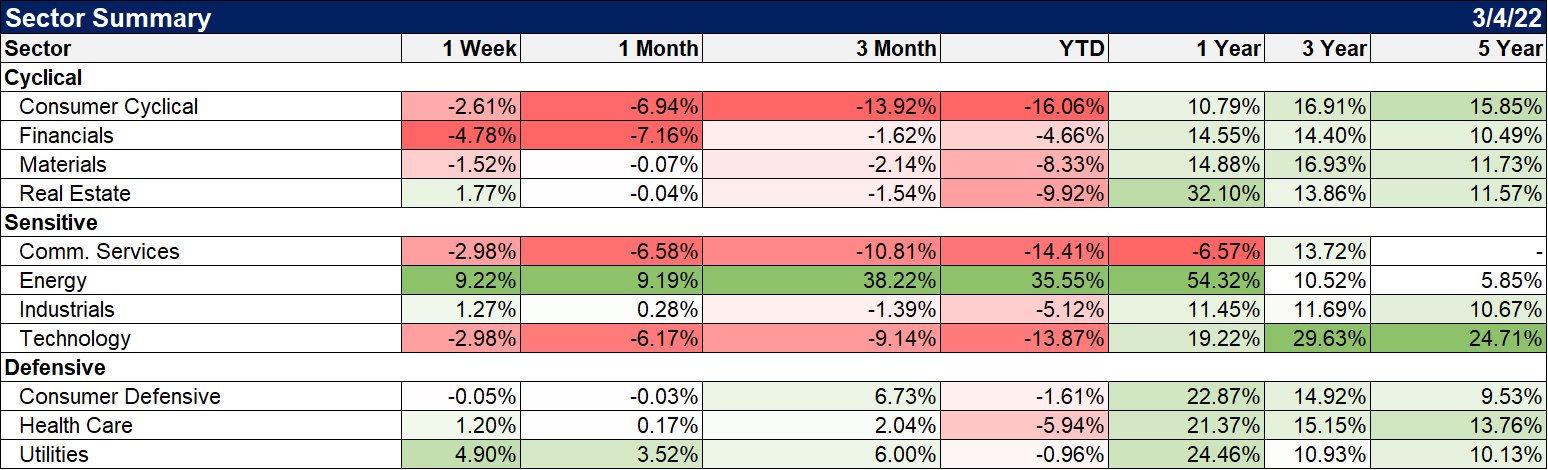

There was considerable volatility in stocks last week but in the end US stocks were only down modestly. Bonds and REITs were higher on the week which helped our portfolios but the real winner was, of course, commodities. The GSCI, with an overweight in energy, rose nearly 20% while the Bloomberg Commodity index, which is more evenly divided across the commodity complex, was up almost 11%. Gold was up a little more than 4% which I’d call a bit disappointing. Copper was up 10% so the copper:gold ratio was higher on the week. That is normally a pretty reliable indicator of improving economic growth but I don’t think I’d trust it given the geopolitical situation. Agricultural commodities were also big winners as Ukraine is a big exporter of wheat and corn.

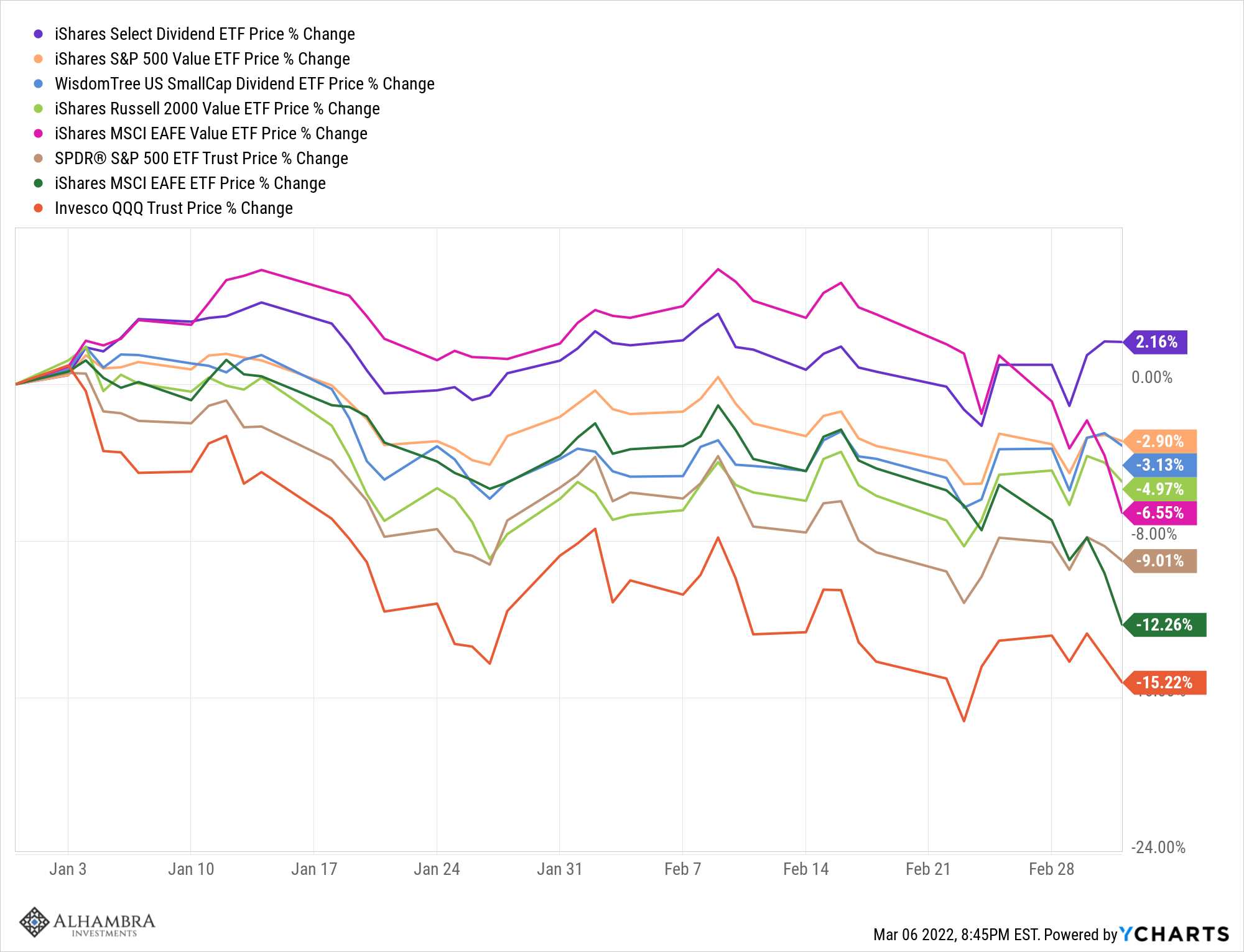

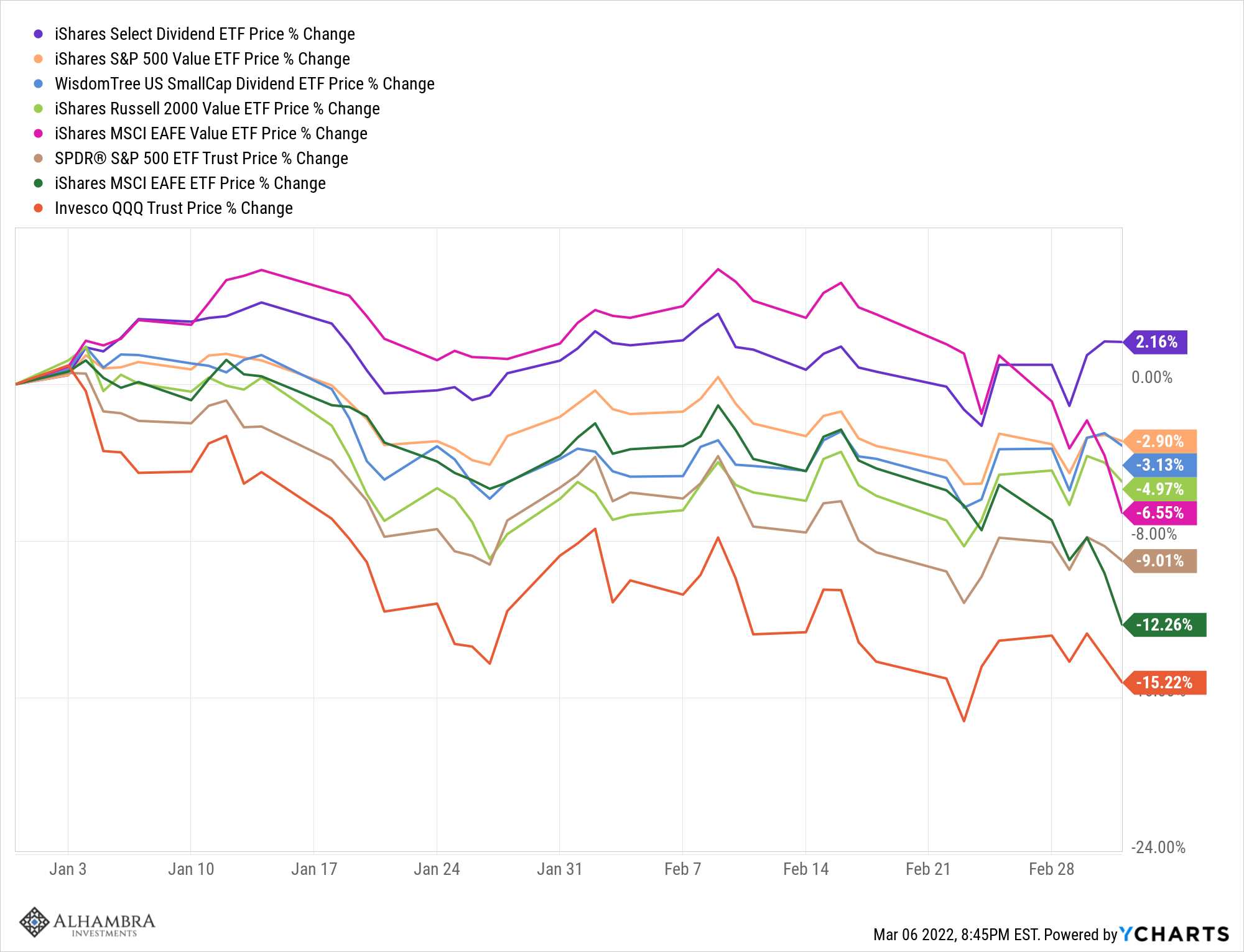

Value stocks continue to outperform, down only a fraction of a percent last week.

Dividend stocks have been the real winners (not shown in chart). Large cap dividend stock ETFs were up over 1% on the week (2.2% YTD) and small caps managed a slight gain as well. |

|

| Sector winners were REITs, utilities, industrials, healthcare and, of course, energy. The more general category of natural resource stocks (we own GNR) were up 1.76% last week. |

|

| Nothing particularly surprising here but credit spreads have widened somewhat during this correction. The move so far remains quite muted and doesn’t warrant a change in the portfolio. |

|

|

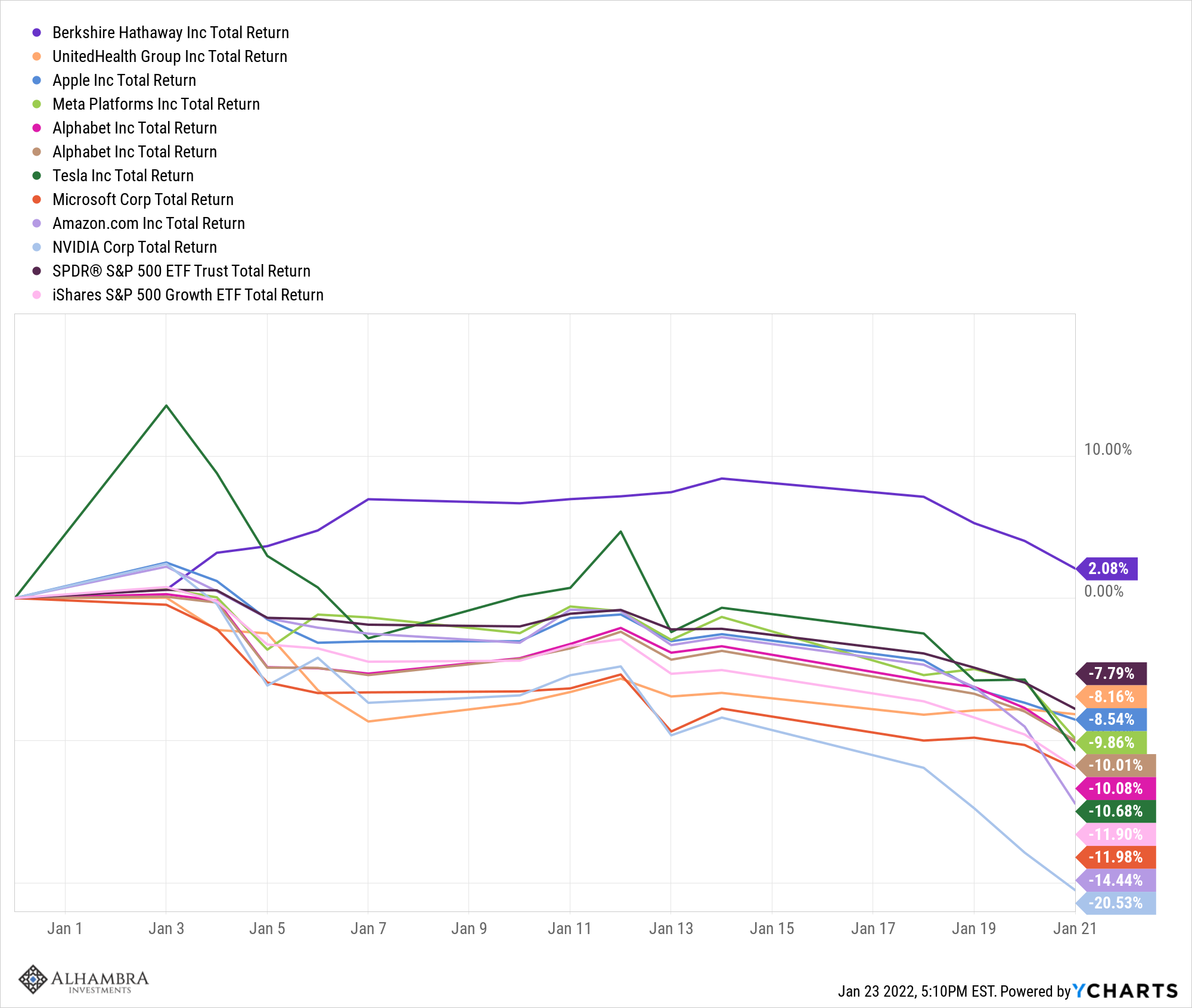

Considering what has transpired this year, it is fairly remarkable that stocks have not performed worse than they have. European stocks are on the verge of a bear market – they will almost surely break the down 20% level this week – and NASDAQ stocks are close. But value and dividend stocks have done incredibly well year to date. |

|

The bulk of our equity exposure is in dividend and value stocks. Even most of our international exposure is in value which has done worse than the US but a lot better than the growth side of the market. The one exception is our small position in Emerging markets and even there, YTD it has outperformed the S&P 500 by a smidgen. Value and dividend stocks aren’t a panacea but they have in the past provided some shelter from the storm when things go wrong and that appears to be the case again.

High oil prices have triggered recessions before and maybe this spike will too. But so far, we don’t have enough evidence to make that call. The yield curve is flatter but still positively sloped; it’s going in the wrong direction but we aren’t there yet. Jeff Snider has also seen some warnings in other rates markets, but, again, nothing that says recession is imminent. We are already positioned defensively and have a healthy cash reserve. And we can do more if we get more evidence of recession. Let’s hope we don’t have to.

Joe Calhoun

Tags:

Alhambra Portfolios,

Alhambra Research,

Australia,

Australian Dollar,

Bonds,

Brazil,

Brazilian real,

Canada,

Canadian Dollar,

commodities,

commodity prices,

Copper,

credit spreads,

currencies,

Dollar Index,

economic growth,

Emerging Markets,

energy stocks,

Featured,

healthcare stocks,

Interest rates,

Markets,

NASDAQ,

Natural Gas,

newsletter,

oil prices,

Real Estate,

REITs,

stocks,

strong dollar,

Ukraine,

US dollar,

value stocks