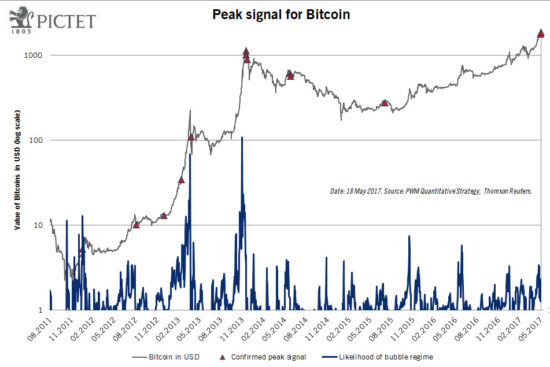

Crypto-currencies like Bitcoin and Ripple are caught in a “bubble regime”, oscillating between extreme peaks and troughs. A new peak is close….Pictet’s inhouse quantitative analysis can provide ways of spotting certain kinds of bubble and predicting when they will burst (see article ‘Forecasting Financial Extremes’).One aspect of this analysis is focused on investor herding behaviour, as measured by the combination of super-exponential cycles and ever faster oscillations around those cycles. Peaks and troughs in these cycles are the moments when these oscillations become infinitely fast.Sometimes, in periods that might be called “bubble regimes”, various assets caught in these super-exponential cycles move permanently between bubble and crash territory instead of following the usual trajectory for stock prices. Examples can be found in the behavior of stocks on the following indexes:Hong Kong’s Hang Seng from 1967 to the peak of the Asian Crisis in 1997.Japan’s Topix from 1982 to 2009, the period covering the inflation and deflation of the Japanese asset bubble.The Nasdaq from 1995 to 2003, the period of the dot.com bubble and burst.Stowe’s Global Coal Index from 2006 to 2008, a period that covered growth and recession in China.Which assets are in a “bubble regime” today? In our view, crypto-currencies are.

Topics:

Edgar van Tuyll van Serooskerken considers the following as important: Bitcoin, Bitcoin bubble, Crypto-currencies, Macroview, Super-exponential cycles

This could be interesting, too:

investrends.ch writes Bitcoin sackt immer weiter ab

investrends.ch writes Bitcoin – Rekord liegt jetzt bei mehr als 106’000 Dollar

Claudio Grass writes “THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Claudio Grass writes “THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Crypto-currencies like Bitcoin and Ripple are caught in a “bubble regime”, oscillating between extreme peaks and troughs. A new peak is close….

Pictet’s inhouse quantitative analysis can provide ways of spotting certain kinds of bubble and predicting when they will burst (see article ‘Forecasting Financial Extremes’).

One aspect of this analysis is focused on investor herding behaviour, as measured by the combination of super-exponential cycles and ever faster oscillations around those cycles. Peaks and troughs in these cycles are the moments when these oscillations become infinitely fast.

Sometimes, in periods that might be called “bubble regimes”, various assets caught in these super-exponential cycles move permanently between bubble and crash territory instead of following the usual trajectory for stock prices. Examples can be found in the behavior of stocks on the following indexes:

- Hong Kong’s Hang Seng from 1967 to the peak of the Asian Crisis in 1997.

- Japan’s Topix from 1982 to 2009, the period covering the inflation and deflation of the Japanese asset bubble.

- The Nasdaq from 1995 to 2003, the period of the dot.com bubble and burst.

- Stowe’s Global Coal Index from 2006 to 2008, a period that covered growth and recession in China.

Which assets are in a “bubble regime” today? In our view, crypto-currencies are. Among these currencies, Bitcoin has by far the largest market capitalisation (according to coinmarketcap.com), followed by fast-growing Ripple and Ethereum. Since 2010, the performance of all these crypto-currencies bears all the marks of following super-exponential trends. As the attached chart shows, Bitcoin is currently approaching previous peaks in the super-exponential cycle.