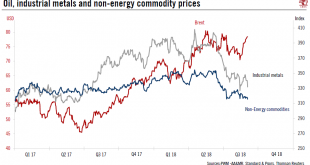

Oil prices are caught between concerns that trade disputes will dent demand, and the risk of supply shortages due to production shortfalls and capacity constraints. We think that these combined factors justify our estimated fair value for oil.In light of the OPEC + Russia decision to increase output, oil prices declined from the end-June to mid- August. This decline is not limited to oil: all commodities have been affected. Industrial metals declined by 12%, and non-energy commodities by...

Read More »Oil price forecast revised up

Tensions surrounding oil supplies from Iran and Venezuela are destabilising the supply/demand balance.The decision by Donald Trump to withdraw from the nuclear agreement with Iran in early May constitutes a major geopolitical shift. Iran is the world’s seventh-largest world oil producer, exporting 1.1 million barrels per day (mbd). At this stage, it is unclear how Iranian exports will be affected, but taken together with the crisis in Venezuelan oil production, it could cause significant...

Read More »Where next for oil prices?

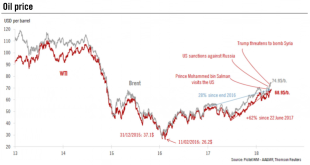

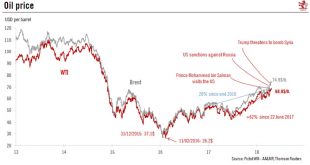

On 19 April, the price of a barrel of oil reached USD69.56 for West Texas Intermediate (WTI) and reached USD75.27 for Brent, today, the highest price since 2014. Since 9 April, oil prices have been significantly above their longterm fundamental equilibrium value. Three factors explain what has happened: Geopolitics. Between Saudi Arabia’s Prince Mohammed bin Salman visit to the US at end March, new US sanctions against...

Read More »Where next for oil prices?

Oil prices are significantly above their long-term equilibrium, but should converge towards their equilibrium in the coming months.Oil prices have surged to their highest levels since 2014 (USD69.56 for West Texas Intermediate (WTI) on 19 April and USD75.27 for Brent on 24 April ). They are now USD6 to USD9 above our calculation of their long-term fundamental price equilibrium.Three factors explain the current price premium:Geopolitics: Between Saudi Arabia’s Prince Mohammed bin Salman visit...

Read More »Limited upside potential for oil

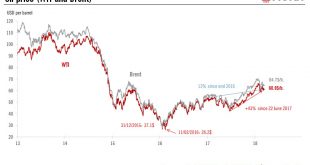

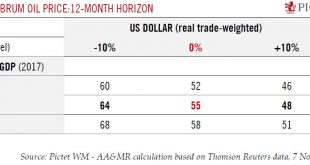

The current spot price is already close to oil’s upwardly revised equilibrium price.Strong global growth, a substantial US fiscal stimulus, signs that reflation is taking hold in the US and a relatively weak US dollar all should represent a favourable environment for commodities, and for oil in particular, for the rest of this year. However, our analysis suggests that oil is now close to its long-term equilibrium price, offering limited upside potential.Now that markets have fully taken on...

Read More »Oil market tilted towards oversupply

The same discipline shown by OPEC and Russia in 2017 will be required to support prices at their current level. After the 30 November agreement between OPEC and Russia to extend oil production cuts until the end of 2018, it is worth looking again at the balance between oil supply and demand. The most recent data indicate that without continued willingness from OPEC to limit supply, the market will be naturally tilted towards oversupply in 2018 and 2019. Non-conventional production, in...

Read More »Upward potential for oil prices is limited

Various factors have contributed to the oil price rally since August, but while a further short-term surge is possible the fundamental long-term equilibrium price for WTI remains USD55-USD58.Recent developments have brought noticeable changes to the outlook for the supply-demand balance. First of all, the steady decline in the value of the US dollar since the end of 2016 has been stopped. In fact, the dollar appreciated by 4% between end September and 7 November.Second, world economic...

Read More »Oil prices: limited upside potential

Having faltered this year, predictions of prices above USD60/b in 2017 appear premature.The market was highly optimistic about oil price at the beginning of this year, with oil analysts expecting that prices would have recovered to USD60-65 by now. These hopes have clearly been dashed, as WTI prices have fluctuated in a range of USD45-55 since January 1.We have been much less optimistic than the market, based on our own modelling of the equilibrium oil price, which has proved a reliable...

Read More »Oil prices: looking for equilibrium

At current levels, the oil price is close to equilibrium, with little in the fundamentals to suggest a sustained move higher in prices in the coming months There were sharp movements in the price over the summer, and further volatility is likely in the coming months. WTI oil prices dropped around 25% between June and early August. Prices subsequently rallied, rising by around 20% to close to USD50/b, before dipping again at the close of August. High inventories played a key role in pushing...

Read More »Oil prices should rise gradually

Despite the lowering of global economic prospects, oil prices could rise to USD 50/b by early 2017. On April 12, the International Monetary Fund (IMF) published its World Economic Outlook survey, containing its economic forecasts for 2016 and 2017. The IMF revised downward its global growth forecast for 2016 by 0.2%. In a recent post we presented our macro-econometric model, which showed a stable long-term relationship between oil price, global economic growth and the US dollar. Based on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org