Of the many rules prescribed for investment success, the most golden of all is to cut your losses before they get too big. As this bearish market is teaching us, it is a rule that is always best kept to! The speculator and dancer (!) Nicolas Darvas gave us ideas how to set the stop-loss. If you read this Newsletter regularly, you will already have appreciated its importance. You may have also witnessed the peaking and catastrophic falls of such market favorites as Weight Watchers (WTW) from 18 November 2015 to 8 February 2016 of -60% and Netflix (NFLX) from 4 December 2015 to 5 February 2016 of -37%. Therefore keeping to the rule of cutting short your losses and letting your profits run immunizes your portfolio against the financial calamity of free falling in good and bad markets. Remember to set stop-losses You may well ask at what point you should exit a stock. Why not at the 10% mark or when you are down 15% or at whatever suits your style and temperament or long-term investment horizon. Research has shown that if you buy a leadership-quality stock at the time it breaks-out of a sound support level on strong volume, and the market is in a healthy uptrend, the stock should not fall further than 8%. Smaller fluctuations are considered part and parcel of normal market volatility and therefore you need to take no further action provided that all other things remain equal.

Topics:

John Henry Smith considers the following as important: Grail Securities

This could be interesting, too:

John Henry Smith writes Free portfolio performance 10 Jun 16

John Henry Smith writes Will the U.S. Stock Market give birth to its own Black Swan?

John Henry Smith writes Stunning results achieved by Grail’s Free Portfolio in just two Months!

John Henry Smith writes The Free Portfolio and the Age of the Alpha Stock

Of the many rules prescribed for investment success, the most golden of all is to cut your losses before they get too big. As this bearish market is teaching us, it is a rule that is always best kept to! The speculator and dancer (!) Nicolas Darvas gave us ideas how to set the stop-loss.

If you read this Newsletter regularly, you will already have appreciated its importance. You may have also witnessed the peaking and catastrophic falls of such market favorites as Weight Watchers (WTW) from 18 November 2015 to 8 February 2016 of -60% and Netflix (NFLX) from 4 December 2015 to 5 February 2016 of -37%. Therefore keeping to the rule of cutting short your losses and letting your profits run immunizes your portfolio against the financial calamity of free falling in good and bad markets.

Remember to set stop-losses

Remember to set stop-losses

You may well ask at what point you should exit a stock. Why not at the 10% mark or when you are down 15% or at whatever suits your style and temperament or long-term investment horizon. Research has shown that if you buy a leadership-quality stock at the time it breaks-out of a sound support level on strong volume, and the market is in a healthy uptrend, the stock should not fall further than 8%. Smaller fluctuations are considered part and parcel of normal market volatility and therefore you need to take no further action provided that all other things remain equal. If, however, a loss exceeds 8%, especially suddenly and on heavy volume, you should press the SELL button immediately and certainly by the time the loss has swelled to 10% or gone passed its 50-day moving average. If on the other hand the evidence clearly tells you that ‘all is not well in the State of Stocks’ there is no reason to even wait until these sinking watermarks are reached. By shielding your investments from devastated trades, you earn the privilege to invest again with the funds you have prudently conserved.

What if pride, ego or indecision prevents you from selling a favorite when it is down more than 8%? A pre-consideration of the simple math of the situation may prompt you into action. To offset an 8% loss in a stock, you need an 8.7% gain to recover. No problem! However what if you waited until the stock has fallen 25% before selling? It takes a 33% gain to break-even. And a 50% loss needs to recover 100% from that price level and uptrends are usually slower than downtrends. Chilling, isn’t it?

Nicolas Darvas (Amazon): “How I Made $2,000,000 in the Stock Market” –> Follow the Price Action!

Nicolas Darvas described the personal terror he experienced in 1955 after buying shares of Jones & Laughlin on margin in “How I Made $2,000,000 in the Stock Market.” Hours of research convinced Darvas, a professional dancer, that “nothing could go wrong.” But wrong it went!

“I saw it fall and yet I refused to face reality. I was paralyzed,” he wrote. Darvas had projected the stock rising to at least $75. It never did. Instead, it went from $52 to $33, a fall of over 36% before he sold and took a loss worth the value of property he owned in Las Vegas. From that point on, he followed price action like a hawk and acted accordingly. A hard lesson for his and for many others, a lesson you can well do without in these uncertain times.

Set a stop-loss on your S&P500 stocks

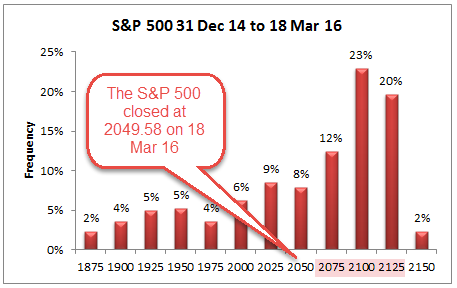

At the time of writing the S&P 500 stands at 2049.58. This can be seen in the histogram of the index’s prices at the 8% frequency bar. The next three bars to the right show the enlarged frequencies of 12%, 23% and 20% respectively, which are likely to represent strong resistance levels. It is only prudent to set a stop loss order as a precaution to protect yourself from the dire consequences of a free fall in your U.S. equity investments.