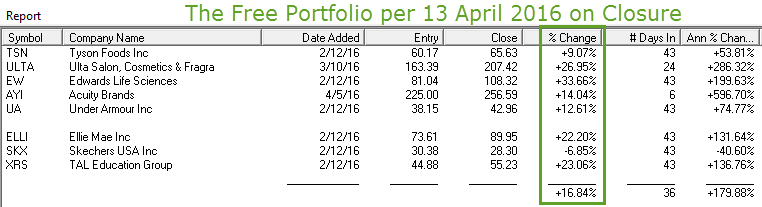

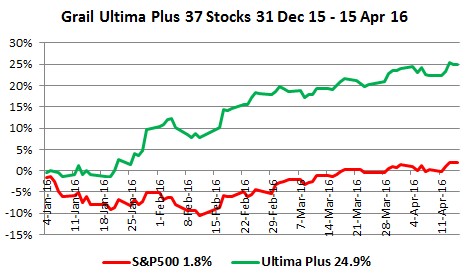

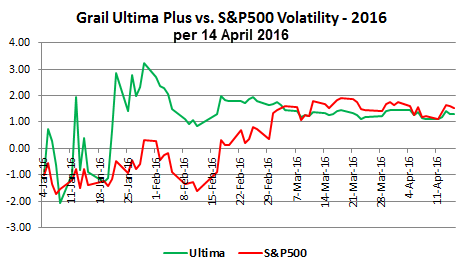

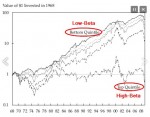

I am very pleased to report that the Free Portfolio in its deadline week exceeded my target of 15%, having reached a return of 16.84%, helped by a gain of 2.7%! The purpose of the portfolio was to give readers irrefutable evidence of the unique power of the Grail Equity Management System (GEMS) to generate high returns with no more risk than the S&P 500. High Return: This graph shows that the mother portfolio has a margin of safety vis-à-vis the index of 23.1%, Low Risk: The second graph, based on daily measurements of sigma, proves that the portfolio is significantly less volatile than the index! This is because the S&P 500’s daily prices are very close to its average. I had targeted readers like you to verify the correctness of the portfolio and be convinced that the widely-used bench-marking strategy is by far riskier than GEMS’s strategy of absolute returns generated by high-grade market leaders. Images of the Abnormal The question is why should investors not be given the opportunity of such high return portfolios, when it is certain that the cause of under-performance is a deep-rooted, but false, financial theory.

Topics:

John Henry Smith considers the following as important: Benoit Mandelbrot, Black Swan, Featured, Free Portfolio, GEMS, Grail Securities, high return, Images of the Abnormal, low risk, low volatility, Nassim Nicholas Taleb, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

I am very pleased to report that the Free Portfolio in its deadline week exceeded my target of 15%, having reached a return of 16.84%, helped by a gain of 2.7%!

The purpose of the portfolio was to give readers irrefutable evidence of the unique power of the Grail Equity Management System (GEMS) to generate high returns with no more risk than the S&P 500.

I had targeted readers like you to verify the correctness of the portfolio and be convinced that the widely-used bench-marking strategy is by far riskier than GEMS’s strategy of absolute returns generated by high-grade market leaders.

Images of the Abnormal

| The question is why should investors not be given the opportunity of such high return portfolios, when it is certain that the cause of under-performance is a deep-rooted, but false, financial theory. Perhaps the explanation is put forward by the eminent academic, Benoit Mandelbrot in his book “The (Mis)Behaviour of Markets”, in the Chapter ‘Images of the Abnormal’: | click for viewing |

So again, why does the old order continue? Habit and convenience. The math is simple, at bottom, easy and can be made to look impressive, inscrutable to all but the rocket scientist. Business schools keep on teaching it. The have trained thousands of financial officers, and thousands of investment advisors.

The Low Risk Anomaly

I have called the current market ‘The Age of the Alpha Stock’, based on the flatness of returns that are today attributed to the market risk premium, which ignores stock-specific growth through portfolio over-diversification. Of course, the banks are known for their non-risk policies as major propagators of index funds in spite of the massive weight of the evidence to the contrary. Naive investors have always relied on their advisors and are now reaping the unfortunate consequences of the trust they placed in them in this Brave New World of mounting losses after the Federal Reserve ended its QE3 monetary policy in October 2014.

| Leading researchers such as Benoit Mandelbrot, Nassim Nicholas Taleb of ‘The Black Swan’ fame,

and Malcolm Baker of Harvard University have argued to a deaf financial world that it is on the wrong track. |

click for viewing |

| Professor Baker summed up his findings of what he calls ‘The Low Risk Anomaly’: |

Baker:

We believe the long-term out-performance of low risk portfolios is perhaps the greatest anomaly in finance. It is large in economic magnitude and practical relevance and it challenges the basic notion of a risk-return trade-off.

This test portfolio verifies these words. My independent research not only confirms the professor’s 41 years of data analysis, but it has additionally found that a portfolio of high-pedigree stocks generate ultra-high alpha returns, such as the Test Portfolio, with no more risk than the market return, as shown above!

Those of you who are investors and prefer not to embrace these underlying fundamental market changes will undoubtedly have to pay the ferryman the cost of a non-change strategy, namely a worsening profit recession. Since the beginning of 2015, the S&P 500’s return is a mere 1.06%, which could decline further if the current headwinds gather momentum, such as a growing global recession, a major credit crisis, caused by low oil prices, a too-high a dollar, and the decline of company earnings in 2016.

Being somewhat of a poetic nature, I give you my last quote, which is from Shakespeare’s Julius Caesar:

There is a tide in the affairs of men

Which, taken at the flood, leads on to fortune;

Omitted, all the voyage of their life

Is bound in shallows and in miseries.

On such a full sea are we now afloat;

And we must take the current when it serves,

Or lose our ventures

The test period has met its objective at the last moment and I hope this long article gives you sufficient cause to think outside the box. I would welcome your business to help you generate outstanding alpha-based profits that is the hallmark of GEMS and escape the increasingly higher negative volatility of the market return. A presentation of GEMS would leave you in no doubt as to its power. I can also send it to you by email or CD.

Market Comment

The S&P500 continues to be in a confirmed uptrend and made a 2% gain on good volume in the two days of Wednesday and Thursday after moving sideways from 1 April. Friday’s action was flat, because of three factors. Firstly the Q1 earnings season picks up tempo next week with bellwether-companies such as Starbucks, Under Armour, Visa, McDonald’s and Caterpillar laying bear their results. Q1 is regarded that it will be one of the worst quarters in recent times, so growth expectations are low. Any positive earnings surprises could trigger on the other hand strong price breakouts, since the dollar has remained relatively weak, down -4.06% since 29 January, which will strengthen repatriated earnings from overseas.

Secondly, it appears that core inflation is cooling. The consumer prices fell 0.1% in March, as did the CPI ex food and energy. Consequently overall inflation fell to 0.9%, whereas core inflation came down to 2.2% from a 4-year high of 2.3%, stemming expectations that inflation is ramping up. If it would ease further, it could have a dampening influence on future interest rate hikes; a plus for the stock market.

And last but not least, this week’s rally was fuelled also by the possibility that the oil meeting in Doha, Qatar over the weekend could lead to agreement of a production freeze. However, now the market is whispering that this is unlikely. If a surprise agreement is nevertheless reached it would probably energize the market at least for a day or two next week, as the earnings period takes on a firmer hold.

Very best regards and happy investing,

John

|

An active Portfolio that’s going nowhere!

|