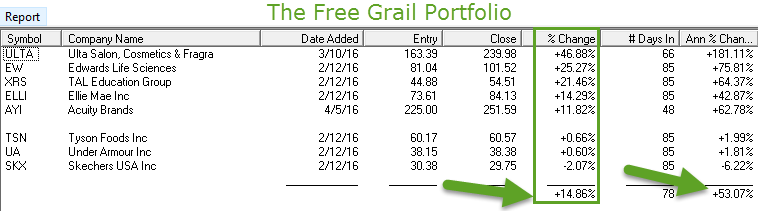

The free portfolio advanced 2.02% this week, but the S&P lost the small amount of 0.12%. Click to enlarge. The Ultima Plus portfolio became operational on 31 December 2015. Click to enlarge. Market Comment Up to Wednesday, the S&P 500 rose to a 10-month high of 2119.12 points, less than 1% below its all-time high of 2130.82 of 12 May last year. But stocks pulled back on Thursday and more decisively on Friday, as bond yields around the world reached or neared record lows amid looming gloomy political and economic headwinds. On the political front, the British newspaper ‘The Independent’ published today a survey that showed that in the last 12 days 55% of voters polled favoured BREXIT, a swing of 10% in just 12 days, while only 44% were in favour of remaining in the EU. In my email Report of 15 May, I had warned of both of the difficulty of overcoming the ceiling of 2130.82 and the dangerous economic consequences of the BREXIT ‘leave vote’ winning. “I would like to add that in my opinion there as lurking Black Swan hiding in all equity markets, which has the name of BREXIT! Describing the uncertainties, Christine Lagarde of the IMF warned that if Britain leaves the European Union the impact would range from “pretty bad to very, very bad.

Topics:

John Henry Smith considers the following as important: Featured, Grail Securities, Janet Yellen, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The free portfolio advanced 2.02% this week, but the S&P lost the small amount of 0.12%. | |

| The Ultima Plus portfolio became operational on 31 December 2015. | |

Market Comment

Up to Wednesday, the S&P 500 rose to a 10-month high of 2119.12 points, less than 1% below its all-time high of 2130.82 of 12 May last year. But stocks pulled back on Thursday and more decisively on Friday, as bond yields around the world reached or neared record lows amid looming gloomy political and economic headwinds.

On the political front, the British newspaper ‘The Independent’ published today a survey that showed that in the last 12 days 55% of voters polled favoured BREXIT, a swing of 10% in just 12 days, while only 44% were in favour of remaining in the EU.

In my email Report of 15 May, I had warned of both of the difficulty of overcoming the ceiling of 2130.82 and the dangerous economic consequences of the BREXIT ‘leave vote’ winning.

“I would like to add that in my opinion there as lurking Black Swan hiding in all equity markets, which has the name of BREXIT! Describing the uncertainties, Christine Lagarde of the IMF warned that if Britain leaves the European Union the impact would range from “pretty bad to very, very bad.” Therefore if the S&P 500’s 2040 support level is breached, as the 23 June voting day approaches and the BREXIT protagonists gain more ground, the market could continue its bearish rally. GEMS forecasts that at the very least there is a 28% probability or a 1 in 3.6 chance, measured from Friday’s close, of a 10% fall in the S&P 500 to 1842. However, this is a modest forecast. In a far worse case scenario, a major correction of 25% or more could be triggered if the British decide to exit the Union. The probability of this happening is 1 chance in 14.5. At a 25% correction, the S&P 500 would drop to 1535 points.”

Last Monday, in a speech to the World Affairs Council, Janet Yellen, the Federal Reserve Chairperson warned of the consequences of a BREXIT as having significant economic repercussions.

Last Monday, in a speech to the World Affairs Council, Janet Yellen, the Federal Reserve Chairperson warned of the consequences of a BREXIT as having significant economic repercussions.

Having only a 4% probability, the market has just about dismissed an interest rate increase in June. In fact many analysts are of the opinion that at the earliest a rate increase would be likely September, provided the Federal Reserve’s targets on employment, inflation, global economic factors, and the role of domestic demand are met.

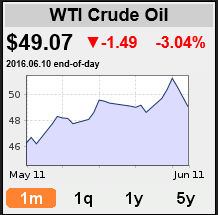

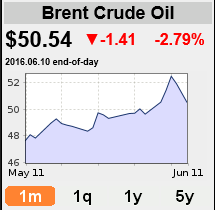

| Finally, another catalyst of concern is the sudden fall in the oil prices at Friday’s close as illustrated below. |  |

| I believe that the bringing on-line of Iranian oil is not been fully factored into prices yet, but this downturn could be the first step. |  |