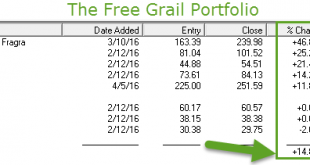

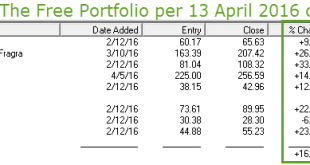

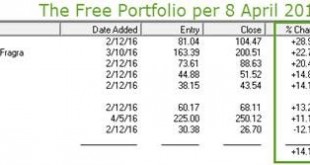

The free portfolio advanced 2.02% this week, but the S&P lost the small amount of 0.12%. Click to enlarge. The Ultima Plus portfolio became operational on 31 December 2015. Click to enlarge. Market Comment Up to Wednesday, the S&P 500 rose to a 10-month high of 2119.12 points, less than 1% below its all-time high of 2130.82 of 12 May last year. But stocks pulled back on Thursday and more decisively on...

Read More »Will the U.S. Stock Market give birth to its own Black Swan?

At 2099.06 points the S&P 500 is now in a confirmed uptrend and on the cusp of attacking the 19 April high of 2100.80. If it conquers this pressure point, the index will enter a zone of resistance up to 2126.64 points. This range will certainly be treated by the market with due trepidation, when it returns from the Memorial Day holiday on Tuesday! According to my stochastics indicator, the market appears to be over-bought and my Grail momentum indicator is swinging a bit to the...

Read More »Stunning results achieved by Grail’s Free Portfolio in just two Months!

I am very pleased to report that the Free Portfolio in its deadline week exceeded my target of 15%, having reached a return of 16.84%, helped by a gain of 2.7%! The purpose of the portfolio was to give readers irrefutable evidence of the unique power of the Grail Equity Management System (GEMS) to generate high returns with no more risk than the S&P 500. High Return: This graph shows that the mother portfolio has a margin of safety vis-à-vis the index of 23.1%, Low Risk: The...

Read More »The Free Portfolio and the Age of the Alpha Stock

This free portfolio is offered to help investors understand that what they may have learnt about risk and return do not correspond to the realities of investing today. COMMENTS ON THE PORTFOLIO Unfortunately Sketchers (SKX), which lost more than 12% has not yet bottomed out. There is a theory, which says that the market is always right, but I believe that the market is always wrong. SKX’s data indicates the latter: Q1 EPS Forecast Q2 EPS Forecast Current Year Forecast Next Year...

Read More »Nicolas Darvas: Follow the Price Action and Set Stop-Losses

Of the many rules prescribed for investment success, the most golden of all is to cut your losses before they get too big. As this bearish market is teaching us, it is a rule that is always best kept to! The speculator and dancer (!) Nicolas Darvas gave us ideas how to set the stop-loss. If you read this Newsletter regularly, you will already have appreciated its importance. You may have also witnessed the peaking and catastrophic falls of such market favorites as Weight Watchers (WTW)...

Read More »How you see the Stock Market determines your Profit or Loss!

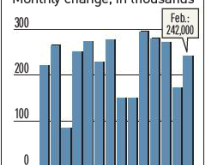

The key economic note this week was that non-farm payrolls for February was 242,000 versus Wall Street’s expectation of only 190,000; 27% above the consensus target. Wages however fell back by 0.1% from February’s gain of 0.5%. The workforce participation rate moved up to 62.9%. The excellent news on Friday was however received mutely by the market. Excellent news received muted by the market The reason was the likelihood that it will increase the probability of further interest rate rises...

Read More »The stock market’s siamese twin oiled Friday’s rally

Dear Investors! Because the stock market is currently strongly correlated to the energy sector, Friday’s rally responded in kind on the news of a surge of 12.3% in the NYMEX WTI sweet crude market after a report had suggested that OPEC may finally agree to cut its production to reduce the world glut. The news instantly oiled the S&P 500’s rise of 1.95%. However despite the strong daily gain, oil prices still ended the week down in spite of being the best one-day gain since February...

Read More »The stock market’s siamese twin oiled Friday’s rally

Dear Investors! Because the stock market is currently strongly correlated to the energy sector, Friday’s rally responded in kind on the news of a surge of 12.3% in the NYMEX WTI sweet crude market after a report had suggested that OPEC may finally agree to cut its production to reduce the world glut. The news instantly oiled the S&P 500’s rise of 1.95%. However despite the strong daily gain, oil prices still ended the week down in spite of being the best one-day gain since February...

Read More »The Age of the Alpha Stock

The fourth quarter 2015 earnings season is now in full swing. From what I have seen of the outstanding earnings surprises and favourable future guidance in the Grail Portfolios, there is enough thrust to propel them higher, as these three examples show. On 28 January Under Armour rose 22.6%! On 27 and 28 January Cirrus Logic climbed 29%! From 25 January Covenant has risen 21.7%! As of 29 January 110 stocks, or 37.4%, of the 294 stocks listed in Grail’s 5 principal portfolios have...

Read More »Beware the Ides of the Earnings Season!

It is critical for an investor to be very vigilant during the earnings season, which already began on January 11 with Alcoa (AA) reporting its results. Not only do companies report their financials, but they also make other significant announcements, such as either raising or lowering their earnings guidance for the coming months. Given the importance of this information, it is no surprise that a company’s stock can often soar or plunge on these disclosures. Therefore, investors need to be...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org