What would “unconscionably excessive” even look, legally speaking? More to the issue, who gets to decide what constitutes “excessive?” The way the phrase has been inserted, it’s as if Congress today seeks to plant its members on some incorporeal higher plane than mere physical substance, too, diving deep into the moral consciousness of the nation and economy in order justify taking general action. Just last week, the House of Representatives passed a bill which proposes to tackle “inflation”, specifically the ridiculous gasoline prices currently plaguing Americans. The vote ended up being 217-207, with four Democrats siding with all Republicans against the proposal. Styled The Consumer Fuel Price Gouging Prevention Act, slightly more than half of half of the US

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, Congress, currencies, economy, Featured, Federal Reserve, Federal Reserve/Monetary Policy, FOMC, jay powell, Markets, newsletter, Oil, rate hikes

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| What would “unconscionably excessive” even look, legally speaking? More to the issue, who gets to decide what constitutes “excessive?” The way the phrase has been inserted, it’s as if Congress today seeks to plant its members on some incorporeal higher plane than mere physical substance, too, diving deep into the moral consciousness of the nation and economy in order justify taking general action.

Just last week, the House of Representatives passed a bill which proposes to tackle “inflation”, specifically the ridiculous gasoline prices currently plaguing Americans. The vote ended up being 217-207, with four Democrats siding with all Republicans against the proposal. Styled The Consumer Fuel Price Gouging Prevention Act, slightly more than half of half of the US legislature wishes the government to take a more proactive approach to the energy “crisis” (there are so many declared crises nowadays, it is increasingly difficult keeping track of them all). Among its more novel (some’d say odious) features, the bill would empower the President to unilaterally declare “unconscionably excessive” fuel prices unlawful. If that wouldn’t be enough (and it wouldn’t), the aspiring law would grant the Federal Trade Commission additional powers to investigate purported price gouging allegedly responsible for our shared economic agony. |

|

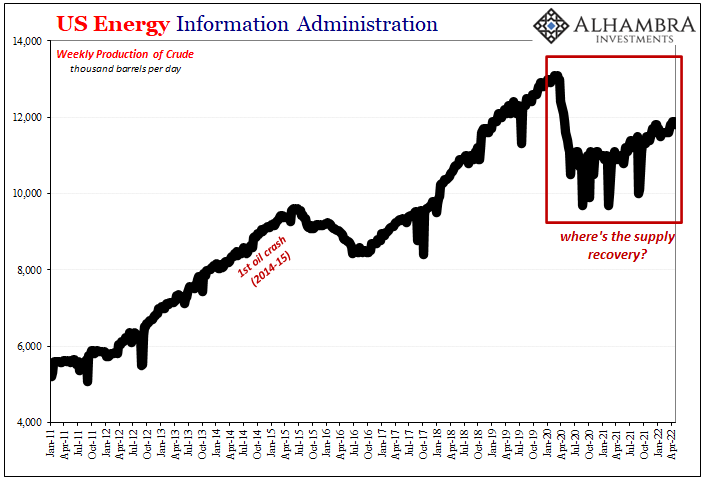

| As usual, the premise for the effort begins on sound ground. At a hearing last Monday, Rep. Frank Pallone (D-NJ), the House Energy and Commerce Committee’s chair, correctly observed, “The problem is Big Oil is keeping supply artificially low so prices and profits stay high.”

Yep, that is the problem and it could not be any clearer: But it absolutely does not follow: 1. That this amounts to gouging, or anything other than the market’s steadfast distrust of those oil prices, no need to impugn motivations; 2. The second half of Pallone’s thinking, which was, “Now I think that when the market is broken, that’s when Congress has to step in to protect American consumers.” The market isn’t broken, it just isn’t telling you what the mainstream is about the most likely future state of the economy. It’s difficult to tell how much of this is serious. For one thing, there’s history to lean back on which conclusively shows whenever Congresspersons feel compelled “to step in to protect American consumers” it only makes the original problem an order of magnitude worse. Even if the market was broken, the government isn’t about to fix it. Hardly anyone even old enough to remember might recall all the details after the Iranian oil fiasco of 1979. For convenience’s sake, I had and not all that long ago anticipating just these political winds of desperation. Uncovering the Volcker Myth, which really is tied into all these energy politics, the US government’s uninspiring involvement required acknowledging, too. After all, how was it going to make up for the fact Gulf Coast refineries were built to process particularly Iranian blends of crude? Once oil from Iran dried up, American stocks of gasoline did, too. Quickly. Recession not long after. |

|

Like today’s House of Representatives, yesterday’s majority mandated big action:

This was, of course, repeatedly pointed out as the current bill was being debated, marked, and voted – even by politically friendly Economists. One of President Obama’s Chief Economists, Jason Furman, appeared on CBSNews Face the Nation yesterday, easily dismissing the powers which might be granted by unconscionably excessive as “gimmicky.”

The politicians in Congress know this; well, some do, anyway, especially those forwarding these bills and having the one house vote on them. You can easily bet they’ve been schooled on the history and even the simple, easy (small “e”) economics as laid out by Mr. Furman. So, why go forward with the absurd proposal which everyone knows is doomed in the Senate anyway? |

|

| It’s all political theater. Every last bit of it; including the absurdity playing out a few blocks from the Capitol on Constitution Ave where the Marriner Eccles Federal Reserve Board building sits.

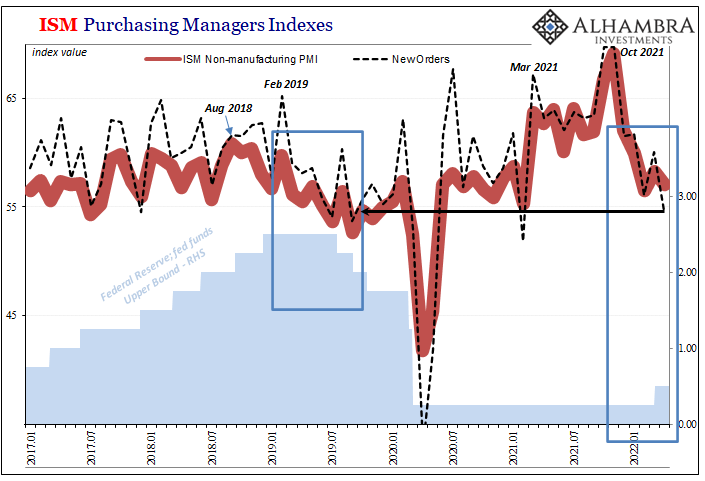

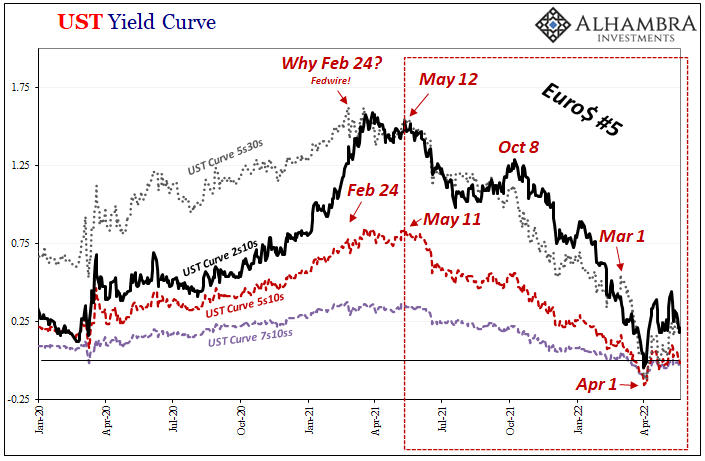

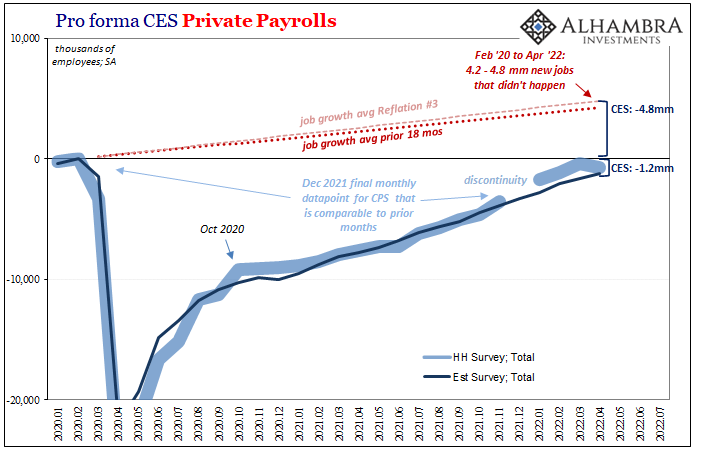

The Consumer Fuel Price Gouging Prevention Act sure seems the House majority’s way of voting no confidence in the FOMC. It also smells more than a little like a recession-panic, too. After all, Jay Powell had said the week prior (two weeks ago) that getting control over what he says is inflation will “include some pain” and no politician willingly wishes to be seen on the side of voter pain – even those who demanded the Fed bring it in the first place! We told you to do something about consumer prices…oh crap. Before the Fed even gets going a little bit (just two rate hikes in) recession alarms are ringing loudly from every corner of the financial world, and increasingly from those dead-center in the real economy, too (Target, Walmart, etc.). The real issue, as pointed out in the House, surrounds energy producers’ keenly chastened eye for false dawns. And that includes 2022 which is, right on cue, proving to be yet another of those. |

|

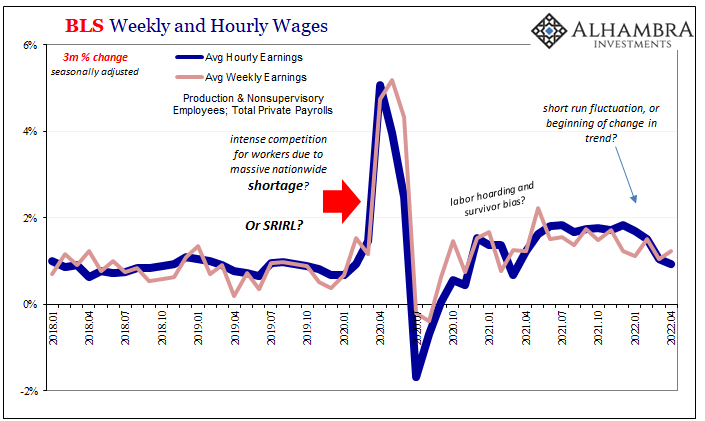

| Though harmful in the short run big picture, you can hardly blame Big Oil for not wishing to suicide more capital on such a bad bet as this actual global economy. From China to Europe through Japan (paying 30% more for imports and getting 10% less by volume), none of it was ever inflation.

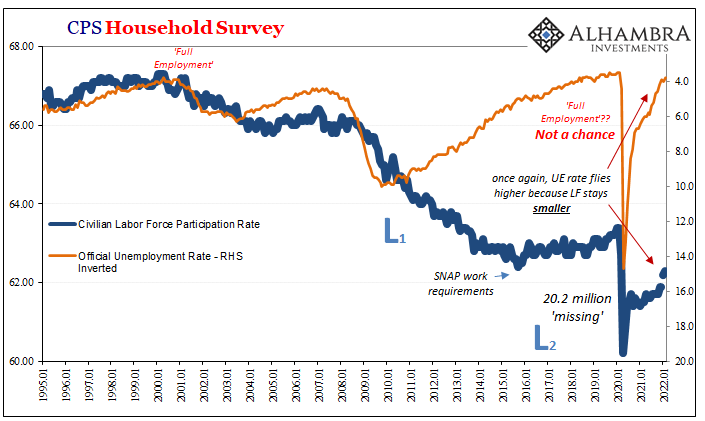

That’s the bigger problem no one wants to address; or even recognize. Last year’s tremendous Price Illusion fooled the vast majority (outside of bonds) into believing the economy must’ve been otherwise in terrific shape, just gangbusters if only it could source more oil and energy. |

|

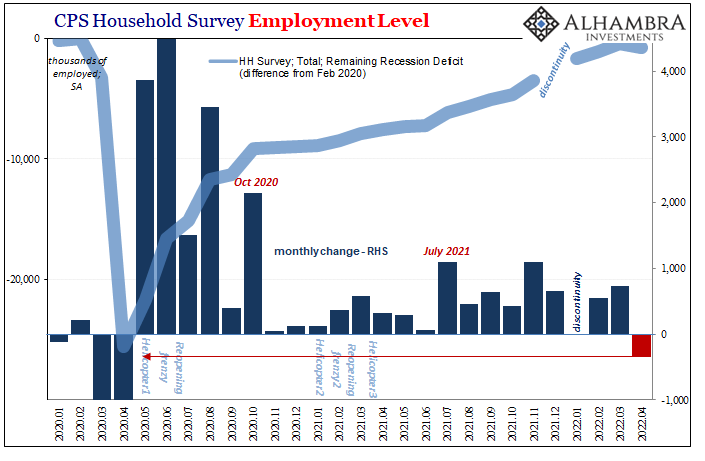

| No. That’s entirely backward. We aren’t getting more oil and energy because those whose financial life depends upon true knowledge of real economic conditions and forces understand bluntly how the real economy never recovered from 2020 (let alone 2008; learned that one the hard way in 2014), and how the probabilities that reality would eventually reveal itself never wavered no matter how high each CPI rate has trended.

That is the recession risk of 2022. Rate hikes won’t change it, nor will Congress’ attempt to position the politics. Shortfall in real economy, awash in political symbolism. Thus, market “volatility” and inversions. The only thing unconscionably excessive is the risk of falling down. Again. Fifth time. |

Tags: Bonds,Congress,currencies,economy,Featured,Federal Reserve/Monetary Policy,federal-reserve,FOMC,jay powell,Markets,newsletter,OIL,rate hikes