Sentiment is being buoyed by two incrementally positive stories; cross-markets implied volatility measures continue to trend lower; dollar weakness has resumed President-elect Biden will reportedly officially name his first cabinet picks today; Fed manufacturing surveys for November will continue to roll out; Brazil and Mexico both reports mid-November inflation readings German IFO Business Climate survey for November was mixed; UK national lockdown will end next week; UK CBI reported its November distributive trades survey Japan reported October department store sales; markets are reassessing RBNZ dovishness after reports that it may add house prices to its mandate Sentiment is being buoyed by two incrementally positive stories. First, President Trump has

Topics:

Win Thin considers the following as important: 5) Global Macro, 5.) Brown Brothers Harriman, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Ryan McMaken writes A Free-Market Guide to Trump’s Immigration Crackdown

Wanjiru Njoya writes Post-Election Prospects for Ending DEI

Swiss Customs writes Octobre 2024 : la chimie-pharma détermine le record à l’export

- Sentiment is being buoyed by two incrementally positive stories; cross-markets implied volatility measures continue to trend lower; dollar weakness has resumed

- President-elect Biden will reportedly officially name his first cabinet picks today; Fed manufacturing surveys for November will continue to roll out; Brazil and Mexico both reports mid-November inflation readings

- German IFO Business Climate survey for November was mixed; UK national lockdown will end next week; UK CBI reported its November distributive trades survey

- Japan reported October department store sales; markets are reassessing RBNZ dovishness after reports that it may add house prices to its mandate

| Sentiment is being buoyed by two incrementally positive stories. First, President Trump has instructed his administration to begin working with the Biden group on the formal transition of power. While widely expected, the move does remove a lingering element of uncertainty and will hopefully head off any national security issues from the delay. Second, former Fed Governor Yellen is set to become the next Treasury Secretary (see below), thus eliminating the (very small) risk of a less conventional candidate. Neither of these are ground-breaking news, but they the help build on recent vaccine optimism and so global stocks and US futures are largely lit up green today.

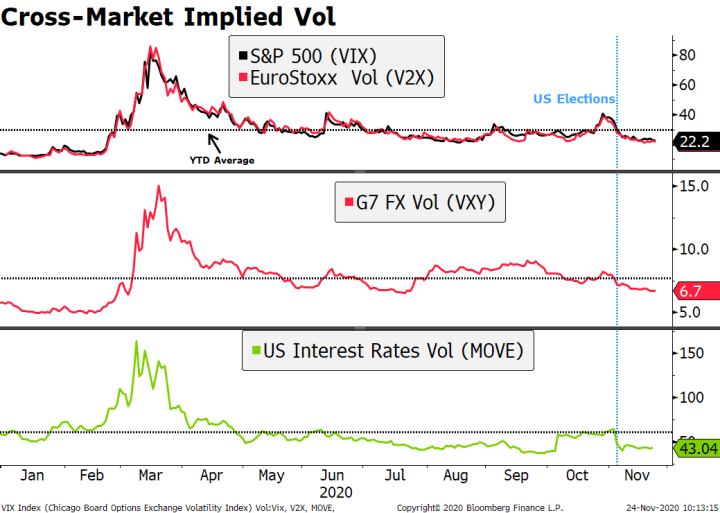

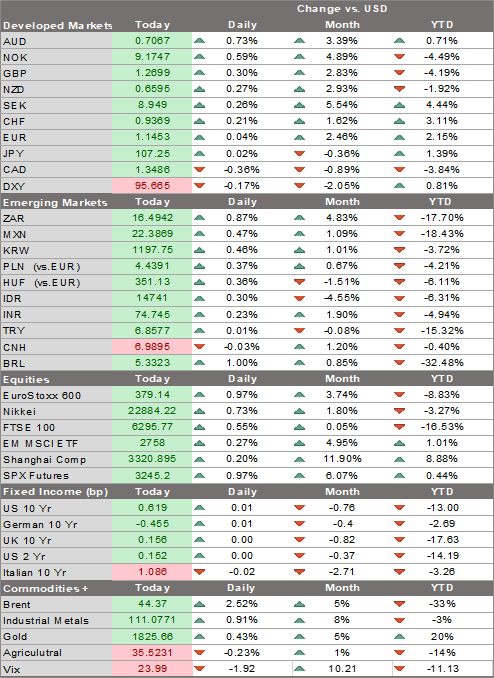

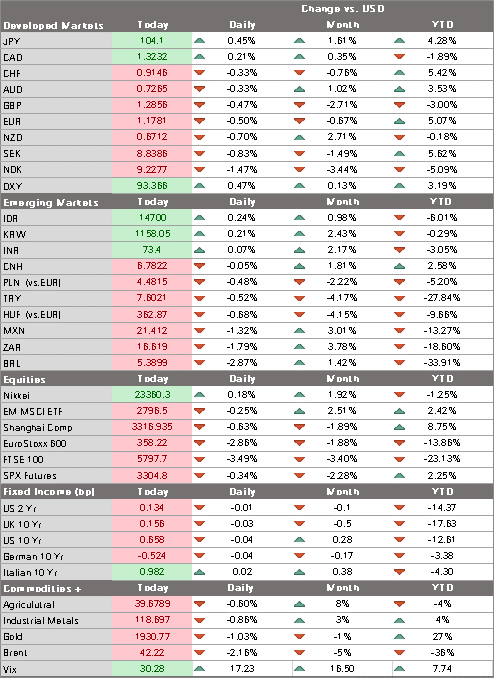

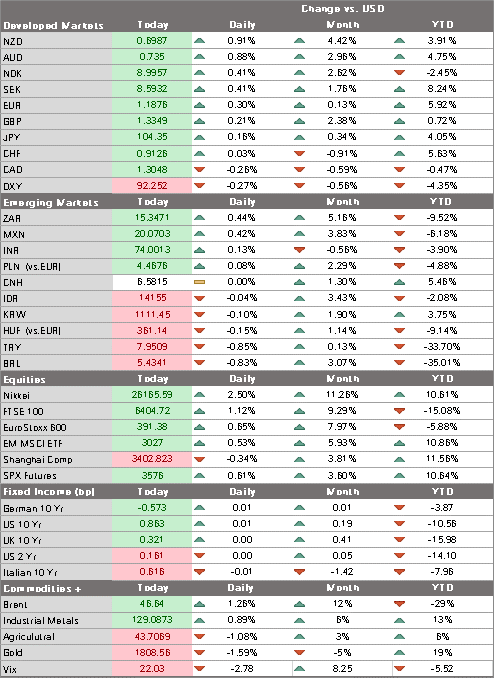

Cross-markets implied volatility measures continue to trend lower as the political and economic downside risks subside. Equity markets implied volatility (measured by the VIX) is now well below the average for the year, though still not back to pre-pandemic levels. The same goes for G7 FX implied volatility (VXY). However, US interest rates volatility (MOVE) is now below pre-pandemic levels, having remained mostly below its YTD average since the June. Dollar weakness has resumed. Yesterday’s price action was pure short-covering, and now that the dust has settled, we believe markets are back to focusing on the underlying fundamental story for the dollar. We remain bearish going into Q1. DXY has given up nearly all of its post-Markit PMI gains and is nearing yesterday’s low near 92.0 and is on track to test the September 1 low near 91.746. The euro is back on track to test its September 1 high near $1.2010, while sterling is likely to test its September 1 high near $1.3480. The yen is lagging a bit as USD/JPY has yet to trade back near yesterday’s low, but we look for a break back below 104 soon. |

Cross-Market Implied Vol, 2020 |

| EUROPE/MIDDLE EAST/AFRICA

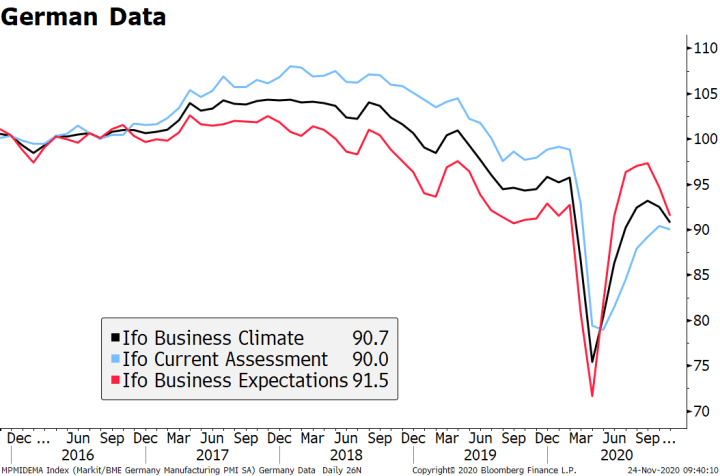

German IFO Business Climate survey for November was mixed. Headline reading fell to 90.7 vs. 90.2 expected and a revised 92.5 (was 92.7) in October. However, the expectations component fell by far more than forecast to 91.5 from a revised 94.7 (was 95.0) in October. Positive vaccine news will hopefully make the drop in sentiment shallower, but we are unambiguously heading into a downturn. This will be followed by December GfK consumer confidence Thursday, which is expected to fall to -4.9 from -3.1 in November. UK Prime Minister Johnson confirmed that the national lockdown will end next week. It will be replaced by a three-tier system of regional restrictions that are meant to last until the spring. Under the new rules effective December 2, schools, childcare, shops, hairdressers, and gyms will be open across all tiers. Restaurants will be takeaway or delivery only in the areas under the tightest Tier 3 restrictions. The government will announce the regional tiers this Thursday after analyzing the latest data on infections. Johnson admitted that the previous tiering system did not work well, “So the scientific advice, I am afraid, is that as we come out our tiers need to be made tougher.” However, the British Medical Association warned that the premier’s plan is not tough enough to control the virus. UK CBI reported its November distributive trades survey. Retailing was expected to fall to -35 but instead dropped only to -25 from -23 in October even as the lockdowns start to bite. Last week, CBI November industrial trends survey came in weak. Total orders fell as expected to -40 vs. -34 in October, while export orders plunged to -51 from -46 in October. Expectations of the next three months for output and average selling prices both moved back into negative territory at -10 and -8, respectively. |

German Data, 2016-2020 |

| ASIA

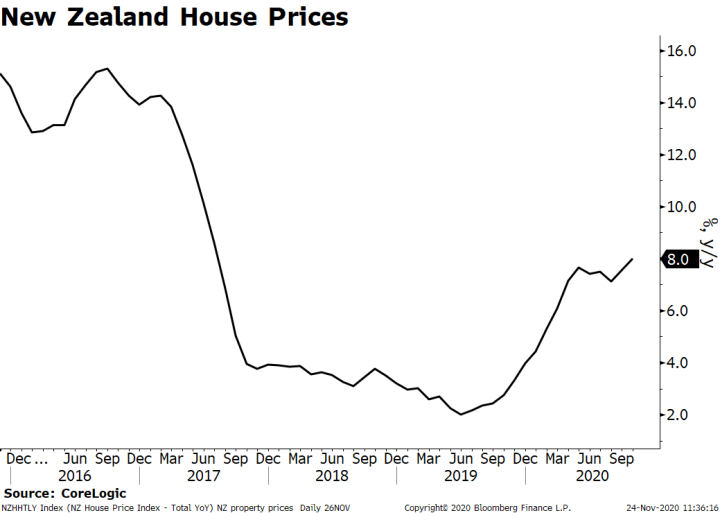

Japan reported October department store sales. Sales fell only -4.3% y/y vs. -35.0% in September, and largely reflects the impact of the sales tax hike last October. This tended to boost the y/y base in September 2019 as consumer frontrunning the hike before lowering the base in October 2019 as the tax hit. It may take a month or two for the y/y comparisons to normalize. Supermarket sales will be reported Thursday and are expected to show similar distortions. Further complicating matters is the likelihood that rising virus numbers will lead to tighter restrictions nationwide. Markets are reassessing RBNZ dovishness after reports that it may add house prices to its mandate. This is coming from Finance Minister Robertson in the form of a new proposal to add house prices stability to the RBNZ’s objectives. If this were to happen, it would appear that negative rates would be much less likely. To be clear, the RBNZ’s credibility does not seem to be at stake here. Governor Orr replied to Robertson by saying the bank will consider the request, but that MPC already takes this variable into account in its decision-making process. Despite the pushback, markets continue to price out some of the risk of cuts next year, with implied rates now showing roughly a 25% chance of easing vs. 50% before the news, while 10-year yields rose 10 bp to just 0.9%. |

New Zealand House Prices, 2016-2020 |

| AMERICAS

President-elect Biden will reportedly officially name his first cabinet picks today. Much of the suspense has been removed after yesterday’s report that former Fed Chair Yellen is getting the Treasury post. Biden has reportedly asked Brainard to remain at the Fed, which suggests she is lined up to take over as Fed Chair when Powell’s term expires. Other cabinet picks have been leaked too, including State, National Security Adviser, Director of National Intelligence, and Department of Homeland Security. Blinken, a long-time aide, as Secretary of State should confirm the incoming administration’s intent to re-join the Paris Climate Accord and to re-establish the nuclear deal with Iran. John Kerry was named climate czar, a new post created by Biden. Top economic spots still open are National Economic Council, Commerce, and USTR. With Brainard likely to stay put at the Fed, we suspect former Fed Governor Ferguson will head up NEC. Fed manufacturing surveys for November will continue to roll out. Richmond Fed is expected at 20 vs. 29 in October. Last week, Empire survey came in at 6.3 vs. 13.5 expected and 10.5 in October, Philly Fed came in at 26.3 vs. 22.5 expected and 32.3 in October, and Kansas City Fed came in as expected at 11 vs. 13 in October. These are the first snapshots for November and suggest some softening of other manufacturing data yet to come. Next week brings the Chicago PMI as well as the more widely followed ISM PMIs. September S&P CoreLogic house price data will also be reported today along with November Conference Board consumer confidence (97.9 expected). Bullard and Williams speak today. Brazil reports mid-November IPCA inflation. Inflation is expected at 4.12% y/y vs. 3.52% in mid-October. If so, this would be the highest since mid-February and would move back into the top half of the 2.5-5.5% target range for the first time since that month. Next COPOM meeting is December 9 and rates are expected to remain steady at 2.0%. However, the CDI market is pricing in the first hike of the tightening cycle at the January meeting. Mexico reports mid-November CPI. Inflation is expected at 3.63% y/y vs. 4.09% in mid-October. If so, this would be the lowest since June and would move back within the 2-4% target range for the first time since July. Banco de Mexico releases its quarterly inflation report Wednesday, while minutes from the November 12 meeting will be released Thursday. At that meeting, the bank surprised markets by keeping rates on hold at 4.0%, noting that the “pause provides necessary space” for inflation to converge back to the bank’s goal. Next policy meeting is December 17.

|

|

Tags: Articles,Daily News,Featured,newsletter