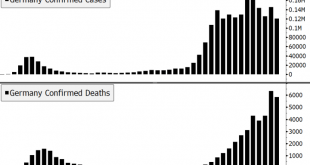

Senate Democrats are setting the table for passage of President Biden’s proposed $1.9 trln relief bill; there were glimmers of possible bipartisanship in some of the votes; US January jobs data is the highlight; Canada also reports January jobs data; Colombia reports January CPI German data is showing further signs of weakness; BOE delivered a less dovish than expected hold; Deputy Governor Ramsden said he envisions slowing the pace of QE later this year Japan...

Read More »Dollar Remains Firm Despite Dovish Fed Hold

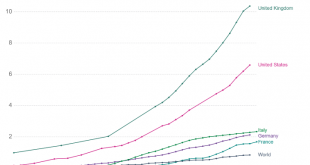

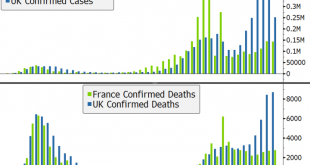

The FOMC delivered a dovish hold, as we expected; we get our first look at Q4 GDP; Fed manufacturing surveys for January will continue to roll out; weekly jobless claims data will be closely watched The vaccination gap between the UK and the US vs. Europe continues to wide, and grievances against suppliers are getting worse; Germany January CPI will be reported; if inflation risks were rising , ECB officials wouldn’t be so concerned about the strong euro and its...

Read More »Dollar Trading Sideways as FOMC Meeting Begins

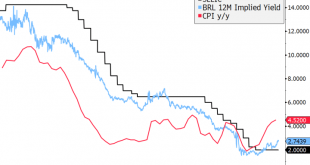

The FOMC begins its two-day meeting today with a decision out tomorrow afternoon; Senate Minority Leader McConnell has finally agreed to a power-sharing deal based on the 2001 model; President Biden signaled willingness to negotiate his stimulus proposal in order to get a bipartisan deal; Fed manufacturing surveys for January will continue to roll out; Brazil reports mid-January IPCA inflation Italian Prime Minister Conte will reportedly resign today; Italian...

Read More »Dollar Flat as Markets Await Fresh Drivers

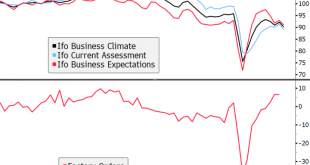

Discussions on President Biden’s proposed $1.9 trln fiscal package are getting off to a rocky start; Fed manufacturing surveys for January will continue to roll out ECB Governing Council member Olli Rehn viewed yield curve control for the region as “not sensible”; on the virus front, Norway tightened mobility restrictions, France looks set to impose another lockdown, and the UK considering closing borders; Germany IFO survey for January came in slightly lower than...

Read More »Dollar Weakness Continues Ahead of ECB Decision

Joe Biden became the 46th President of the US; three Democratic Senators were also sworn in; weekly jobless claims data will be the highlight of an otherwise quiet week; Fed manufacturing surveys for January will continue to roll out; Brazil kept rates on hold at 2.0%, as expected ECB is expected to keep policy unchanged; Norges Bank kept rates steady at 0%, as expected; Chancellor Sunak is reportedly drawing up plans to extend support for the UK labor market in...

Read More »Dollar Continues to Soften Ahead of Inauguration

President-elect Biden will be inaugurated and becomes the 46th President of the United States at noon; he will hit the ground running by announcing a raft of executive orders upon taking office; Janet Yellen’s confirmation hearing was revealing; Canada and Brazil are expected to keep rates unchanged Italian political tensions appear to have calmed; German government announced a hardening of mobility restrictions; UK reported December CPI BOJ began its two-day...

Read More »Drivers for the Week Ahead

President-elect Biden will be inaugurated Wednesday; security in Washington DC and many state capitols has been beefed up due to concerns of violence; the Senate reconvenes Tuesday and will immediately begin work on confirming Biden’s cabinet choices; reports suggest that if asked, Yellen will disavow a weak dollar policy whilst affirming commitment to a market-determined exchange rate Weekly jobless claims data Thursday will be the highlight of an otherwise quiet...

Read More »Dollar Regains Some Traction as Markets Search for Direction

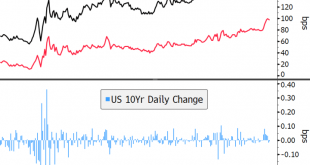

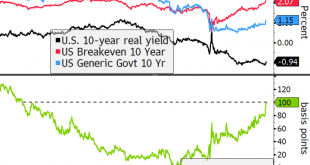

House Democrats will move ahead with impeachment proceedings today; December CPI data will be the US highlight; heavy UST supply this week wraps up with a $24 bln sale of 30-year bonds; December monthly budget statement will be of interest the Fed releases its Beige Book report; several Fed officials pushed back against notions of tapering anytime soon Italian political noise continues; UK and Germany warned of more restrictive measures; Russia will restart its...

Read More »Dollar Runs Out of Steam as Sterling Leads the Way

The US curve continues to steepen; real US yields have become less negative; UST supply will remain an issue as $38 bln of 10-year notes will be sold today; Brazil reports December IPCA inflation Yields in Europe and UK are following the trend higher in the US markets, but not as fast; Italy is facing another bout of political instability; BOE Governor Bailey pushed back against negative rates Japan’s government will declare a state of emergency for Osaka, Kyoto, and...

Read More »Drivers for the Week Ahead

As of this writing, a stimulus deal is close and a US government shutdown Monday may have been avoided; the Fed gave US banks the go-ahead to resume stock buybacks Friday; Fed manufacturing surveys for November will continue to roll out; weekly jobless claims will be reported on Wednesday due to the holiday All eyes remain on Brexit; things are getting very tricky now in terms of timing; with the UK going into stricter lockdown, we believe the pressure is building on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org