(Disclosure: Some of the links below may be affiliate links) During your financial life, you will go through several stages of wealth. Maybe you have already crossed several of them, or maybe you are at the first stage of wealth. Regardless of where you are, it is important to know what is ahead and prepare for your future stages of wealth. There are many things you can do to prepare your future financial stages. In this article, I will talk about the 4 main stages of wealth and what you can do to live better through all of them. Stages of Wealth You can define your financial life over several stages of wealth. These stages of wealth are sometimes called phases of wealth. If you are going to live all the way through retirement, whether it is early retirement or

Topics:

Mr. The Poor Swiss considers the following as important: 9) Personal Investment, 9) The Poor Swiss, Featured, Financial Independence, Investing, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

(Disclosure: Some of the links below may be affiliate links)

During your financial life, you will go through several stages of wealth. Maybe you have already crossed several of them, or maybe you are at the first stage of wealth.

Regardless of where you are, it is important to know what is ahead and prepare for your future stages of wealth. There are many things you can do to prepare your future financial stages.

In this article, I will talk about the 4 main stages of wealth and what you can do to live better through all of them.

Stages of Wealth

You can define your financial life over several stages of wealth. These stages of wealth are sometimes called phases of wealth.

If you are going to live all the way through retirement, whether it is early retirement or not, you will go through these stages of wealth. And you need to plan for each of these stages as you go. There are different things you need to pay attention to during each of these stages. And there are different things you can do to improve each of these stages.

It is not easy to define these stages of wealth properly because people have different definitions of these stages of wealth. For instance, I will talk about the wealth preservation and wealth distribution stages as two different stages. But some people put them together. And some people use different stages as well. But the names are not that important. What is important is that you recognize these stages and prepare for them. It is also important to know where you are.

Wealth Protection Stage

The first of the four stages of wealth is the wealth protection stage. During this stage, you need to protect yourself and your wealth. At this stage, your most valuable asset is your human capital. Your human capital is the value of your future earnings.

This stage is the foundational stage. It will not take you much work to get it done, and it will make the second stage much stronger. Keep in mind that the level of protection you need will vary depending on your risk capacity and your personal situation. Some people will need more protection than others.

First, you will need to prepare an emergency fund. An emergency fund will help you cover the emergency expenses that you will have during the next phases. For most people, an emergency fund of one to six months of expenses is enough. If you have a big expense, you do not want to get into debt to pay it. Your emergency fund will act as a buffer against taking on bad debt.

Talking about bad debt, the other thing you need to do is to get rid of bad debts. You should make a priority to get rid of credit card debt. If you have other high-interest debts, you should work on getting rid of it as well. Not all debts are bad. If you have a 1% mortgage, there is no point in paying it off. But if you pay a 6% car loan, you should get rid of that. But having debts generally means living beyond your means.

Another protection is to take good insurance for some risks. In Switzerland, this is generally not an issue since important insurance is mandatory. But if you do not have mandatory health insurance in your country, it may be important to take it.

Insurance for the loss of a job or death is also important at this stage. If you lose your job, you do not want to be in trouble after a few months. And if you die, you want your family to be safe from financial troubles. Again, in Switzerland, we are mostly insured about this. But if you are a very high-income earner, you may want extra layers of protection.

And the last thing you need to do for this stage is actually to save money. If you are not saving any money, you are not protecting your wealth. A lot of people will be stuck in this stage for a very long time because of that.

There are many ways to save money in Switzerland. Even though this country is expensive, if you are careful, you can save money. Once you have saved enough money for your emergency fund, you can start investing your savings. This will lead you to the next stage of wealth.

Wealth Accumulation Stage

The second of the four stages of wealth is the wealth accumulation stage. This stage will likely be the longest of the stages for you.

Once your wealth is protected, you will need to grow your wealth. For this, you will need to invest your savings. Investing will make your money grow faster. It is essential if you want to accumulate wealth at a faster pace.

There are many ways to invest your money. You can invest in the stock market, like me. Or you can invest in real estate. You can also start a business or invest directly in other businesses. And there are many other alternative businesses available. What is important is to find the investing that works for you and your risk capacity.

Personally, I recommend investing in the stock market with passive index funds. But this may not work as well for you. If you invest in the stock market, the wealth accumulation stage is the one stage you can be the most aggressive with. You have many years in front of you at this stage, and you still have an income. It means you can take calculated risks on the stock market. I am not saying that you should invest with a ton of leverage or short the market. But I am saying that there is nothing wrong with a 100% stock portfolio during this stage.

You could even go through the wealth accumulation stage without investing. But in that case, it will take much longer to reach your financial goal. Inflation will eat your savings very quickly. It is why it is crucial to invest your money.

During this stage, your wealth is already protected. But there are still several things that you need to pay attention to.

First, if you want to accumulate wealth faster during this stage, you will have to save more money. For this, you can either spend less money or earn more money. You can work on both axes at the same time. But do not try to spend less than what you are comfortable with. Some people make their lives miserable during this stage because they think that the next stage will solve everything. But there is no miracle stage. You need to enjoy each of the four stages of wealth.

Nevertheless, your savings rate is the most important metric during this stage. How much of your savings you save will define how long it will take you to retire. But keep in mind that you can also earn more to save more. You do not have to lower your expense.

Then, you need to make sure you are maximizing your returns. If you are investing in index funds, the only thing you can do is to minimize investing fees. These investing fees are the only thing you have control over when you are investing. And they can weigh you down a lot.

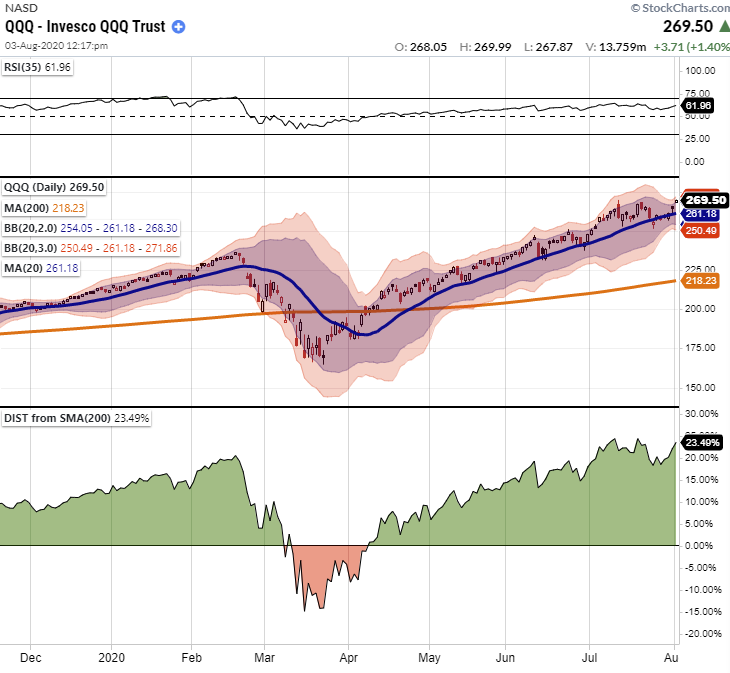

If you invest in the stock market, you really need to keep in mind that time in the market is the most important thing. You should not try to time the market. You should ride the ups and downs. If the market is down, buy more shares, and if the market is up, buy fewer shares (and be happy that your previous shares are up).

Even though it is a good time to take risks, it is not a reason to gamble. If you are losing money by taking too much risk, you will diminish the chances of reaching the next stage of wealth.

At this stage, you will also need to try to optimize your taxes. For this, you need to make good use of tax-advantaged retirement accounts, mainly the third pillar. Investing the maximum each year in your first pillar is a good way to start accumulating wealth. And depending on your goals and financial status, you could also take advantage of the second pillar.

Depending on what your goals are, you may enter the next stage at a different time. If you are planning to retire early with the 4% rule, you will be able to retire once your net worth reaches your target FI Number. But you may want to wait to have a buffer. If you plan for standard retirement, you will reach the next stage once you retire and get your retirement benefits.

Wealth Preservation

The third of the stages of wealth is the wealth preservation stage. Some people are actually calling this stage the wealth distribution stage. The rationale is that you are distributing wealth to yourself. But the name does not matter. It is the stage where you live from your investments.

During this stage, you want to preserve your wealth. You want your wealth to last as long as possible because you will live from your wealth.

At this stage, you want to make sure that your withdrawal strategy is sound. You want to know what you will sell and when you will sell it to live from your investments. If you only have cash, you may not need such a strategy. But cash will not sustain you long enough.

At this stage, you may need to be less aggressive. Most people will switch a part of their portfolio to bonds at this stage. It is not mandatory to do so, but it could be good for your peace of mind. Another way to prepare for this stage is to start accumulating a larger buffer of cash. For me, I would prepare a one-year buffer before I would retire. This would help not to have to sell at the wrong time.

During this stage, you will still need to minimize your taxes and your investing fees. If you are retiring in Switzerland, your main taxes will likely be your wealth taxes. The only thing you can do about it is to move to another state with lower taxes (geo-arbitrage is very strong in Switzerland). But this may not be what you want to do.

Finally, if you plan on retiring with a house and no income, you may have to consider paying off your mortgage (or reducing it) before this stage. Without any income, you may not qualify to renew a mortgage after your retirement. And the bank may force you to sell your house. It is important to consider that in the transition between accumulation and preservation stage.

This stage is related to your retirement or your early retirement. If you are after early retirement, you will have two different sub-stages:

- One stage where you do not get retirement benefits

- One stage where you get the retirement benefits.

These two sub-stages are slightly different. But they have the same goal, to preserve your wealth in the long-term. You want your wealth to sustain your lifestyle as long as possible, ideally forever.

Wealth Distribution Stage

The last of the four stages of wealth is the wealth distribution stage. It is probably the stage that people like the least to talk about. Indeed, this stage is related to your death.

Sometimes, this stage is called wealth conservation because you want to conserve your wealth after your death.

When you are reaching the last years (or decade) of your retirement, you may want to talk about what will happen to your wealth after your passing. Most people do not like to talk about that. But most people would not like to see a lot of their wealth wasted either.

If you have children, you will likely be able to pass your money to them without taxes. Indeed, most inheritance to children is tax-free in Switzerland. However, if you plan to donate money to other people, they will have to pay taxes on it. So, you will need to plan this accordingly.

You could also start distributing your money earlier. That way, you will reduce your taxes (less wealth is less wealth tax) and conserve more of your wealth.

If you plan on donating some money to charity, you could also start doing it in advance. Doing so will also reduce your taxes.

If you have a large estate, the best way to ensure it is being passed on without issues is to write a will. If your situation is straightforward and you want to follow default inheritance rules, you may be fine without it. But a will could help make things more simple.

Conclusion

The four stages of wealth are equally important. If you are not prepared for one of these stages of wealth, you may encounter issues or stay longer than necessary in one stage.

It is important to know and prepare these stages. You do not need to plan them all. But once you are in a stage, you should already prepare for the next one. For instance, if you are accumulating wealth, you should be prepared on withdrawing it later.

I hope this article will prepare you better for each of the four stages of wealth.

At which of these four stages of wealth are you?

Tags: Featured,Financial Independence,Investing,newsletter