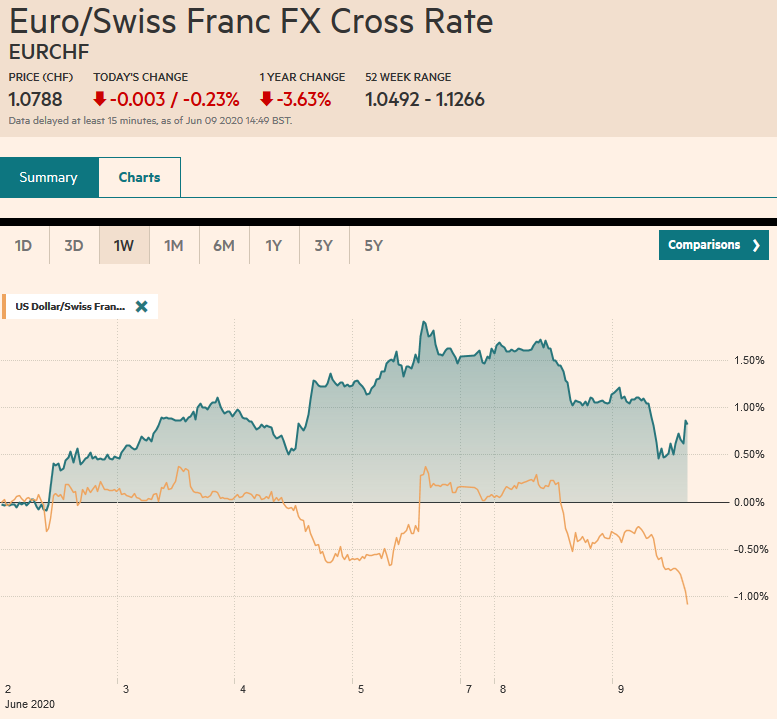

Swiss Franc The Euro has fallen by 0.23% to 1.0788 EUR/CHF and USD/CHF, June 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 turning higher on the year was the last straw before an arguably overdue bout of profit-taking kicked-in and is the dominant feature today in the capital markets. It began slowly in the Asia Pacific region. Equities were mixed, and Australia’s 2.4% rally and the 1.6% gain in Hong Kong stood out. Europe’s Dow Jones Stoxx 600 was off for a second day (~1.3%), and US stocks are trading heavily, warning that the S&P 500 may give back most of yesterday’s gains. Bonds have found a bid, and the US 10-year yield that had been pushing above 90 bp comes back to near 82 bp. Asia

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, CHF, Currency Movement, Featured, Federal Reserve, HKMA, jobs, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.23% to 1.0788 |

EUR/CHF and USD/CHF, June 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

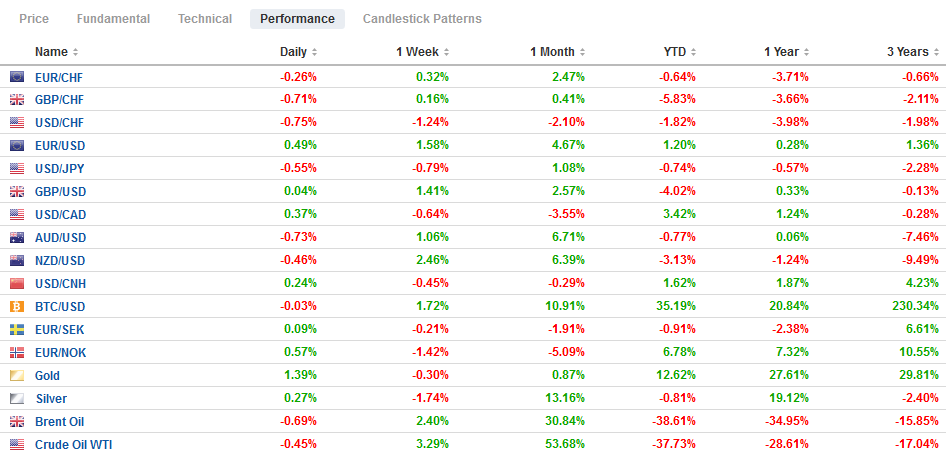

FX RatesOverview: The S&P 500 turning higher on the year was the last straw before an arguably overdue bout of profit-taking kicked-in and is the dominant feature today in the capital markets. It began slowly in the Asia Pacific region. Equities were mixed, and Australia’s 2.4% rally and the 1.6% gain in Hong Kong stood out. Europe’s Dow Jones Stoxx 600 was off for a second day (~1.3%), and US stocks are trading heavily, warning that the S&P 500 may give back most of yesterday’s gains. Bonds have found a bid, and the US 10-year yield that had been pushing above 90 bp comes back to near 82 bp. Asia Pacific benchmark 10-year yields were 3-6 bp lower, while core yields in Europe were a couple basis points lower, outperforming the peripheral bonds. The euro snapped its longest in advance in many years last week, and today the Australian dollar is ending an eight-day advance, its longest in around 2.5 years. The greenback is stronger against all the majors, but the two other major funding currencies, the yen and Swiss franc. The JP Morgan Emerging Market Currency Index is ending an eight-day rally today as widespread profit-taking is being seen throughout the capital markets. Gold is recovering from its recent dip and is back above $1700. Oil is lower for the second consecutive session. Light sweet crude for July delivery settled last week near $39.55, and today it is a little more than $2 lower than that. |

FX Performance, June 9 |

Asia Pacific

The PBOC appears to be trying to put a floor under the dollar. The dollar has fallen in seven of the past eight sessions coming into today. During this period, it fell from near CNY7.18 to CNY7.07 yesterday. The PBOC set the reference rate at CNY7.0711 today though the median bank model in the Bloomberg survey had it at CNY7.0656. Meanwhile, the Hong Kong Monetary Authority continues to offset the flows from the mainland and elsewhere drawn by the new IPOs and yield-pick up over the US by intervening to defend the band. The HKMA bought about $1.2 bln in today’s operation. At the same time, the US has not followed-up yet on US Trump’s announcement that it was reviewing Hong Kong’s special trade status, and the surge of forward points seen on the threat continues to unwind.

Separately, the US is moving quietly to exempt more Chinese imports from its punitive tariffs. The next exemptions include some television LCD main-board assemblies and lithium-ion batteries. At the same time, the US is expected to shortly announce sanctions on individual Chinese officials for human rights violations related to the Uighur minorities. Lastly, the US wants China to participate in US-Russia talks to replace the START treaty (nuclear weapons) that expires early next year. China is balking.

Japan reported its first decline in cash wages this year for April. The 0.6% year-over-year decline was smaller than economists projected. Last April, cash wages had fallen by 0.3% year-over-year. Separately, Japan reported machine tool orders fell 52.8% year-over-year in May after a 48.3% fall in April. The Japanese economy is contracting for its third consecutive quarter.

The dollar approached JPY109.85 at the end of last week after the surprising US jobs data. It sold-off to JPY108.25 yesterday, which may have weighed on Japanese share prices today. Follow-through selling today has pushed it to about JPY107.80, putting an expiring $350 mln option at JPY107.85 on the bubble. The greenback has not closed below the 20-day moving average (~JPY107.90) in a month. A trendline from early last month is near JPY107.60 today, and the (61.8%) retracement of the recent rally is found closer to JPY107.45. The Australian dollar edged higher initially, reaching to $0.7040 before reversing lower. A key reversal requires it to close below yesterday’s low (~$0.6960). It has been to nearly $0.6915 today. That $0.6960 area may now serve as resistance.

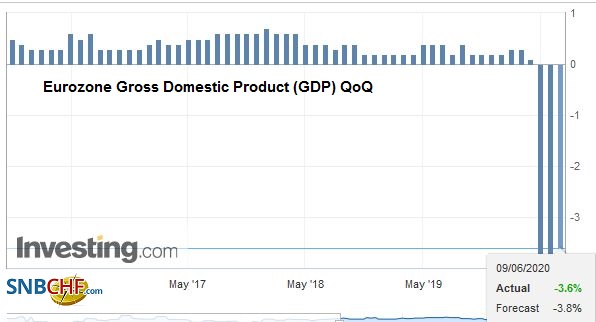

EuropeThe global shutdown saw the German trade surplus evaporate in April. The 3.5 bln surplus, down from 17.4 bln in March and 17.8 bln in April 2019, is the smallest since the end of 2000. Exports fell by nearly a quarter in the month (-24%) after falling 11.7% in March. Imports fell 16.5% after a 5% decline in March. That said, it has taken the pandemic and the economic shock to spur German fiscal policy into action. Ordoliberalism recognizes the emergency and Germany economic support is among the largest. The risk is that it plants the seeds for a new divergence that could be the source of the next crisis in Europe. |

Eurozone Gross Domestic Product (GDP) QoQ, Q1 2020(see more posts on Eurozone Gross Domestic Product, ) Source: investing.com - Click to enlarge |

The Swiss franc fell every day last week against the euro for the first time since last November. The streak was snapped yesterday as the euro pulled back by about 0.5%, and follow-through selling is seen today. Since the mid-May low of near CHF1.05, the euro has recovered nearly 4% and poked above CHF1.09 before the weekend. The break of CHF1.0760 today signals risk toward CHF1.07. The franc’s pullback last week took pressure off the Swiss National Bank, which has been intervening. Last week, snapped a 14-week uninterrupted increase in Swiss sight deposits, one of the quickest places intervention can be seen. The sight deposits rose by around 20% over the streak.

The euro rose to almost $1.1385 at the end of last week before reversing lower. It slipped briefly through $1.1270 yesterday and held above the five-day moving average ($1.1265). Follow-through selling today pushed it to almost $1.1240 in the European morning, where early bids were found. Resistance is seen in the $1.1280-$1.1300 band, where the upper end holds an option for roughly 800 mln euros that expires today. Given the sharpness of the euro’s recent rally, it ought not to be surprising that the first important retracement (38.2%) is not found until closer to $1.1185. Sterling is also threatening a key downside reversal today. It initially traded above yesterday’s high and reached its best level since March 12 (~$1.2755) but has since reversed lower and fell below yesterday’s low (~$1.2630). A close below there is critical to confirm the pattern. The initial objective may be close to $1.25.

America

The National Bureau of Economic Research is the official arbiter of the US business cycle. It does not use the rule-of-thumb of two consecutive contracting quarters of growth to define a recession, the end of the business cycle. It declared that the record-long expansion peaked in February and that the broad impact from the magnitude of the decline in employment and output signals a recession. Economists generally accept that a recession has begun, but hold out the possibility that what is a deep contraction is short-lived. None of the NBER recessions have lasted less than half a year. The average length of the last three recessions was about 11 months. That said, the NY Fed’s GDP-tracker sees a 25.5% contraction in Q2 to be followed by a further 12% drop in Q3. Of course, the broad direction of the economy now is a function of the Covid-19.

The signaling effect of the Federal Reserve is often under-appreciated. Many who thought that letting its balance sheet shrink was “quantitative tightening” did not, we argued, give just due to the signaling channel of policy. Now too, this channel has been key to the recovery of the capital markets and bank lending. Many of the facilities that the Fed announced in March and April have yet to be launched, like ones for the corporate bonds and business loans. The Fed has bought a limited amount of ETFs that track the corporate bond market, but not individual bonds. Companies have to meet some modest criteria (US-based, investment grade as of March 22, and not a beneficiary of specific support under the Cares Act) and register. This may create a stigma, and the cool industry response may delay the launching. In the EMU, the ECB buys corporate bonds that it wants under its own eligibility criteria. There is no registration.

However, the Fed is flexible and announced some adjusted to its Main Street lending program for small and medium-sized businesses. It reduced the minium-size to $250k loans from $500k. The banks wanted a $100k floor. It also increased the maximum-size loan $300 mln from $200 mln. By widening the range, more companies can be eligible. The terms also were adjusted to make them more attractive. The loans were lengthened from four years to five, and the period that the payment can be deferred was extended to two years from one.

The US JOLTS report will likely be scrutinized after controversial jobs report end the end of last week. The non-farm payroll results are not really contested. All the sectors gained, but the government, which seemed to be educators. The controversy stems from the other survey, the one for households and how the furloughed workers categorized themselves. The labor force itself has shrunk, and this also distorts the calculus. Moreover, the weekly initial jobless claims show a considerably worse picture of the labor market. The incongruence of the different methodologies is not unusual. When seen through the framing of the PMI, ISM, and the gradual re-opening in many states, it does appear that the long-road toward recovery has begun. Separately, Mexico reports May CPI figures, and a small increase is expected. Banxico meets against on June 25, and the strength of the peso will offset the uptick in CPI and encourage another rate cut.

The US dollar is threatening its largest gain against the Canadian dollar today since May 1, when it rose a little more than 1%. The US dollar held yesterday’s low in early Asia (~CAD1.3360) and bounced smartly as recent positions were unwound. The greenback reached almost CAD1.3480 in the European morning. The speed of the move seems to reflect the frothiness of the market. Early North American players may sell the US dollar into that rally. Initial support is seen around CAD1.3440. While the US dollar has made new lows against the peso in recent sessions, they were marginal and seemed to take a lot of effort. The downside momentum faltered around MXN21.50. The short-covering has seen the dollar rise MXN21.91 today. Resistance is seen around MXN22.00, but if the price action is not just a one-day wonder of Turn Around Tuesday, an initial corrective target may be nearer MXN22.60.

Tags: #USD,$CHF,Currency Movement,Featured,federal-reserve,HKMA,jobs,newsletter