With the country in recession, we remain cautious on Italian sovereign debt. But growing tensions inside the government could have a silver lining.The main leading indicators are pointing towards the recession continuing in Q1 2019 in Italy. We expect growth to move marginally back into the black in Q2 2019, with the Italian economy growing by 0.3% in 2019 overall. Even though we have ruled out a snap 2019 election from our central scenario, the chances of one being called are significant enough not to be overlooked, given rising tensions within the populist governing coalition. Should a snap election be held in 2019, it would be unlikely, in our view, to happen before September/October.Along with uncertainties surrounding the governing coalition and poor economic prospects, rating

Topics:

Laureline Chatelain and Nadia Gharbi considers the following as important: Italian growth, Italian sovereign debt, Italy debt, Italy government, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

With the country in recession, we remain cautious on Italian sovereign debt. But growing tensions inside the government could have a silver lining.

The main leading indicators are pointing towards the recession continuing in Q1 2019 in Italy. We expect growth to move marginally back into the black in Q2 2019, with the Italian economy growing by 0.3% in 2019 overall. Even though we have ruled out a snap 2019 election from our central scenario, the chances of one being called are significant enough not to be overlooked, given rising tensions within the populist governing coalition. Should a snap election be held in 2019, it would be unlikely, in our view, to happen before September/October.

Along with uncertainties surrounding the governing coalition and poor economic prospects, rating agencies Standard & Poor’s and Fitch could well lower Italy’s sovereign rating, as Moody’s has already done.

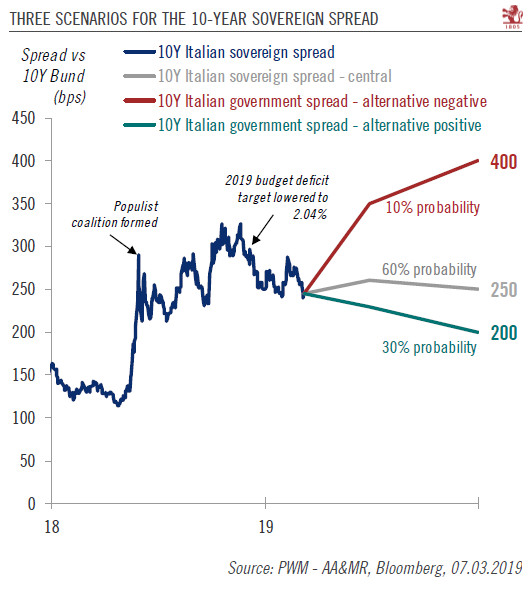

As a result of these developments, we expect the 10-year Italian sovereign spread over Bunds to remain volatile, moving in a range of 240-280 basis points (bps) this year. We are sticking with our base year-end forecast of a 250bps spread.

However, there is the possibility that an early election brings to power a centre-right-wing coalition with a conservative fiscal stance. This would lead to an improvement in investor sentiment. In addition, any cut in Italy’s rating will probably come with a change in ratings agencies’ outlook for Italian sovereign debt from ‘negative’ to ‘stable’. This could ease fears about a potential downgrade of Italian sovereign debt to the high-yield category. In this positive scenario, to which we assign a probability of 30%, spreads over Bunds for 10-year Italian government bonds could fall to 200bps.

Overall, however, we remain cautious on Italian sovereign debt and we are underweight euro area peripheral debt in general.