Despite a weaker than expected February employment report, the three-month average remains robust and we would tend to dismiss this weak print as a mere ‘blip’.With only 20,000 job additions, the US employment report for February was weak. However, with the three-month average remaining robust at 186,000, we would tend to dismiss this weak print as a mere ‘blip’. Furthermore, the weak reading is inconsistent with other labour market data and indicators, including recent consumer and business surveys.Some details of the report reinforce the view that it is too early to conclude that this marks a sharp cyclical turning point in the economy. Employment in temporary help services was up on the month (+6,000) and up 2.2% year-on-year (y-o-y). This is an important positive bellwether, in our

Topics:

Thomas Costerg considers the following as important: Macroview, US monetary policy, US payrolls, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Despite a weaker than expected February employment report, the three-month average remains robust and we would tend to dismiss this weak print as a mere ‘blip’.

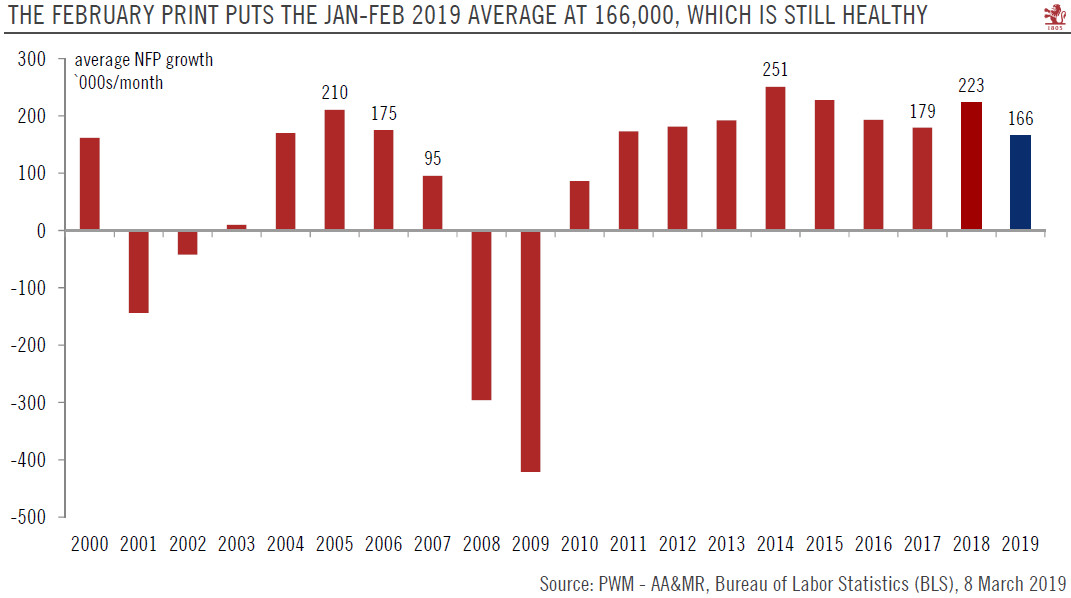

With only 20,000 job additions, the US employment report for February was weak. However, with the three-month average remaining robust at 186,000, we would tend to dismiss this weak print as a mere ‘blip’. Furthermore, the weak reading is inconsistent with other labour market data and indicators, including recent consumer and business surveys.

Some details of the report reinforce the view that it is too early to conclude that this marks a sharp cyclical turning point in the economy. Employment in temporary help services was up on the month (+6,000) and up 2.2% year-on-year (y-o-y). This is an important positive bellwether, in our view.

Meanwhile, wage growth was stronger than expected at 3.4% y-o-y. From a medium-term business cycle perspective, this is an ‘amber light’, since it demonstrates that the US business cycle is gradually entering a ‘late cycle’ phase, with higher recession risks. But we would still tend to downplay these in the very near term. We still think there are several factors underpinning solid growth in the near term, including vibrancy in the domestic energy sector and the ongoing, economy-wide technological upgrades underway.

From a Federal Reserve perspective, this report is likely to play to the hands of the Fed’s doves, implying that more caution is warranted in the near term, given US data is muddy and global growth continues to be uneven (especially in China and Europe). The Fed is likely to ignore the uptick in wage growth since it no longer prescribes to the Phillips curve link between the labour market and inflation.

We still expect a US rate hike later this year, although the risk remains to the downside, especially as it will depend on developments abroad, including in China and Europe. The dovish turn at the ECB could reinforce the downside risks to our Fed scenario.