Our baseline scenario suggests limited upside potential for the dollar against the yen, given the current low stock market volatility environment.The Japanese yen has been weak recently, as volatility in the US stock market has receded. Indeed, the sharp increase in US stock market volatility at the end of last year favoured the yen through short-covering and repatriation flows, whereas the subsequent rebound in global risk appetite has penalised the defensive yen (see chart).This recent depreciation of the Japanese currency relative to the greenback is unconfirmed by the interest rate differential in 2019, which is unlikely to be as supportive of the dollar relative to the yen as it was in 2018. We also see its recent divergence with the USD/JPY rate as temporary.Our scenario for 2019 on

Topics:

Luc Luyet considers the following as important: currencies, Japanese Yen, Macroview, USD/JPY

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joseph Y. Calhoun writes Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

Our baseline scenario suggests limited upside potential for the dollar against the yen, given the current low stock market volatility environment.

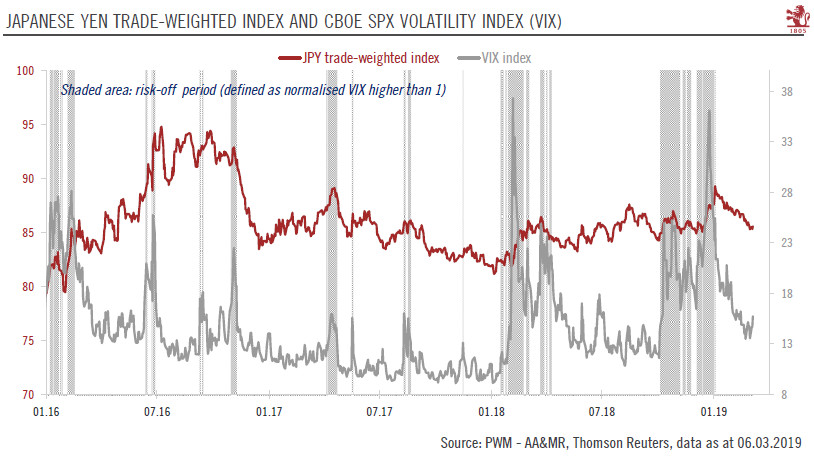

The Japanese yen has been weak recently, as volatility in the US stock market has receded. Indeed, the sharp increase in US stock market volatility at the end of last year favoured the yen through short-covering and repatriation flows, whereas the subsequent rebound in global risk appetite has penalised the defensive yen (see chart).

This recent depreciation of the Japanese currency relative to the greenback is unconfirmed by the interest rate differential in 2019, which is unlikely to be as supportive of the dollar relative to the yen as it was in 2018. We also see its recent divergence with the USD/JPY rate as temporary.

Our scenario for 2019 on risk appetite is that the current low level of volatility will not be the norm. As a result, higher stock market volatility would likely bring back some upward pressure on the Japanese yen.

Looking forward, market volatility and the interest rate differential (two key drivers of the yen) are expected to favour an appreciating yen. The extreme fundamental undervaluation of the yen should magnify this trend. Our projections for the USD/JPY rate are JPY110 in three months, JPY107 in six months and JPY102 in 12 months.