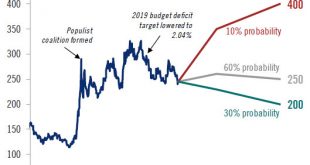

With the country in recession, we remain cautious on Italian sovereign debt. But growing tensions inside the government could have a silver lining.The main leading indicators are pointing towards the recession continuing in Q1 2019 in Italy. We expect growth to move marginally back into the black in Q2 2019, with the Italian economy growing by 0.3% in 2019 overall. Even though we have ruled out a snap 2019 election from our central scenario, the chances of one being called are significant...

Read More »Fiscal battle looms over Italian bonds

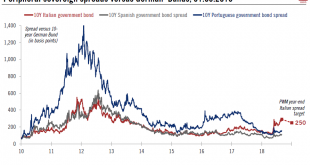

Given the market volatility we expect around 2019 budget discussions in Italy, we remain bearish on euro peripheral bonds in general.Italy is coming back into focus as investors become increasingly nervous about 2019 budget discussions. September will be a key moment to gauge the intentions of the Italian government regarding its 2019 budget. Indeed, more details will become available when the Italian government publishes the updated Economic and Financial Document (DEF), no later than 27....

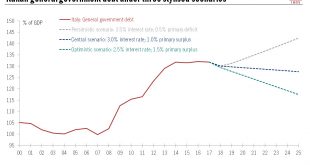

Read More »Different paths for Italian public debt

The fiscal policies of the new Italian government will determine the trajectory for Italian debt. The high uncertainty means we are bearish on euro area peripheral bonds.At 132% of GDP, Italy has the second-highest public debt load in the euro area after Greece. Italy’s debt ratio has remained broadly stable over the past five years, but the sustainability of public debt remains highly vulnerable to shocks, let alone a recession or financial crisis.In addition, here are still lots of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org