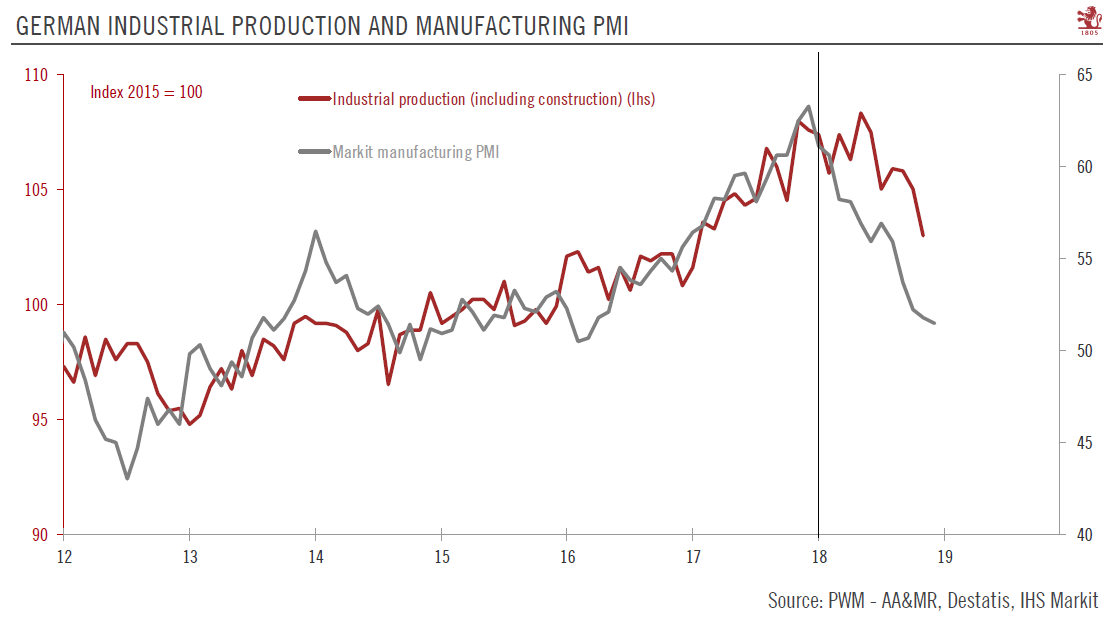

Sagging industrial production and confidence figures point to weak Q4 GDP.German industrial production (including construction) fell by 1.9% month-on-month in November, extending the sector’s decline to five out the six last prints. Year on year, industrial production was down by 4.6%, the worst performance since November 2009.While some idiosyncratic factors were likely at play, such as below-average water levels on the Rhine, which may have had an impact on energy production and chemical goods output, confidence surveys show that there is a clear underlying weakness in the German industrial sector. On a brighter note, hard data shows that production in the German automotive sector is slowly normalising after the considerable disruption caused by the need to conform to the new worldwide

Topics:

Nadia Gharbi considers the following as important: European manufacturing, German PMI, Germany, Macroview

This could be interesting, too:

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Marc Chandler writes Trump’s Tariff Talks Wobble Forex Market, Close Neighbors Suffer Most

Marc Chandler writes Searching for Direction

Marc Chandler writes Serenity Now

Sagging industrial production and confidence figures point to weak Q4 GDP.

German industrial production (including construction) fell by 1.9% month-on-month in November, extending the sector’s decline to five out the six last prints. Year on year, industrial production was down by 4.6%, the worst performance since November 2009.

While some idiosyncratic factors were likely at play, such as below-average water levels on the Rhine, which may have had an impact on energy production and chemical goods output, confidence surveys show that there is a clear underlying weakness in the German industrial sector. On a brighter note, hard data shows that production in the German automotive sector is slowly normalising after the considerable disruption caused by the need to conform to the new worldwide emissions testing protocol last year. Yet the environment for German cars remains challenging. While the likelihood of US tariffs on German cars has diminished, uncertainty around future prospects for German car exports to the US is likely to continue weighing on sentiment.

While industrial production data points to recession, other hard data and surveys do not. On balance, all the data available so far point to virtually no growth in Q4, but Germany should (just about) avoid a recession.

Looking ahead, fundamentals such as labour market and credit conditions remain healthy, and will continue to support consumer demand. Moreover, fiscal policy will turn more supportive in 2019. But for a trade-oriented manufacturing-heavy economy like Germany’s, the external environment remains key. Uncertainty has not completely disappeared in this regard. German manufacturers were hit by weakening external demand in 2018, notably in key markets like China, but also by global uncertainty stemming from trade tensions and Brexit turmoil. Should trade tensions ease, we might see a rebound in external demand for German goods in early 2019.