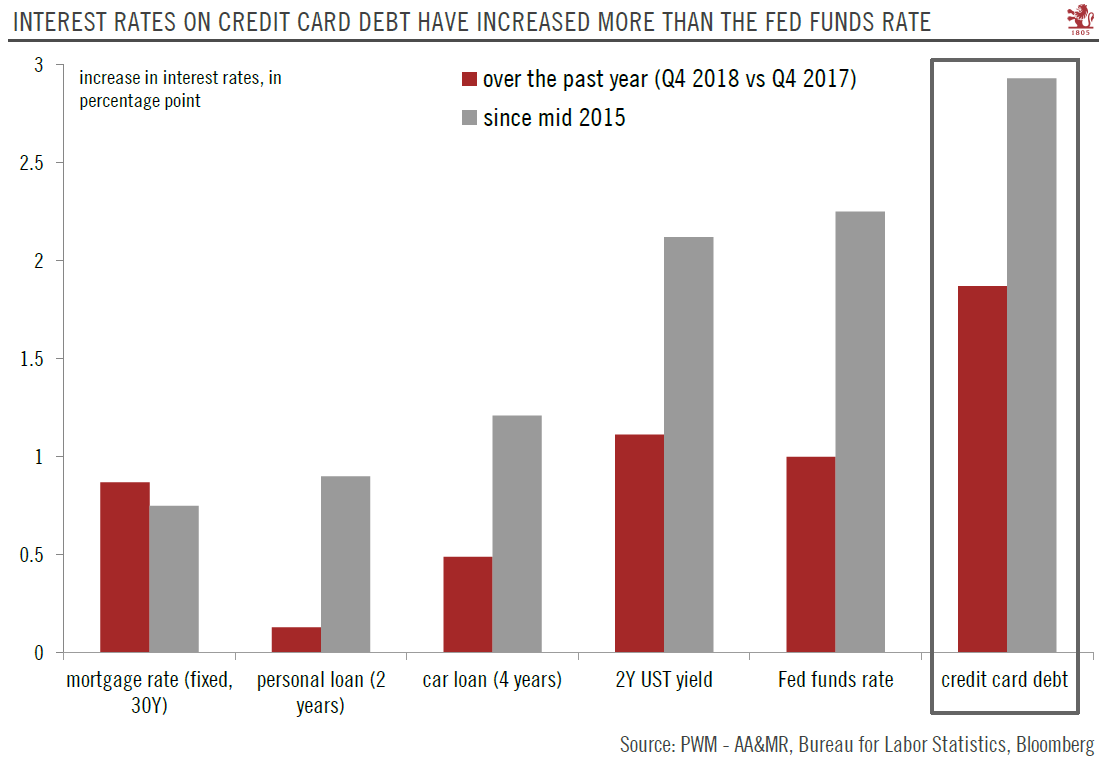

The increase in interest rates paid for credit card debt far exceeds the rise in the Fed funds rate, pointing to sizeable divergence in the impact Fed tightening is having on the US economy.The Fed’s interest-rate tightening since Q4 2015 has had divergent repercussions on interest rates paid by ‘end users’ across the US economy.Interest rates on credit card debt have risen particularly sharply since the start of Fed tightening.How monetary policy is transmitted to the ‘real economy’, including consumers and small businesses, remains a blind spot in US monetary policy, and is too often glossed over by Fed policymakers.Very recently, the Fed has turned its attention to gyrations in stock markets and movements in corporate bond markets.While interest rates have increased sharply in the

Topics:

Thomas Costerg considers the following as important: Macroview, US Fed hike, US Federal Reserve

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The increase in interest rates paid for credit card debt far exceeds the rise in the Fed funds rate, pointing to sizeable divergence in the impact Fed tightening is having on the US economy.

The Fed’s interest-rate tightening since Q4 2015 has had divergent repercussions on interest rates paid by ‘end users’ across the US economy.

Interest rates on credit card debt have risen particularly sharply since the start of Fed tightening.

How monetary policy is transmitted to the ‘real economy’, including consumers and small businesses, remains a blind spot in US monetary policy, and is too often glossed over by Fed policymakers.

Very recently, the Fed has turned its attention to gyrations in stock markets and movements in corporate bond markets.

While interest rates have increased sharply in the credit card space, credit debt borrowing continues to march higher, and US private consumption remains in stellar shape. The flip side is that US consumers may well face a ‘day of reckoning’ at some point as interest continues to compound.