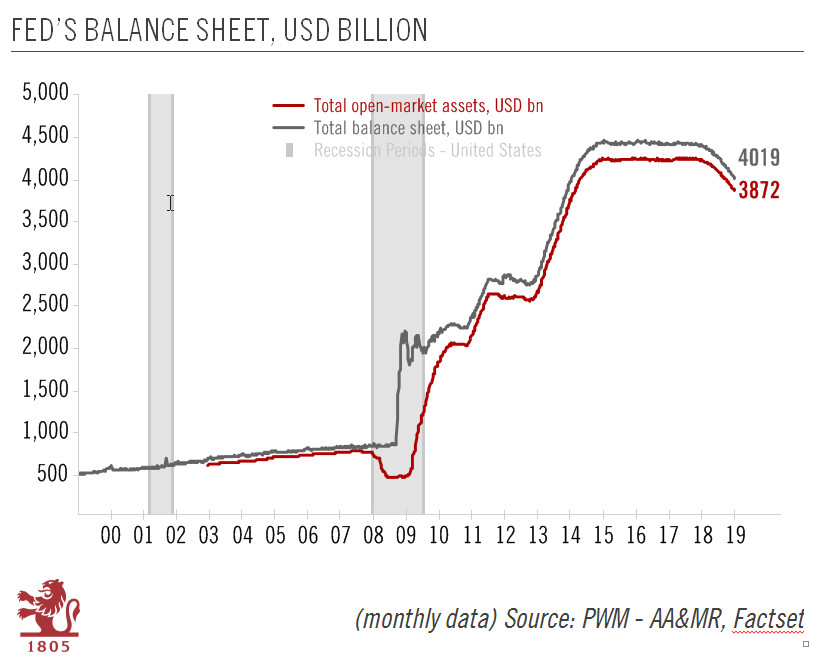

Hints that Fed balance-sheet reduction could in question.Fed Chairman Jerome Powell made dovish remarks at a conference on Friday to the effect that the Fed would be ‘patient’ about further rate increases after having delivered four rate hikes in 2018.Crucially, Powell mentioned possible tweaks to the Fed’s preset plans for balance sheet shrinkage to calm financial markets concerns, after downplaying the balance sheet aspects at the December post-policy meeting press conference.This dovishness – a response to market signals– came even as the December nonfarm payroll report showed there is still strong momentum in the US economy. However, the outlook remains in large part dependent on how upcoming trade talks with China go, as recent business surveys have shown that confidence remains

Topics:

Thomas Costerg considers the following as important: fed balance sheet, Fed dovishness, Fed policy normalisation, Fed rate policy, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Hints that Fed balance-sheet reduction could in question.

Fed Chairman Jerome Powell made dovish remarks at a conference on Friday to the effect that the Fed would be ‘patient’ about further rate increases after having delivered four rate hikes in 2018.

Crucially, Powell mentioned possible tweaks to the Fed’s preset plans for balance sheet shrinkage to calm financial markets concerns, after downplaying the balance sheet aspects at the December post-policy meeting press conference.

This dovishness – a response to market signals– came even as the December nonfarm payroll report showed there is still strong momentum in the US economy. However, the outlook remains in large part dependent on how upcoming trade talks with China go, as recent business surveys have shown that confidence remains fragile. Another important parameter for this year’s growth will be oil prices, which we believe are positively correlated with US growth given the shale oil boom and the US’s rise to the position of the world’s largest oil producer. The sharp drop in the December Texas business survey warrants monitoring in that regard.

All in all, his latest speech shows Powell is trying to reach out to market participants, as he believes that the Fed’s firm stance status quo could ultimately backfire on US growth if financial conditions continue to tighten and business financing costs (and debt-raising capabilities) worsen. This ‘overture’ to markets in the form of re-opening the debate about the Fed’s balance sheet could be a significant step, even though Powell did not give many details about what is really on the table.

Still, the genie is now out of the bottle, and markets will likely pursue the case for slower balance sheet normalisation. Markets are unlikely to let go of its bait. As a result, compared with our current scenario, there is now a growing chance that the Fed could reassess the balance sheet aspects of its policy normalisation and ultimately slow the current pace of its reduction. But we think it could take a few more months of intense data watching before this becomes really clear.