While the latest move will inject liquidity into the Chinese banking system, more direct stimulus can be expected in a bid to lift China’s slowing economy.The People’s Bank of China (PBoC) announced a further reduction in banks’ required reserve ratios (RRR) on Friday by 1 percentage point. According to the central bank, this round of RRR cuts will inject roughly Rmb800 billion of net liquidity into the banking sector.In our view, this move was partly motivated by the economy’s seasonal liquidity needs before the Lunar New Year (which will occur in early February in 2019). The RRR cuts were also likely motivated by the rapid deceleration in the Chinese economy in the past few months.However, the RRR cuts alone will not be able to halt the economic slowdown in China right away. The

Topics:

Dong Chen considers the following as important: China policy stimulus, China reserve requirements, Chinese policy easing, Chinese tax cuts, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While the latest move will inject liquidity into the Chinese banking system, more direct stimulus can be expected in a bid to lift China’s slowing economy.

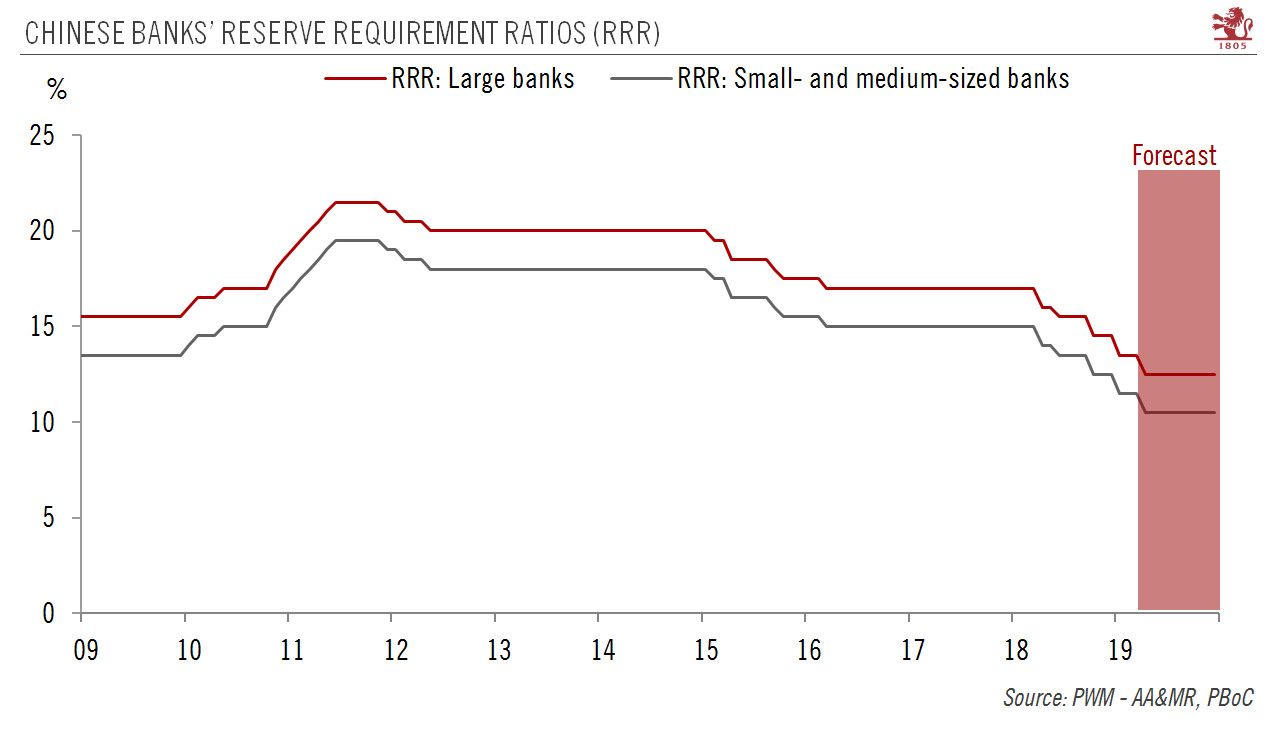

The People’s Bank of China (PBoC) announced a further reduction in banks’ required reserve ratios (RRR) on Friday by 1 percentage point. According to the central bank, this round of RRR cuts will inject roughly Rmb800 billion of net liquidity into the banking sector.

In our view, this move was partly motivated by the economy’s seasonal liquidity needs before the Lunar New Year (which will occur in early February in 2019). The RRR cuts were also likely motivated by the rapid deceleration in the Chinese economy in the past few months.

However, the RRR cuts alone will not be able to halt the economic slowdown in China right away. The government needs to resort to policies that can boost aggregate demand more directly.

Looking forward, we expect the government to engage in more policy easing, such as corporate and value-added tax cuts, fiscal support for infrastructure investment and relaxation of property market restrictions.

After personal income tax cuts late last year, we expect the government to cut corporate income tax rates and the value added tax rates as well. In addition, more fiscal support is needed to revive infrastructure investment. After collapsing for most of 2018, growth in infrastructure investment finally started to stabilise towards the end of last year. However, the pace of recovery is still quite slow, limited by local governments’ reduced capability to obtain funding as a result of the deleveraging campaign. Local government bond issuance needs to pick up to fill in the blanks left by local government financing vehicles (LGFVs). Restrictive property policies need to be relaxed to boost construction activity and to improve local government’s revenue through land sales.

Some of the aforementioned policy measures are already in the pipeline (such as corporate tax and value-added tax cuts), but others are still absent (such as relaxation of property market regulations). In any case, even after the policy announcements, there will be a lag before their impact shows up in economic data.

As a result, we expect the Chinese economy to continue decelerating in Q1-Q2 2019, with growth momentum perhaps starting to stabilise towards the end of Q2. For the moment, our Chinese GDP forecast for 2019 remains unchanged at 6.1%.