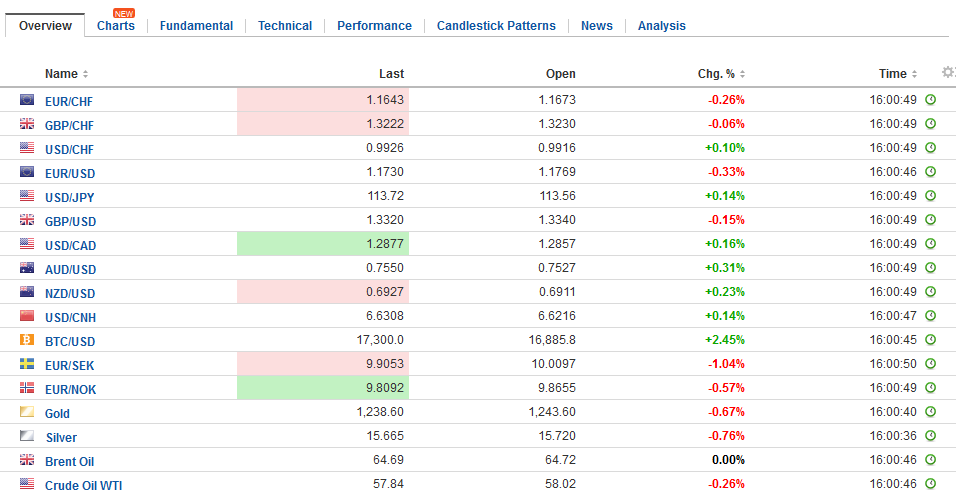

Swiss Franc The Euro has fallen by 0.15% to 1.1651 CHF. EUR/CHF and USD/CHF, December 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Trends The US dollar is trading with a lower bias against most of the major and emerging market currencies. The upside surprise in Sweden’s inflation is helped the krona recover from its recent slide. It is the strongest of the majors, gaining 1.1% against the dollar and nearly as much against the euro, which is in a third of a cent range below .18. Sweden’s CPI rose 0.2% for a 1.9% year-over-year rate. Economists had mostly expected a 1.7% rate. The underlying rate, which uses fixed rate mortgages rose 0.2% for a 2.0% year-over-year pace

Topics:

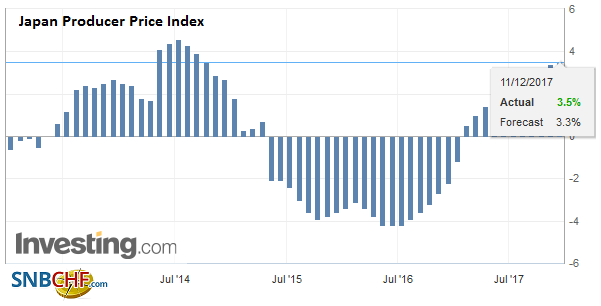

Marc Chandler considers the following as important: Brexit, EUR, Eurozone ZEW Economic Sentiment, Featured, FX Trends, GBP, Germany ZEW Current Conditions, Germany ZEW Economic Sentiment, Japan Producer Price Index, newsletter, Oil, SEK, U.K. Consumer Price Index, U.S. Producer Price Index, USD

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Swiss FrancThe Euro has fallen by 0.15% to 1.1651 CHF. |

EUR/CHF and USD/CHF, December 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX TrendsThe US dollar is trading with a lower bias against most of the major and emerging market currencies. The upside surprise in Sweden’s inflation is helped the krona recover from its recent slide. It is the strongest of the majors, gaining 1.1% against the dollar and nearly as much against the euro, which is in a third of a cent range below $1.18. Sweden’s CPI rose 0.2% for a 1.9% year-over-year rate. Economists had mostly expected a 1.7% rate. The underlying rate, which uses fixed rate mortgages rose 0.2% for a 2.0% year-over-year pace from 1.8%. It is the first increase since July. Sweden’s underlying rate rose 1.9% last year. Yesterday, the euro closed at SEK10.03, the highest for the year, but today is testing SEK9.90. A close below SEK9.92 today could see another 1% move in the coming days. |

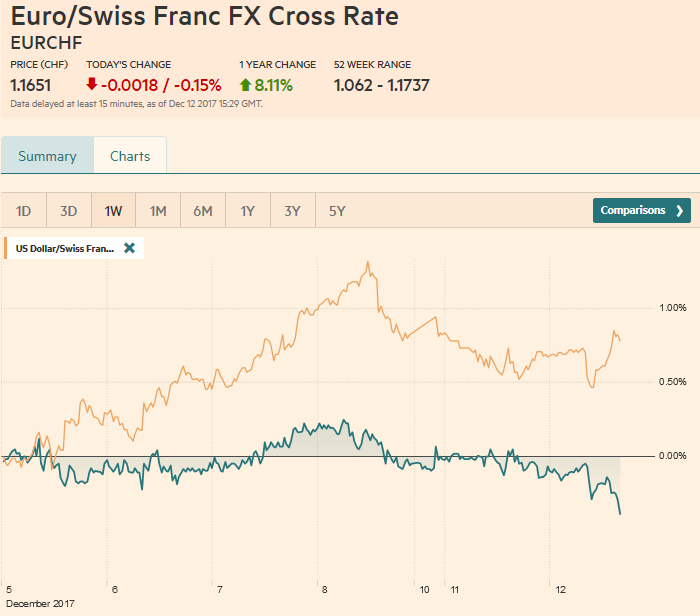

FX Daily Rates, December 12 |

| The Norwegian krone is recovering seemingly in sympathy after yesterday’s softer than expected CPI report. There is some nervousness ahead of central bank meeting on Thursday. The weakness of the krone may prompt officials to raise the expected path of rates. |

FX Performance, December 12 |

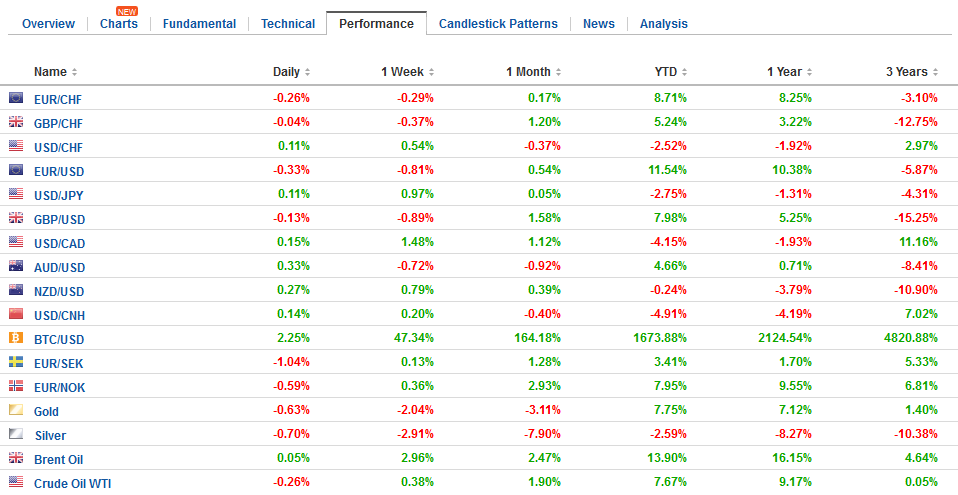

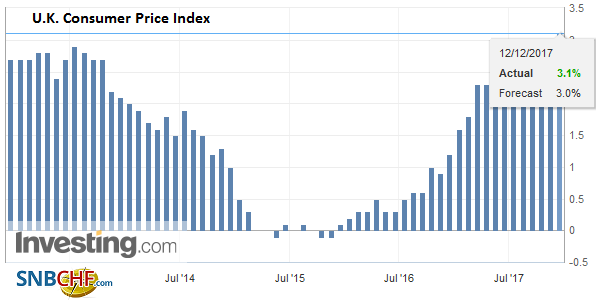

United KingdomStill, it is UK that is the main talking point today. There are three issues. First, the shuttering of the Forties Pipeline for emergency repairs is disrupting the oil market. It is a very important pipeline for the UK and for the setting of the benchmark. The price of Bent jumped 2% yesterday and is up 0.8% today as it pushed through $65 a barrel. WTI for January delivery is advancing, but at half the pace as Brent. It was up 1.1% yesterday and is up 0.45% today. It is approaching the year’s high seen last month just above $59.00. Third is Brexit. Trade Secretary Fox said that the UK wanted trade agreement “virtually identical” to what they have now. He dismissed the EU suggestion that if the UK chooses to leave the single market, a Canada-like agreement is the most that it can reasonable expect as bluster. This is what the UK officials have argued repeatedly in recent months, the negotiations have remains stuck in stage one (the divorce) longer than anticipated. Next week, the UK cabinet will hold its first meeting to discuss a new trade agreement. Meanwhile, the debate over what “regulatory equivalence” continues among cabinet officials. There can be no mistake about it: The fissures in the Tory Party over Brexit remain profound and this will hamper negotiations next year as it has this year. Sterling briefly jumped on the CPI report, but was quickly sold. It was successfully pushed below the 20-day moving average (~$1.3345) for the first time in more than four weeks. Bids may protect the $1.3300 area, though a break could see losses extend toward $1.3200-$1.3220 in the coming days. Sterling is the worst performing of the major currencies, and it could be the third declining day in a row and the fifth in six sessions. Note that there is a GBP428 mln option struck at $1.3350 that expires in NY today. |

U.K. Consumer Price Index (CPI) YoY, Nov 2017(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

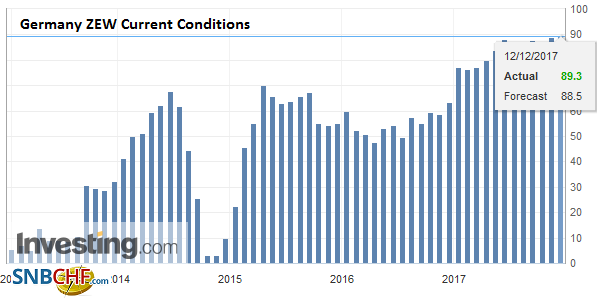

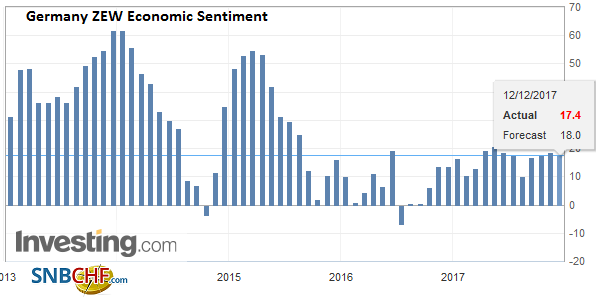

GermanyThe German ZEW survey was mixed. The assessment of the current situation rose to 89.3 from 88.8. This is slightly stronger than expected, but the expectations metric slipped to 17.4 from 18.7. |

Germany ZEW Current Conditions, Dec 2017(see more posts on Germany ZEW Current Conditions, ) Source: Investing.com - Click to enlarge |

| We would not want to exaggerate the significance of the decline in the expectations component, which is still above where it finished at the end of Q3 (17.0) and above the six and 12-month moving averages. |

Germany ZEW Economic Sentiment, Dec 2017(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

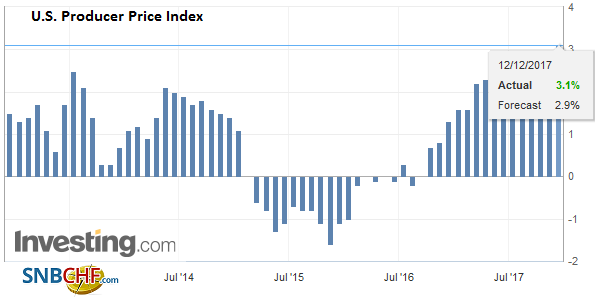

United StatesAhead of tomorrow’s FOMC meeting and CPI report, the US November PPI will be reported. It is not typically a market mover. The details may help economists fine tune their forecasts for the CPI. There seems to be little doubt among investors that the Fed will indeed hike rates tomorrow, the third hike of the year and the fifth in the cycle. The September forecasts pointed to three more hikes next year. The market is skeptical. |

U.S. Producer Price Index (PPI) YoY, Dec 2017(see more posts on U.S. Producer Price Index, ) Source: Investing.com - Click to enlarge |

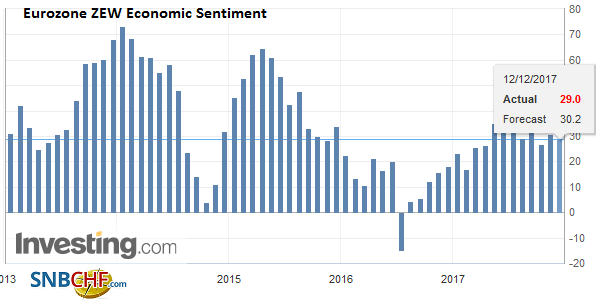

Eurozone |

Eurozone ZEW Economic Sentiment, Dec 2017(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

Japan |

Japan Producer Price Index (PPI) YoY, Nov 2017(see more posts on Japan Producer Price Index, ) Source: Investing.com - Click to enlarge |

S&P cut Colombia’s credit rating one notch to BBB-, which is one step inside investment grade status. The rating agency expressed concern about the fiscal stance, where the tax increase did not generate sufficient revenues. Colombian local currency bonds have been attractive to foreign investors, who have boosted their holdings from 4% in 2012 to 25% recently. The other two main rating agencies see Colombia as a BBB equivalent credit and have stable outlooks.

The Philippine peso was buoyed by Fitch’s recent upgrade to BBB from BBB- and a stable outlook, but it sold off today in response to news that its trade deficit set a record in October (~$2.845 mln). It is the weakest of the Asian emerging market currencies, slipping about 0.3%, giving back yesterday’s gain. The central bank meets on December 14 and is not expected to hike rates.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,Brexit,Eurozone ZEW Economic Sentiment,Featured,Germany ZEW Current Conditions,Germany ZEW Economic Sentiment,Japan Producer Price Index,newsletter,OIL,SEK,U.K. Consumer Price Index,U.S. Producer Price Index