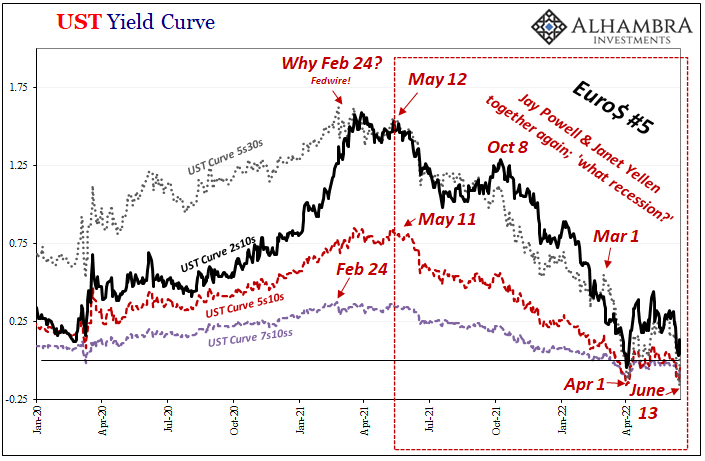

If the March gasoline/oil spike hit a weak global economy really hard and caused what more and more looks like a recessionary shock, a(n un)healthy part of it was the acceleration of Euro$ #5 concurrently rippling through the global reserve system. This much was apparent right from the start, with financial markets gone haywire three months ago (mid-March seasonal bottleneck), and then more of the same into April right to now. The updated TIC data for the month of April is everything we already expected, including the usual after-the-fact corroboration of the situation displayed to us in real-time by market performance. The stand-outs were definitely Japan and China, both JPY and CNY together careening towards the eurodollar, global recession risk abyss. Before

Topics:

Jeffrey P. Snider considers the following as important: $CNY, 5.) Alhambra Investments, bonds, China, currencies, economy, eurodollar system, Featured, Federal Reserve/Monetary Policy, global dollar shortage, Japan, JPY, Markets, newsletter, tic

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

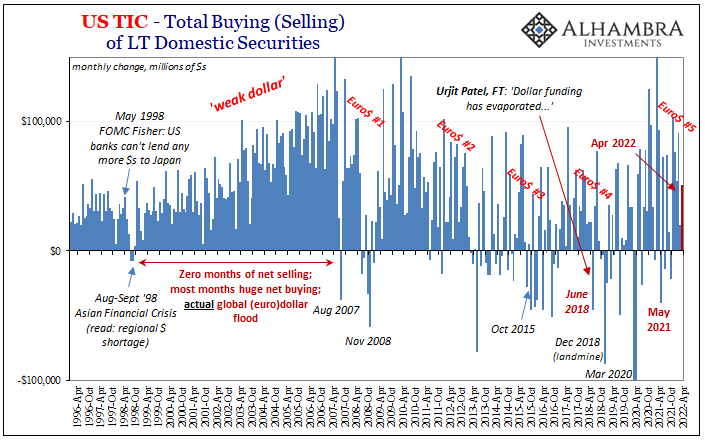

| If the March gasoline/oil spike hit a weak global economy really hard and caused what more and more looks like a recessionary shock, a(n un)healthy part of it was the acceleration of Euro$ #5 concurrently rippling through the global reserve system. This much was apparent right from the start, with financial markets gone haywire three months ago (mid-March seasonal bottleneck), and then more of the same into April right to now.

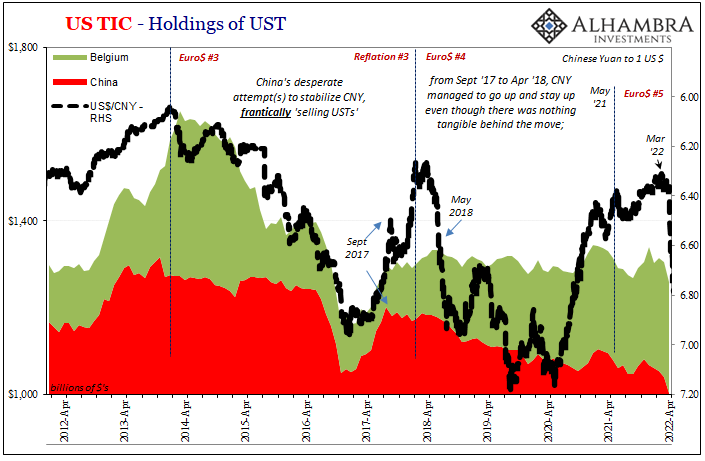

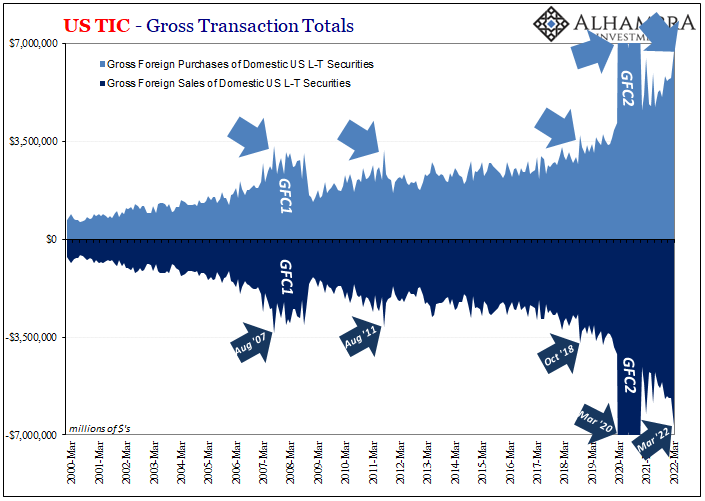

The updated TIC data for the month of April is everything we already expected, including the usual after-the-fact corroboration of the situation displayed to us in real-time by market performance. The stand-outs were definitely Japan and China, both JPY and CNY together careening towards the eurodollar, global recession risk abyss. Before those, first the usual overlay. |

|

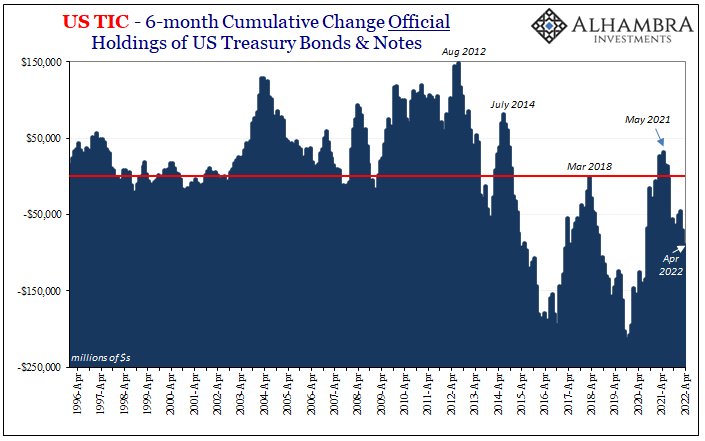

| Official institutions selling USTs (not because they hate America, or even as UST prices were falling), and US banks liabilities to be laid out overseas decelerated even further to their lowest cumulative point since last March (with a negative for this April).

Both those being key warning signs about escalating global dollar shortage. |

|

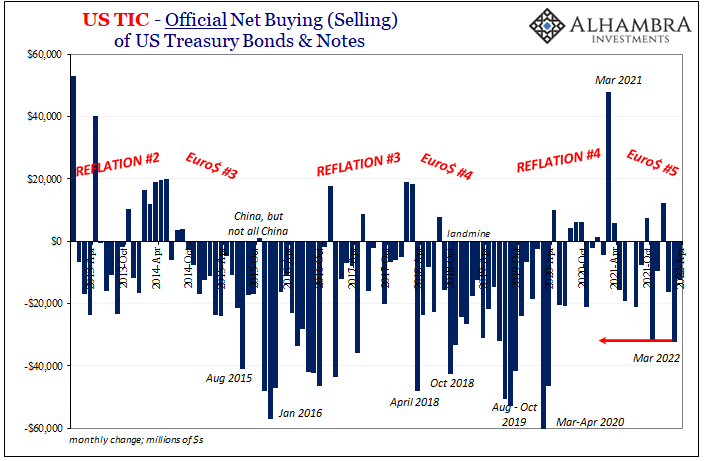

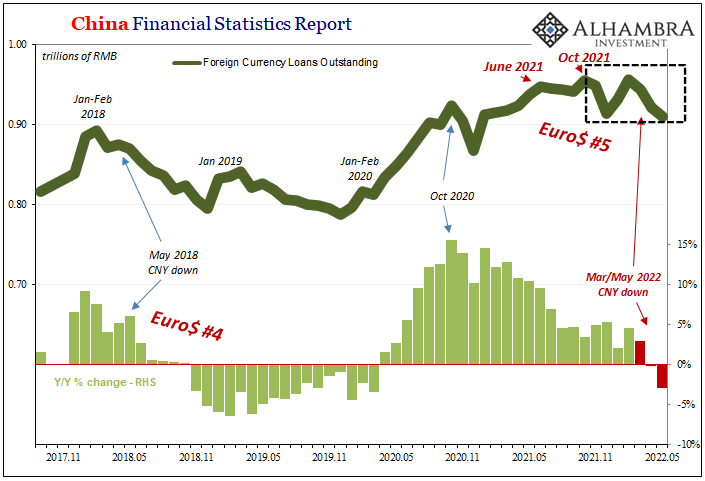

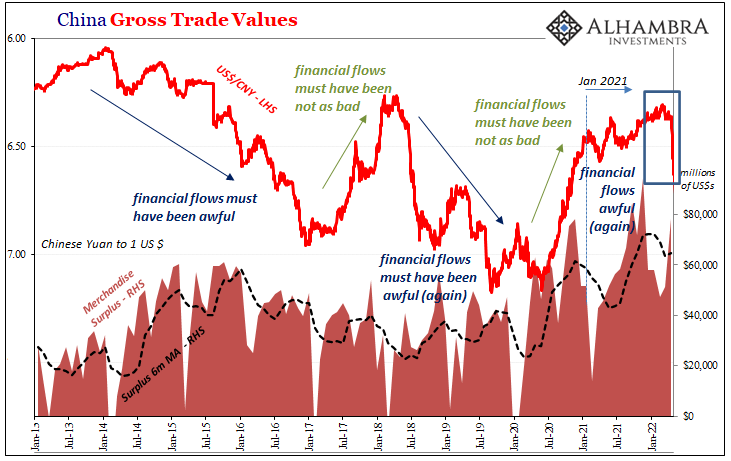

| Against that backdrop, yeah, plummeting CNY and JPY. According to TIC, government efforts in each those places were ramped way up attempting to address what can only have been a rampaging (likely collateral-disrupted) funding environment across much of Asia.

Blame will fall on Xi’s reckless shanghai of Shanghai, but as should become more apparent as more time goes by and with more data confirming this is globally synchronized in all the familiar if unwelcome eurodollar ways; not COVID no matter how much Zero-COVID might get applied even in key global places like China’s industrialized East. The TIC figures now released are as striking as the drop in each currency had been when taking place. |

|

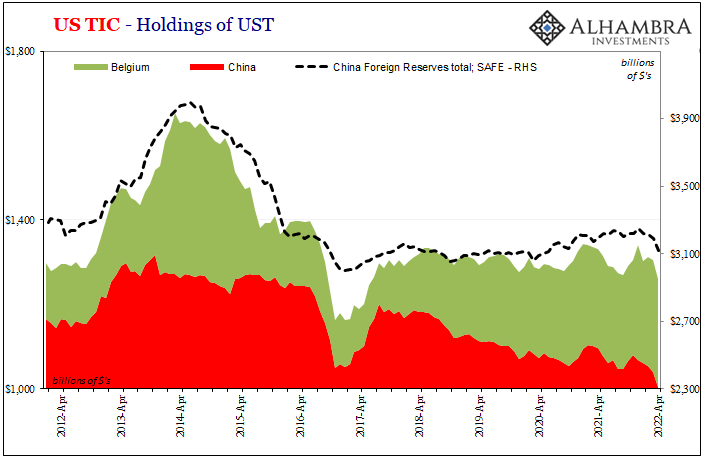

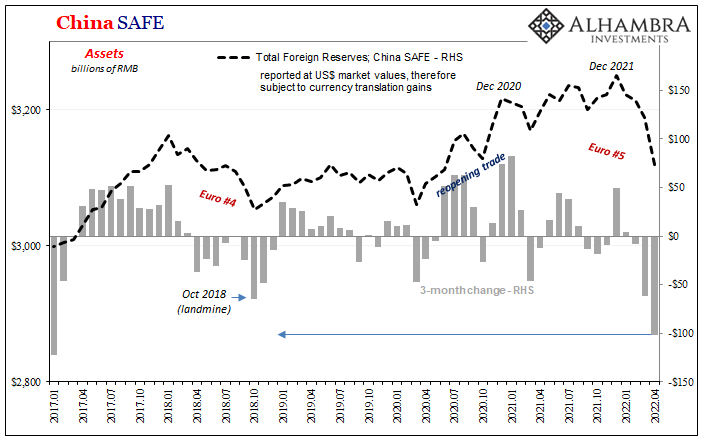

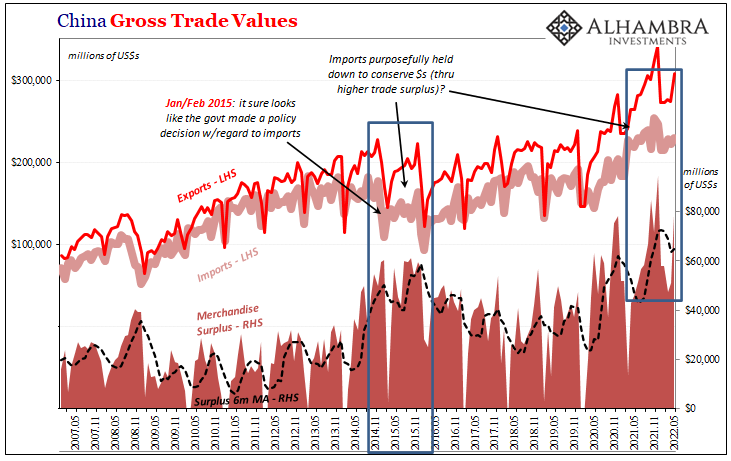

| Taking Mainland China first, registered holdings of USTs fell to just barely more than $1 trillion, down by $36.2 billion in April alone to the lowest reported balance in well over a decade.

There was also a substantial decline in USTs reported for Belgium, almost $10 billion, which we associate with China for very good reasons (see: below China/Belgium TIC charted against SAFE). This was a combined $45.1 billion just in April which goes right along with the equally significant reduction in SAFE holdings reported from China – and, of course, CNY’s near-crash. |

|

| It’s worth reiterating what’s demonstrated (conclusively) by this data, beginning with the fact that China’s yuan isn’t being purposefully “devalued” as a matter of policy, rather the Chinese commercial and financial requirements are being stripped of “dollars” as a function of this increasingly difficult and dangerous Euro$ #5.

While China continues to enjoy record and near-record merchandise trade surpluses, therefore a surplus of “dollars” from it, the reason they aren’t and haven’t been able to literally bank those surpluses is what you see above – the negative financial eurodollar flows had to have been so much worse (which we already knew, just more corroboration from here an American source). |

|

| The implications, obviously, extend far beyond Beijing’s limited reach and capacity to affect CNY’s trajectory therefore China’s quite perilous monetary condition (despite conventional thinking totally contrary; we’re constantly led to believe there is no more effective, nearly omniscient technocratic ideal than the CCP’s PBOC which performs far more like the hapless bureaucrats at the Fed in just being along for what is always the eurodollar’s ride).

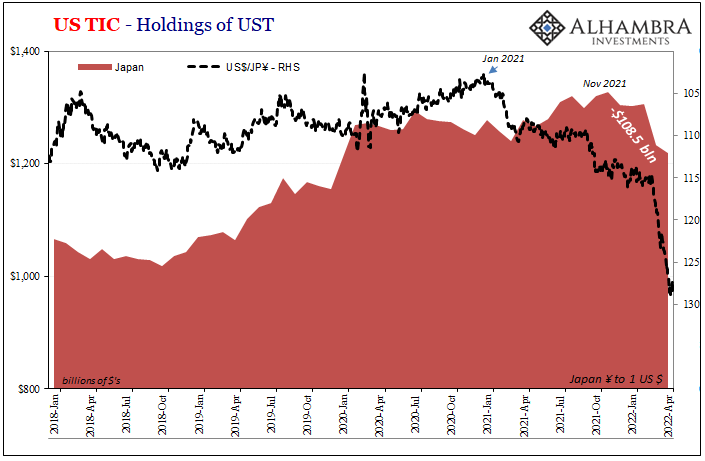

In this case, the wreckage has extended to China’s primary eurodollar benefactors located in Japan. This sort of contagious baby-out-with-the-bathwater behavior by the global eurodollar system had become more apparent during the earlier stages of Euro$ #4, now taken to new extremes for reasons that I think relate to Japan’s own increasingly perilous situation (see: paying 40% more for 10% fewer imports of food and fuel). Japan has its own serious problems in addition to its major financial institutions being so closely linked to risky, unrewarding China by redistributing much toward the Chinese dollar short. For April TIC data, registered UST holdings in Tokyo fell again after March’s big plunge. |

|

|

|

| https://t.co/Ll8vCoF2XU— Jeffrey P. Snider (@JeffSnider_AIP) April 29, 2022

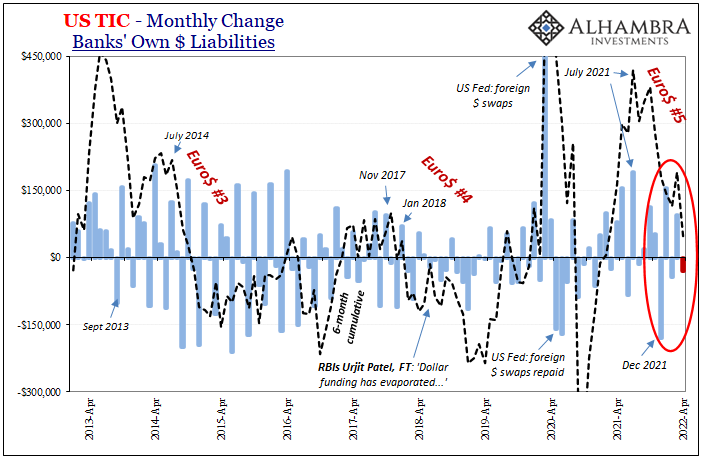

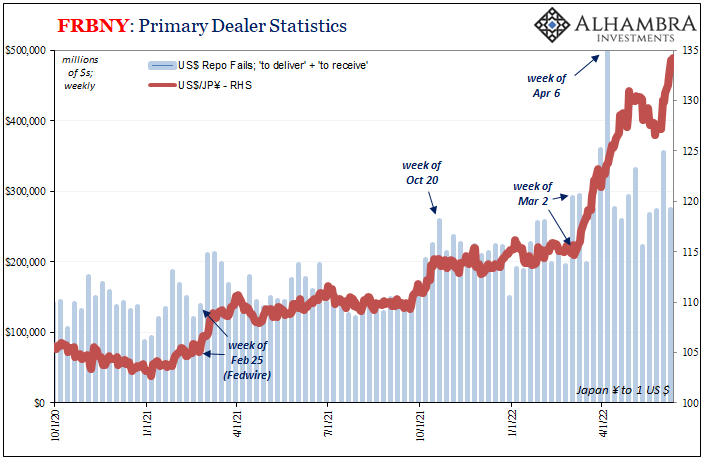

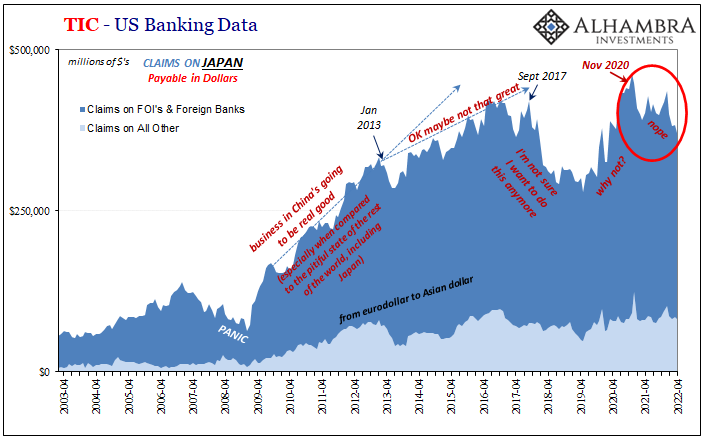

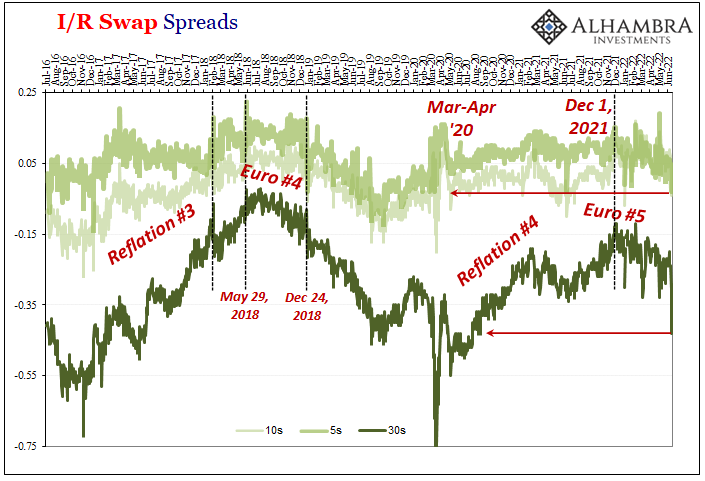

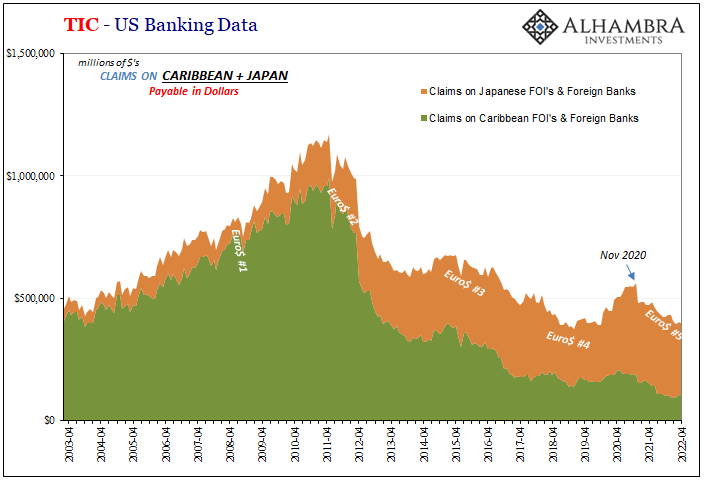

Because of this rather unique situation, eurodollars via Tokyo on their way to Shanghai, and the potential (though hidden therefore unable to be confirmed yet easily and reasonably suspected) for widespread, tortuous use of collateral-for-collateral swaps underpinning much of it, the last few years have seen a close(r) correlation between implied collateral availability (repo fails) and JPY’s own fate. We need only be reminded of this growing fragility by the Bank of Japan’s rather absurd “collateral pool” created during 2016’s Euro$ #3 debacle (which obviously didn’t help in the long run, as anyone with common sense might’ve long ago guessed). In terms of overall bank liabilities beside collateral, US banks appear to be lending less to their Japanese counterparts, directly by increasing the costs of funding when charging higher rates or indirectly by demanding more (or better) collateral. April recorded another large decline of US bank liabilities extended to Japan (below). This, however, not a new development rather one that has accelerated since, drum roll, last December when the eurodollar futures curve first inverted and swap spreads detoured toward the exact wrong direction (from inflation and rate hikes). |

|

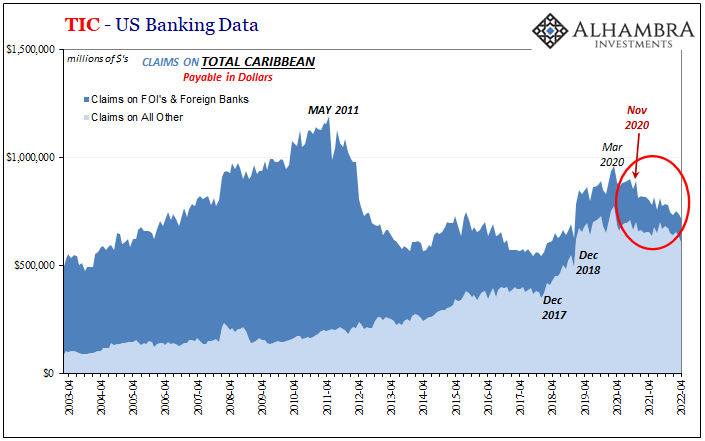

| What’s interesting is how much of a correlation there now seems to be between this type of eurodollar retrenchment between US banks and the Japanese and the same between US banks and those located in Emil Kalinowski’s current homeland in the Caribbean.

TIC-indicated dollar activity to both of those very different places dropped sharply during the month of April. American bank liabilities reported to the Caribbean are way down, -11% year-over-year, updated at just $716.9 billion being the lowest since December 2018 (and might actually be worse given data and discontinuity issues regarding CLOs). |

|

| Bank liabilities to Japan are the worst since February 2020. | |

| None of this is, or indicates, genuine inflation. Quite the contrary, all these same familiar symptoms are clear signs of deflationary money that has been working through the global system for quite a long time already to have now (in April) reached these accelerating, recession-inducing proportions storming across the world.

Since the eurodollar way of doing financial and commercial business means globally synchronized, we’re not just dealing with a global dollar shortage that’s a financial and economic burden and reduction for the global economy outside the US, up-to-date economic data like the current state of financial markets pretty clearly shows the domestic side already greatly affected by the gathering storm. It was never delta or omicron, as many tried to claim, and it isn’t the Fed’s rate hikes or Russia’s misadventures (though that really hasn’t helped and may have been the final straw). Currencies aren’t being purposefully devalued. Foreigners are being forced to sell USTs, not ditching them voluntarily because they worry over a dollar crash that never happens, and sure isn’t happening right now. This remains the eurodollar’s world, and we are all – everyone everywhere – trying to live in it. Since March and April, it’s become a whole lot more difficult. If you hadn’t already noticed. |

Tags: $CNY,$JPY,Bonds,China,currencies,economy,eurodollar system,Featured,Federal Reserve/Monetary Policy,global dollar shortage,Japan,Markets,newsletter,tic