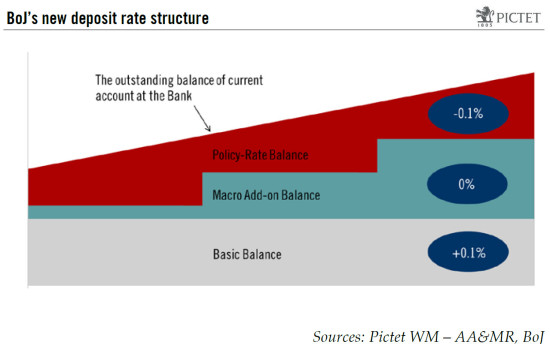

Under a three-tier system, the Bank of Japan (BoJ) introduces a negative interest rate (-0.1%). Haruhiko Kuroda did it again. After having continuously denied the idea of using a negative interest rate, the governor of the Bank of Japan (BoJ) has now decided to introduce one. More specifically, the BoJ will adopt a three-tier system in which the outstanding balance of each financial institution’s current account at the Bank will be divided into three tiers, to each of which a positive interest rate, a zero interest rate or a negative interest rate will be applied, respectively (statement). This new programme is called “Quantitative and Qualitative Monetary Easing (QQE) with a Negative Interest Rate” and was passed with a 5-4 majority vote. The size of the BoJ’s monthly asset purchases has been left unchanged (annual pace of JPY80 trillion), but the timeline to reach the inflation target of 2% has been (once again) delayed by six months (now around the first half of fiscal 2017). Negative rate likely applied to a very small share of deposits, initially Under the three-tier system, a positive interest rate of 0.1% will be applied to the basic balance, a zero interest rate will be applied to the macro add-on balance and a negative interest rate of -0.1% will be applied to the policy-rate balance.

Topics:

Luc Luyet and Jacques Henry considers the following as important: Japan, JPY, Macroview, Monetary Policy, Topix, Yen

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Marc Chandler writes Geopolitics Roil Capital Markets

Marc Chandler writes Fragile and Consolidative Tone Starts the Week in FX

Marc Chandler writes FX and Rates Unwind Yesterday’s Powell Effect, US Index Futures Slide

Under a three-tier system, the Bank of Japan (BoJ) introduces a negative interest rate (-0.1%).

Haruhiko Kuroda did it again. After having continuously denied the idea of using a negative interest rate, the governor of the Bank of Japan (BoJ) has now decided to introduce one. More specifically, the BoJ will adopt a three-tier system in which the outstanding balance of each financial institution’s current account at the Bank will be divided into three tiers, to each of which a positive interest rate, a zero interest rate or a negative interest rate will be applied, respectively (statement). This new programme is called “Quantitative and Qualitative Monetary Easing (QQE) with a Negative Interest Rate” and was passed with a 5-4 majority vote. The size of the BoJ’s monthly asset purchases has been left unchanged (annual pace of JPY80 trillion), but the timeline to reach the inflation target of 2% has been (once again) delayed by six months (now around the first half of fiscal 2017).

Negative rate likely applied to a very small share of deposits, initially

Under the three-tier system, a positive interest rate of 0.1% will be applied to the basic balance, a zero interest rate will be applied to the macro add-on balance and a negative interest rate of -0.1% will be applied to the policy-rate balance.

- The basic balance corresponds to the balance accumulated thus far under QQE by each financial institution.

- The macro add-on balance is the sum of the amount of each financial institution’s required reserves, the amount of the BoJ’s various lending support programmes received and a ratio of its outstanding basic balance, taking into account the fact that the outstanding balance will increase as QQE progresses.

- The policy-rate balance is the outstanding balance of each financial institution’s current account at the Bank in excess of the basic balance and the macro add-on balance.

Basically, existing deposits at the BoJ will still be rewarded with 0.1%, in order to preserve the earnings of financial institutions. The negative interest rate will only be applied to the unreasonably increased amount of excess reserves under the progress of QQE. As a result, the share of current accounts concerned by this negative rate is likely to be very small.

It is more about the signal and the yen

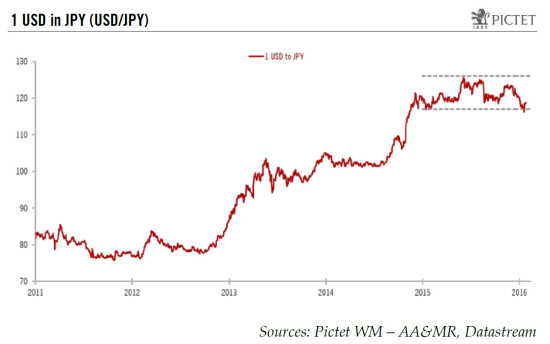

Rather, the decision to introduce a negative interest rate is targeted at weakening the Japanese yen. With this new framework, the new liquidity added through QQE has now a higher chance of leaving Japan in search of higher returns. Furthermore, there were increasing doubts about the willingness and capability of the BoJ to further increase its accommodating monetary policy. By shifting focus from the size of QQE to the rates, the BoJ opens new options to curb any unwanted JPY strengthening, as it stands ready to lower interest rates further into negative territory, if necessary.

Finally, although the deadline to reach the inflation target has been postponed, the monetary decision confirms the BoJ’s strong commitment to lift inflation towards 2%. Overall, this confirms our FX scenario that, on the one hand, too strong a yen is not welcome given its disinflationary effect, while on the other, too weak a yen is unlikely given its political costs (hurting SMEs and alienating countries in the Trans-Pacific Partnership) and its already large undervaluation. On this basis, we continue to think the USD/JPY rate will move during 2016 within the 117-126 range seen in 2015.

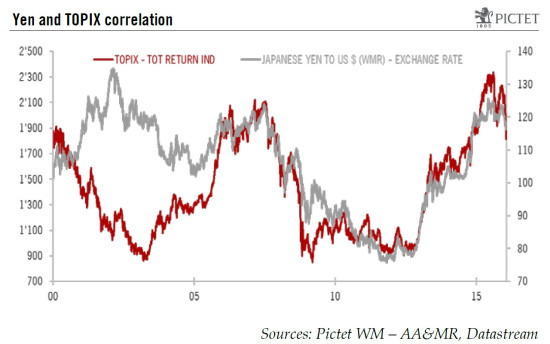

Yen and TOPIX are strongly correlated

Amongst the main global equity markets, the TOPIX recorded the worst start to the year, with a 16% decrease between 1 January and 21 January 2016. The drawdown is even higher, at 19%, between 24 November and 21 January. The yen’s strength since H2 2015 has been a drag on the Japanese equity markets as the correlation between the exchange rate and equity returns, which had decreased in H2 2014 and H1 2015, became stronger again.

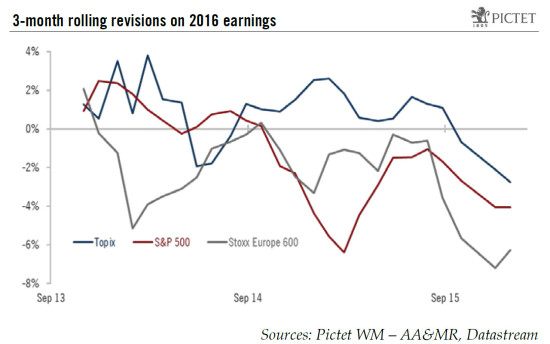

Poor corporate earnings and depressed valuation

Over the past few years, Japanese companies enjoyed the best earnings trend globally. Yet yen appreciation has started hammering Japanese earnings and 3-month rolling earnings revisions have turned negative since September 2015. The sector that suffered the most was cyclicals: 2015 earnings growth (fiscal year ending March 2016), which stood at 16% in November 2015, was cut in half since then. This is a dramatic change, as cyclicals account for 43% of the index capitalisation. Japanese derating was thus the most severe and, at 12x forward earnings, valuation is back to levels prevailing before Abenomics. A weakening of the yen is therefore a good piece of news to trigger a bounce-back on Japanese equities.

Funding currencies likely to suffer in the short-term

A week after the dovish signal from the ECB, the introduction of a negative rate by the BoJ confirms that, among factors exogenous to markets, the policy response from central banks should offer some support to risk appetite. Arguably, though, the Fed’s response is what matters the most. At the margin, the BoJ’s action and the probable ECB action in March should favour a more patient Fed. The weakening pressures on the yen and the euro should lead to appreciating pressure on the US dollar trade-weighted index, causing a tightening of financial conditions. Meanwhile, in China, the People’s Bank of China has strengthened its grip on the yuan, reducing the fears of an imminent sharp devaluation of the yuan. This should help a short-term rebound in EM FX, while funding currencies (mostly EUR, CHF and JPY) weaken.