Private consumption drives 2015 French and Spanish GDP growth and the trend is likely to continue in 2016. Spain and France are the first countries among the euro area’s largest economies to publish GDP figures. According to preliminary estimates, Spanish and French real GDP expanded by 0.8% and 0.2% q-o-q respectively in Q4, both in line with consensus expectations. Over the year, GDP rose by 3.2% and 1.1% respectively in Spain and in France. The relatively good performance of both countries, which account for 32% of total euro area GDP, bodes well for the euro area as a whole (Q4 GDP figure to be published on 12 February). As a result, our forecasts for euro area GDP growth are left unchanged at 1.5% for 2015 and 1.8% for 2016, with some downside risks given global uncertainty related to EM growth and market volatility so far this year. French investment surprised on the upside In France, real GDP grew by 0.2% q-o-q (0.8% q-o-q annualised; 1.2% y-o-y) in Q4, after an unrevised 0.3% q-o-q Q3 print. For 2015 as a whole, the French economy expanded by 1.1%, marking an acceleration from the 0.2% posted in 2014. The breakdown by expenditure components showed that investment (0.8% q-o-q), rebounded strongly in Q4, marking its fastest growth rate since Q4 2011. The acceleration in investments was led by non-financial corporations (+1.3% q-o-q after +0.

Topics:

Nadia Gharbi considers the following as important: euro area, France, GDP, Macroview, Spain

This could be interesting, too:

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Trump’s Tariff Talks Wobble Forex Market, Close Neighbors Suffer Most

Marc Chandler writes The Market Discounts around a 40% Chance of not One but Two 50 bp Cuts in last Three FOMC Meetings of the Year Ahead of Jobs Report

Lance Roberts writes Technological Advances Make Things Better – Or Does It?

Private consumption drives 2015 French and Spanish GDP growth and the trend is likely to continue in 2016.

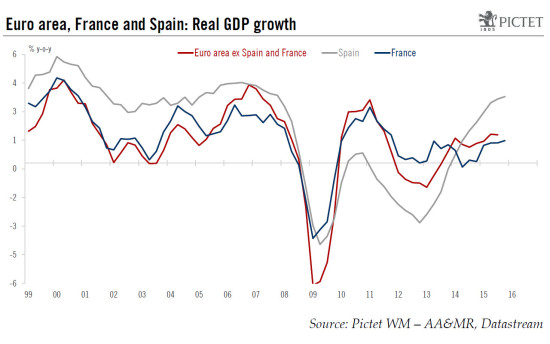

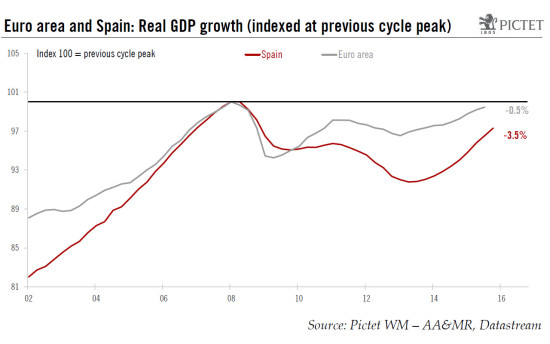

Spain and France are the first countries among the euro area’s largest economies to publish GDP figures. According to preliminary estimates, Spanish and French real GDP expanded by 0.8% and 0.2% q-o-q respectively in Q4, both in line with consensus expectations. Over the year, GDP rose by 3.2% and 1.1% respectively in Spain and in France. The relatively good performance of both countries, which account for 32% of total euro area GDP, bodes well for the euro area as a whole (Q4 GDP figure to be published on 12 February). As a result, our forecasts for euro area GDP growth are left unchanged at 1.5% for 2015 and 1.8% for 2016, with some downside risks given global uncertainty related to EM growth and market volatility so far this year.

French investment surprised on the upside

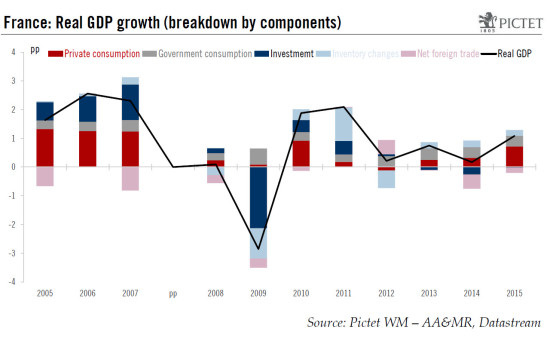

In France, real GDP grew by 0.2% q-o-q (0.8% q-o-q annualised; 1.2% y-o-y) in Q4, after an unrevised 0.3% q-o-q Q3 print. For 2015 as a whole, the French economy expanded by 1.1%, marking an acceleration from the 0.2% posted in 2014.

The breakdown by expenditure components showed that investment (0.8% q-o-q), rebounded strongly in Q4, marking its fastest growth rate since Q4 2011. The acceleration in investments was led by non-financial corporations (+1.3% q-o-q after +0.5%), followed by households (+0.1% q-o-q after -0.5%) and general government investments (0.4% q-o-q after ‑0.4%).

Conversely, while public consumption (+0.4% q-o-q) kept up its pace of increase, private consumption (-0.4% q-o-q after +0.4%) slipped back in Q4. Nevertheless, part of the decline in household spending was attributable to temporary factors (mild weather and the impact of the Paris attacks) as consumption in energy and services both declined. As a result, final domestic demand excluding inventory changes rose very slightly and contributed positively to activity.

Turning to foreign trade, exports (+0.6% q-o-q after -0.6%) bounced back, while imports (+1.6% q-o-q after +1.5%) kept up a decent pace of growth. As a result, foreign trade again contributed negatively to GDP.

Overall, over the year (see chart below), private consumption (+0.7pp after +0.3) was the main driver of GDP growth in 2015, followed by public consumption (+0.4pp after +0.4). Conversely, investment (+0.0pp after ‑0.3) was no longer a drag on growth. Finally, net trade contributed negatively to growth (-0.2pp after -0.5).

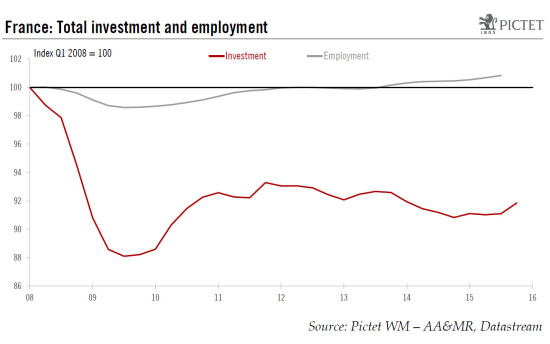

France’s main challenges: investment and employment

Employment and investment remain the two main challenges for the French economy. While real investment growth contributed around 0.8pp per year to French real GDP growth on average over the period 1999-2007, this contribution (-0.2pp on average over the period 2008-2014) has been negative since the financial crisis in 2008. Investment is 8% below its pre-crisis level, and the divergence between Germany and France, which tended to show similar trends in investment dynamic, has widened.

Nevertheless, GDP growth is likely to be increasingly supported by investment, which should benefit from improving financial and monetary conditions, provided that risks do not materialise, in particular lower business confidence as a result of external uncertainties.

As for employment, the labour market is slowly normalising. However, more reforms are needed as the French labour market still suffers from long-standing issues, in particular the rigidity and complexity of its labour code, high minimum wages and lasting unemployment benefits.

Overall, the recovery is likely to continue in France in 2016, led primarily by private consumption. Household consumption should continue to be supported by rising real disposable income on the back of low oil prices, tax cuts and a gradual labour market normalisation.

Spain ending the year with strong growth

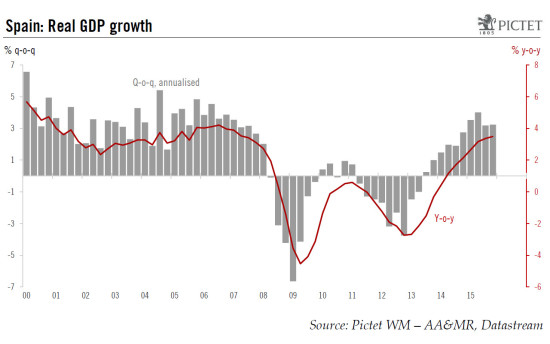

The Spanish economy ended the year on a solid footing, rising by 0.8% q-o-q in Q4, a similar pace to Q3 GDP (0.8% q-o-q in Q3). For 2015 as a whole, the Spanish economy expanded by 3.4%, marking a strong acceleration from the 1.4% posted in 2014, and its fastest annual growth rate since 2007.

With the GDP growth posted in 2015, the Spanish economy is still 3.5% below its pre-crisis level. After a double-dip recession between 2008 and 2013, where GDP lost almost 9% of its level (see the chart below), the Spanish economy continues its recovery with an average growth of 0.6% q-o-q per quarter since Q3 2013.

Details of the expenditure breakdown for Q4 are not yet available (to be published on 25 February). Nevertheless, based on monthly macroeconomic indicators and Bank of Spain forecasts, GDP growth in Q4 seems to have been driven by domestic demand, mainly supported by buoyant private consumption and rebounding investment spending. Conversely, net foreign trade did not contribute to growth as exports failed to compensate for the increase in imports.

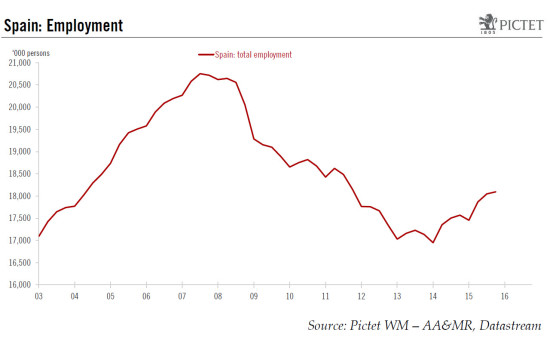

Private consumption has been supported by lower oil prices and improving labour market conditions. In this regard, according to INE’s latest main labour force survey (EPA), Spain’s unemployment rate (seasonally adjusted) dropped to 20.9% in Q4 from 21.2% in Q3, its lowest level in almost five years. This was supported by a further rise in employment. Indeed, the Spanish economy created 525,000 jobs in 2015, mainly in the services sector. Although, the increase compensated less than a fifth of the jobs lost between the period 2007-2013 and remained too heavily influenced by temporary contracts, we need to go back to 2006 to see a larger annual increase.

Reversal in reforms increasingly likely

Nonetheless, the risk of seeing a reversal in labour market reforms has increased recently. Indeed, more than one month after an inconclusive general election, which saw the ruling party (PP) lose its majority in parliament, the probability of a left-wing PSOE-Podemos government has substantially increased. Last week, Mariano Rajoy, the PP leader, returned the king’s invitation to form a government after admitting that he lacks support. However, he did not opt out of the responsibility of forming a government, but merely deferred the decision.

In the meantime, PSOE-Podemos came together. Nevertheless, a left-wing alliance (combined seats: 159, falling short of minimum majority 176) such as this would still need the support of other smaller national and local left parties or for some parties (PP and Ciudadanos) to abstain in the confidence vote. Moreover, they would still need to manage strong differences, in particular over the Catalan issue. On this point, both Podemos and PSOE have diverging views: Podemos supports a referendum whereas PSOE is in favour of a change in constitution to grant more autonomy to Catalonia. On this point, recent comments suggested that an alternative could be a referendum on reforms, rather than independence. On top of that, several PSOE leaders have mentioned their reluctance to form a government with Podemos. As a result, new elections in March-April cannot be ruled out either.

Overall, despite political uncertainty, which might weigh on private investment, the Spanish economy is likely to continue to materially outperform the euro area average, with estimated growth of 2.8% for 2016 (euro area estimated at 1.8%) driven mainly by private consumption.