The economy ended last year with soft momentum, and the sharp tightening in US financial and monetary conditions will undoubtedly weigh on US economic growth over the coming months. However, we remain upbeat about consumption and the housing sector. US real GDP, curbed by lower stockbuilding and a slowdown in consumption growth, grew by a soft 0.7% in Q4. We have cut our forecast for 2016. However, we still expect reasonably healthy growth (2.0%). In Q4 2015, US real GDP grew by a weak 0.7% q-o-q annualised, just a fraction below consensus estimates (+0.8%). As a result, year-on-year growth dropped from 2.1% in Q3 to 1.8% in Q4 (2.5% in Q4 2014), noticeably slower than the average pace recorded since the US economy bottomed out in Q2 2009 (2.1%). However, due to a favourable base effect, on a yearly average basis, GDP growth worked out at 2.4% last year, in line with our most recent estimates, and at exactly the same rate as in 2014. The weakness of growth in Q4 should not be taken too negatively, as it was partly linked to transitory factors. The pace of stockbuilding dropped further and a warmer-than-normal period damped consumption of utilities. In any case, quarterly GDP growth rate can be very volatile in the short-term (see chart above). Growth in final domestic demand slowed as well in Q4 Although consumption growth decelerated from 3.

Topics:

Bernard Lambert considers the following as important: GDP, growth, Macroview, United States, US GDP

This could be interesting, too:

Dirk Niepelt writes “Governments are bigger than ever. They are also more useless”

Lance Roberts writes Technological Advances Make Things Better – Or Does It?

Dirk Niepelt writes Urban Roadway in America: Land Value

Lance Roberts writes Risks Facing Bullish Investors As September Begins

The economy ended last year with soft momentum, and the sharp tightening in US financial and monetary conditions will undoubtedly weigh on US economic growth over the coming months. However, we remain upbeat about consumption and the housing sector.

US real GDP, curbed by lower stockbuilding and a slowdown in consumption growth, grew by a soft 0.7% in Q4. We have cut our forecast for 2016. However, we still expect reasonably healthy growth (2.0%).

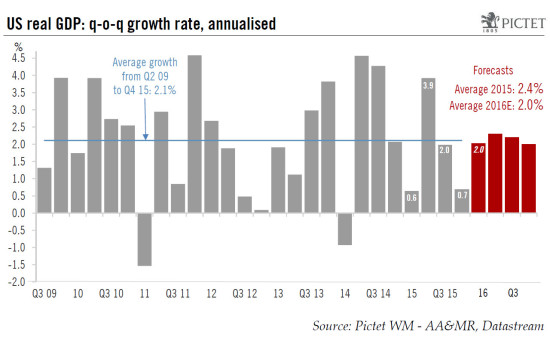

In Q4 2015, US real GDP grew by a weak 0.7% q-o-q annualised, just a fraction below consensus estimates (+0.8%). As a result, year-on-year growth dropped from 2.1% in Q3 to 1.8% in Q4 (2.5% in Q4 2014), noticeably slower than the average pace recorded since the US economy bottomed out in Q2 2009 (2.1%). However, due to a favourable base effect, on a yearly average basis, GDP growth worked out at 2.4% last year, in line with our most recent estimates, and at exactly the same rate as in 2014.

The weakness of growth in Q4 should not be taken too negatively, as it was partly linked to transitory factors. The pace of stockbuilding dropped further and a warmer-than-normal period damped consumption of utilities. In any case, quarterly GDP growth rate can be very volatile in the short-term (see chart above).

Growth in final domestic demand slowed as well in Q4

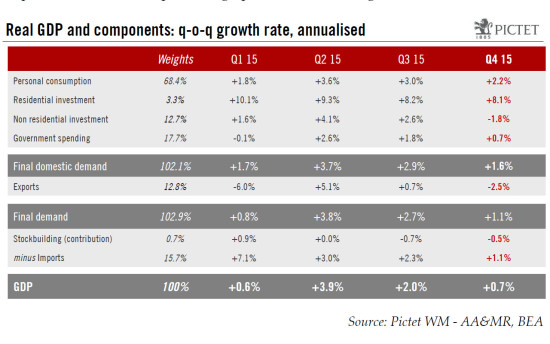

Although consumption growth decelerated from 3.0% q-o-q annualised in Q3 to 2.2% in Q4, this result was noticeably above the most recent consensus estimates (1.8%). Nevertheless, in a context of falling gasoline prices, this slowdown was surprising. Exceptionally warm and wet weather for the season probably contributed to this deceleration, by temporarily damping spending on utilities. Meanwhile, residential investment posted another quarter of relatively solid growth of 8.1% (see table below), whilst non-residential investment contracted by 1.8%. Investment in intellectual property increased modestly (+1.6%), but this was more than compensated by a 2.5% decline in investment in equipment (which followed a strong 9.9% increase in Q3) and another marked contraction in investment in structures (-5.3%). Another sharp decline in the number of rigs in operation last quarter had been pointing to a parallel movement for investment in structures in the oil sector, and that’s exactly what happened: -38.5% q-o-q annualised in Q4, after -47.1% in Q3. Investment in structures in the oil sector accounted for 0.8% of GDP in Q4 2014 (6.4% of non-residential investment). However, following its collapse, it now accounts for ‘only’ 0.35% of GDP (2.8% of non-residential investment). Therefore, the negative contribution of this very specific GDP component to annualised q‑o-q GDP growth in Q3 worked out at -0.2 percentage points in Q4, after -0.3 in Q3 and ‑0.7 in Q2. The drag on growth from this component is easing, and this should continue in 2016.

Meanwhile, government consumption grew by a modest 0.7% q-o-q annualised in Q4, following on from +1.8% in Q3 (see table above). The end result was that growth in final domestic demand slowed from 2.9% in Q3 to 1.6% in Q4.

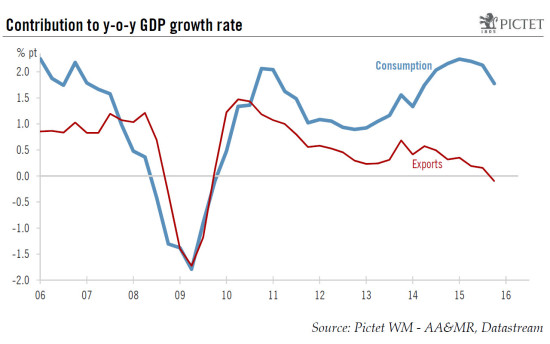

Unsurprisingly, in a context of soft world demand and a rapidly appreciating dollar, total exports fell by a heavy -2.5% q-o-q annualised in Q4, and by 0.8% y-o-y. Meanwhile, imports increased by 1.1% q‑o-q annualised in Q4, so net exports subtracted 0.5 percentage points to Q4 GDP growth.

Finally, the pace of stockbuilding fell further from 0.5% of GDP in Q3 2015 to 0.4% in Q4, a ratio now back to the long-term average of 0.4%. As a corollary, stockbuilding made for another quarter a decidedly negative contribution to GDP growth in Q3 (-0.5 percentage points; see table above).

We continue to expect reasonably healthy growth in 2016

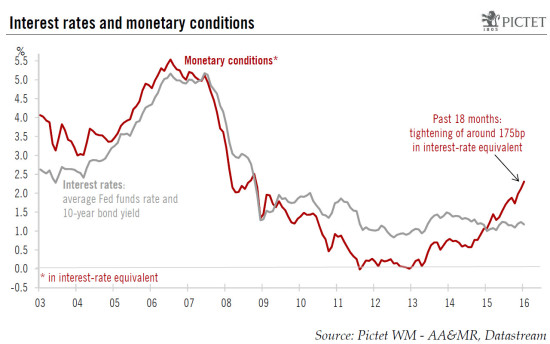

What to expect for this year? There are certainly legitimate reasons to be worried. First, as we have just seen, GDP growth in Q4 was surprisingly soft. And to the notable exception of job creation, most monthly economic data available for December 2015 and January 2016 have not been particularly encouraging overall, to say the least. The US economy started 2016 with a weak momentum. Secondly, turmoil in the financial markets worldwide and a sharp tightening in US financial and monetary conditions will undoubtedly weigh on US economic growth over the coming months. So far this year, US stock market indices have fallen by some 8% and – despite its very recent downward correction – the real trade-weighted dollar has gained some 1.5%. The manufacturing sector will certainly remain quite weak and net exports will continue to constitute a marked drag.

However, there are also positive factors to consider:

(1) Although the recent sharp fall in oil prices has contributed to the turbulence on the financial markets, it also implies an additional boost to household real income. We estimate that recent movements in gasoline prices will add some 1.4 points to real disposable income growth in Q1 2016 (q-o-q annualised). Besides that, employment growth is remaining solid, wage increases are likely to pick up progressively and, as it rose sharply towards the end of last year, the saving rate may well fall back over the coming months. In short, we continue to expect a pick-up in consumption growth over the coming quarters.

(2) Lower oil prices will continue to weigh on investment in the oil sector. However, as we have seen above, the importance of this component in GDP is much smaller than a year ago. Moreover, the pace of contraction is likely to slow further. Therefore, the negative impact will become smaller over the coming quarters. Meanwhile, growth in residential investment should remain robust. Demand for housing is bolstered by the improvement in employment and incomes, whilst the stock of homes available for sale remains pitched at very low levels. Regarding stockbuilding, although the level of inventories remains relatively high, the pace of stockbuilding has fallen noticeably in H2 2015. Any negative contribution from stockbuilding is likely to be much more limited this year.

(3) Although rather irregularly – with some temporary softening in Q4 (see above) – public spending is at last recovering, and the upturn should continue. At the end of last year, Congress reached an agreement on important budget issues, which imply overall fiscal policy will at last turn modestly supportive in 2016.

In that context, it seems unwise to us to turn too pessimistic on the US economy. Of course, downward risks have clearly increased recently and if stock market indices continue to fall heavily and a full-blown worldwide financial crisis develops, the US economy will not be immune. However, this is not our main scenario. We believe a serious downturn in the US economy remains unlikely for this year and we continue to expect US growth to remain relatively healthy.

Nevertheless, when looking at specific forecast numbers, we have to take into account the softness of Q4 GDP number, and the unexpected additional substantial tightening in monetary and financial conditions recorded over the past few weeks. We are therefore cutting our forecasts for GDP growth from 2.5% to 2.0% for q-o-q annualised growth in Q1 2016, from 2.3% to 2.1% for y-o-y growth in Q4 2016, and from 2.2% to 2.0% for the 2016 yearly average growth rate. This latter figure is now significantly lower than the Bloomberg consensus estimate (2.4%). However, even after these downward revisions, we continue to expect growth in 2016 to remain reasonably healthy, as it should settle slightly above potential growth (currently at around 1¾%). Our early forecast for 2017 is also put at 2.0%, also below consensus forecasts (2.3%).