Swiss Franc The Euro has fallen by 0.13% to 1.0893 EUR/CHF and USD/CHF, August 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Chinese officials took the US tariff hike quietly last week but struck back today. The PBOC fixed the dollar higher (CNY6.90), which it has not done, and will halt imports of US agriculture. The dollar shot through CNY7.0 to finish the...

Read More »FX Weekly Preview: The Dog Days of August are Upon Us

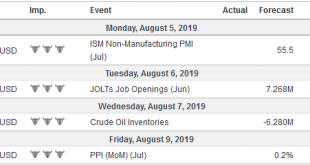

The die is cast. To defend the uneven expansion and ward off disinflationary forces, monetary authorities will provide more accommodation. The Federal Reserve delivered its first rate cut in more than a decade and stopped unwinding its balance sheet two months earlier than it previously indicated (worth $100 bln of additional buying of Treasuries and Agencies). Following the end of the tariff truce, and after the July...

Read More »Swiss Retail Sales, June 2019: 0.7 percent Nominal and 0.7 percent Real

05.08.2019 – Turnover in the retail sector rose by 0.7% in nominal terms in June 2019 compared with the previous year. Seasonally adjusted, nominal turnover rose by 1.4% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays rose by 0.7% in June 2019 compared with the previous year. Real...

Read More »August Monthly

After falling against all the major currencies in June, the US dollar rebounded in July. The Dollar Index finished the month at new two-year highs with the Fed’s suggestion it was engaged in a mid-course correction rather than a sustained easing cycle. The dollar also appeared buoyed by the extent of the dovishness by the ECB and the heightened risks that the UK leaves the EU at the end of October without an agreement....

Read More »Switzerland has highest underemployment in Europe

© Mr.phonlawat Chaicheevinlikit | Dreamstime.com In 2018, 830,000 people in Switzerland were unable to find the work they wanted, according the Federal Statistical Office. While 243,000 were looking but not immediately available and 231,000 were unemployed, most (356,000) were underemployed – working but unable to find as many hours of work as they’d like. The additional hours sought by underemployed workers was...

Read More »Brexit Update

The October 31 deadline for the UK to leave the EU is less than 100 days away. The new Prime Minister is beginning to convince others that that UK will, in fact, leave at the end of October. PredictIt.Org shows the odds of the UK leaving has risen to almost 50% from about a 33% chance a month ago. Here is a summary of where the situation stands and some key dates going forward. Boris Johnson handily won the Tory...

Read More »Swiss apprenticeships – too many places, not enough takers

© Industryviews | Dreamstime.com Figures on unfilled apprenticeship places show the difficulty of matching supply and demand in the labour market. This year there were 12,000 unfilled apprenticeship positions in Switzerland. Switzerland’s apprenticeship model, which helps match workers’ skills with employer demand, is one driver of Switzerland’s low unemployment (4.9%) – 2018 ILO basis. However, it seems to suffering...

Read More »After Fed Disappoints, Will Trump Initiate Currency Intervention?

Following months of cajoling by the White House, the Federal Reserve finally cut its benchmark interest rate. However, the reaction in equity and currency markets was not the one President Donald Trump wanted – or many traders anticipated. The Trump administration wants the Fed to help drive the fiat U.S. dollar lower versus foreign currencies, especially those of major exporting countries. Instead, the U.S. Dollar...

Read More »FX Daily, August 2: End of Tariff Truce Trumps Jobs

Swiss Franc The Euro has fallen by 0.40% to 1.0929 EUR/CHF and USD/CHF, August 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The market was finding its sea legs after being hit with wave and counter-wave following the FOMC decision, and more importantly, Powell’s attempt to give insight into the Fed’s thinking. Trump’s tweet than signaled an end to the tariff...

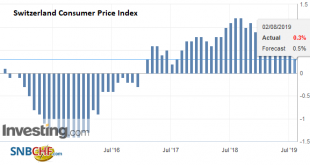

Read More »Swiss Consumer Price Index in July 2019: -0.3 percent YoY, -0.5 percent MoM

02.08.2019 – The consumer price index (CPI) fell by 0.5% in July 2019 compared with the previous month, reaching 102.1 points (December 2015 = 100). Inflation was 0.3% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The decrease of 0.5% compared with the previous month can be explained by several factors including falling prices for clothing and footwear...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org