Swiss Franc The Euro has fallen by 0.40% to 1.0929 EUR/CHF and USD/CHF, August 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The market was finding its sea legs after being hit with wave and counter-wave following the FOMC decision, and more importantly, Powell’s attempt to give insight into the Fed’s thinking. Trump’s tweet than signaled an end to the tariff truce with a 10% levy on the 0 bln of imports from China that have not been subject to action previously. Investors understood this to mean a greater slowdown and pushed yields and equities sharply lower. The Asia Pacific and European markets have responded in kind. Japanese and Hong Kong markets

Topics:

Marc Chandler considers the following as important: $CNY, $TRY, 4.) Marc to Market, 4) FX Trends, Brexit, Eurozone Producer Price Index, Eurozone Retail Sales, Featured, newsletter, trade, U.S. Nonfarm Payrolls, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

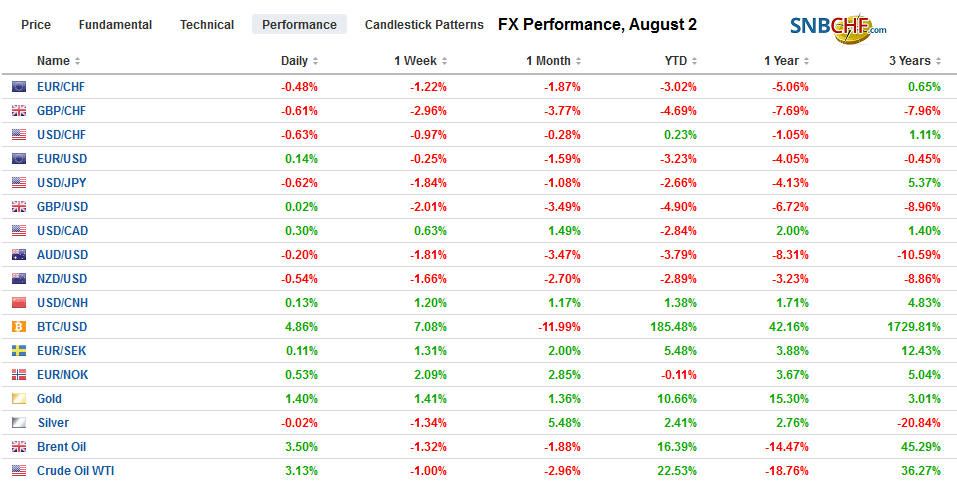

Swiss FrancThe Euro has fallen by 0.40% to 1.0929 |

EUR/CHF and USD/CHF, August 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

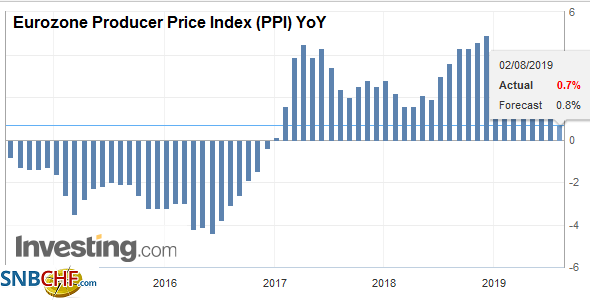

FX RatesOverview: The market was finding its sea legs after being hit with wave and counter-wave following the FOMC decision, and more importantly, Powell’s attempt to give insight into the Fed’s thinking. Trump’s tweet than signaled an end to the tariff truce with a 10% levy on the $300 bln of imports from China that have not been subject to action previously. Investors understood this to mean a greater slowdown and pushed yields and equities sharply lower. The Asia Pacific and European markets have responded in kind. Japanese and Hong Kong markets were off around 2% to lead the region lower. The Dow Jones Stoxx 600 in Europe fell by about 2% in the morning turnover. US 10-year yields fell to three-year lows yesterday and off another further five basis points to 1.84%. Core European bond yields are off three-four basis points, which puts the 10-year German Bund yield at nearly minus 50 bp. Other core bond yields are also setting new record lows. The US dollar is mixed, with the dollar-bloc and Scandis weaker, while the yen and Swiss franc lead the gainers. Gold is seeing yesterday’s surge retrace a bit, while WTI for September delivery is firmer after a nearly 8% drop yesterday. Copper is off 2% and is seen as another expression of concerns about global growth. |

FX Performance, August 2 |

Asia Pacific

Chinese officials threatened some unspecified retaliation for ending the tariff truce. Apparently, Trump rejected advice to notify China before tweeting the tariff increase, while his economic and trade advisers were still within in the Oval Office, according to reports. The Chinese yuan sold off in both its on and offshore variants in response to the end of the tariff truce. The PBOC did not have to sell the yuan, the market did it for them. Economists estimate that the new tariffs will shave something on the magnitude of 0.4%-0.5% off China’s GDP. The PBOC seemed to try to moderate the decline, but the dollar still rose and brought the important 7.0 level back into view. The interest rate differentials put the nine- and 12-month forward rares above CNH7.0. The dollar’s 12-month forward rate is also above CNY7.0.

Japan made good on its threat to remove South Korea from its privileged export list as of August 24. This will exacerbate the challenge to a broad swath of South Korean industry, which will need licenses for their exports to Japan. South Korea has a similar list and is threatening to remove Japan toward the end of the month. The US plea to a “standstill” arrangement appears to have fallen on deaf ears. The timing is particularly poor as both economies appear challenged by the slowdown in China, disruption of US-Chinese trade, and North Korea’s third missile test this week.

Consistent with a string of better than expected economic news this week, Australian reported a 0.4% rise in June retail sales after a 0.1% gain in May. Earlier this week, Australia reported firmer than expected Q2 CPI (0.6% quarter-over-quarter and 1.6% year-over-year) and July manufacturing PMI. The Reserve Bank of Australia meets next week and after cutting rates in June and July is expected to pause before cutting rates again later this year. The Reserve Bank of New Zealand meets next week as well, and it is expected to deliver another 25 bp rate cut.

The dollar first broke above important resistance at JPY109 yesterday before reversing low and dropping to about JPY107.25. This bearish large outside down day saw follow-through buying that pushed the greenback to nearly JPY106.80 in the Europea morning. This essentially matches the low from June, which was the lowest the dollar has been since the flash crash in January that saw it briefly dip below JPY105. As is often the case, old support now becomes resistance, and the JPY107-JPY107.25 may be challenging to surmount with nearly $1.6 bln in options struck in the range that expire today. The Australian dollar’s losing streak is threatening to extend into the 11th consecutive session today, and during this streak, it has consistently taken out the previous day’s low. It saw nearly $0.6785 today and had begun the streak nearly three cents highs. It is at its lowest level since the flash crash that Bloomberg reports was near $0.6740. The dollar rose to CNY6.95 and almost CNH6.98. Note that President Trump’s reference to the unrest in Hong Kong as being a riot, which is Beijing’s language, may be seen as a signal of US recognition that it is an internal issue for which some Chinese officials have accused the US of fomenting.

EuropeThe Tories working majority in the House of Commons was halved to a single seat as the Lib Dems won the byelection in Wales. The Tory candidate was the incumbent but had been recalled for being convicted of falsifying expense claims. It the was the first test of the new Prime Minister, but given the flawed candidacy, it might not have been an accurate indication. The Conservative vote was split with the Farage’s Brexit Party, and if this had not been the case, the Tories would have held on to the seat. The dismal showing for Labour, which came in fourth, maybe one of the saving graces for both the Tories and may help explain the broader resurgence of the Lib-Dems. |

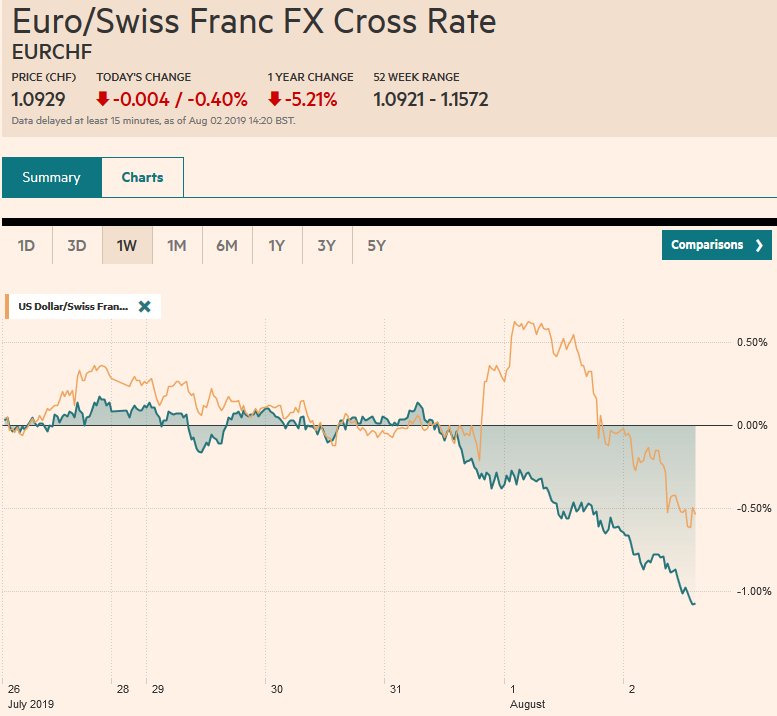

Eurozone Retail Sales YoY, June 2019(see more posts on Eurozone Retail Sales, ) Source: investing.com - Click to enlarge |

| There is some rare good news to report on US-Europe trade. Later today, the US is likely to announce a “beef deal” that will boost its exports to the EU. This is an example of managed trade. In broad details, the US share of Europe’s quota on imports of hormone-free beef was made possible by concessions from Australia, Argentina, and Uruguay to take smaller shares earlier this year. Reports suggest that over time, US farmers can secure 80% (or 35k metric tons) of Europe’s quota, but may begin with half as much. The fact that the US wants to “celebrate” this agreement is sending a different signal from the confrontational approach seen recently in reaction to France’s proposed digital tax. |

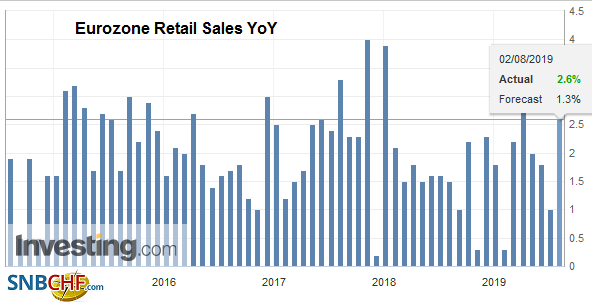

Eurozone Producer Price Index (PPI) YoY, June 2019(see more posts on Eurozone Producer Price Index, ) Source: investing.com - Click to enlarge |

S&P reviews Turkey’s credit rating today. It currently assigns Turkey a B+ rating and has a stable outlook. It is the same as Moody’s, but Moody’s has a negative outlook. Fitch has it one notch above at BB-, but it also has a negative outlook. Investors may not like the politicization of Turkey’s monetary policy and the loss of central bank independence, but the lira has performed well since the large repo cut on July 25. The dollar closed near TRY5.70 on the eve of the decision and fell to near TRY5.5150 in the middle of this week. It is straddling TRY5.60 today. More rate cuts are coming as inflation is easing. The improving economic outlook may be worth maintaining the B+ rating, but the outlook could be reduced to negative.

The euro has managed to resurface above $1.1100, but it is still struggling to establish a foothold above it. The reaction to the US employment data is key. There are some chunky option expirations today. These include an option for 1.2 bn euro euros at $1.1075, 1.6 bln euros at $1.1100, and about 510 mln euros at $1.1120. The euro’s downside momentum eased since breaking to $1.1020 and a higher close today would be the fourth this week. It finished last week just above $1.1125 and a close above it today would begin healing the technical damage that has recently been inflicted. Sterling continues to struggle to sustain even the most mild of upticks. It has been unable to distance itself from yesterday’s low near $1.2080. Resistance is seen in the $1.2150-$1.2180 area. The euro is extending its streak to the 13th consecutive weekly advance against sterling.

America

Powell ultimately signaled at the press conference yesterday that the Federal Reserve was obligated to underwrite the administration’s trade policy. The global risks and the impact that Powell cited already evident on US manufacturing and business investment stems largely from the US trade policy. The uncertainty (impact) and certainty (the current impact) could be addressed because it so so happened that price pressures were below target. President Trump apparently was informed that little substantive progress was made in the first round of trade talks since the new truce was announced at the G20 meeting in Japan. He seized upon the Powell Put (not for equities but for interest rates) to slap a 10% tariff on $300 bln of Chinese exports to the US. The new levy will likely include a broad range of consumer goods that have thus far had escaped action. The market understood the implications and set the implied yield of the January 2020 fed funds futures contract down 16 bp to 1.64%, effectively pricing in two rate cuts in last three FOMC meeting this year. It is now closer to 1.605%. In terms of politics, taking a harder line on China appears to enjoy bipartisan support.

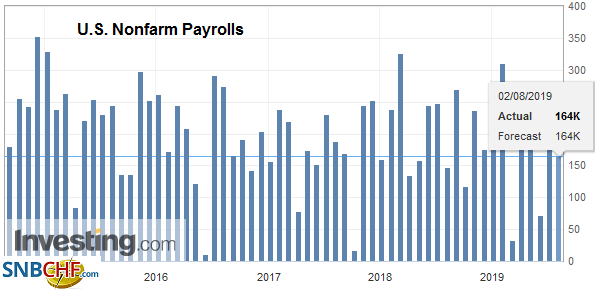

| The Fed meeting and the end of the tariff truce will steal some of the thunder of today’s jobs report. Powell expressed little concern about the US domestic economy outside of prices. The labor market remains robust even though job growth has slowed. In Q1, non-farm payrolls grew 174k a month, and in Q2, they averaged 171k. In 2018, jobs grew at an averaged pace of 223k. Nevertheless, employment growth, even at the median forecast of around 165k in July, is sufficient to absorb the new additions to the labor market. |

U.S. Nonfarm Payrolls, July 2019(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge |

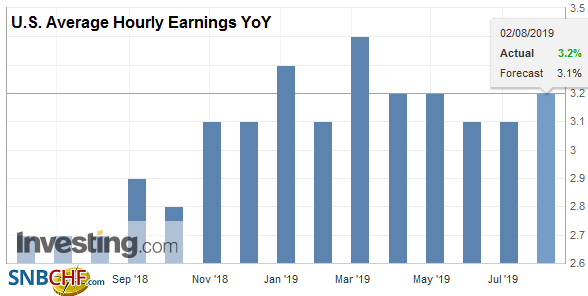

| Hour earnings are expected to rise by 0.2%, which will keep the year-over-year pace at 3.1%. Despite the healthy labor market, average hourly earnings growth has slowed to 0.2% average a month in H1 19 compared with an average increase of 0.3% in H1 18 and all of last year. |

U.S. Average Hourly Earnings YoY, July 2019(see more posts on U.S. Average Hourly Earnings, ) Source: investing.com - Click to enlarge |

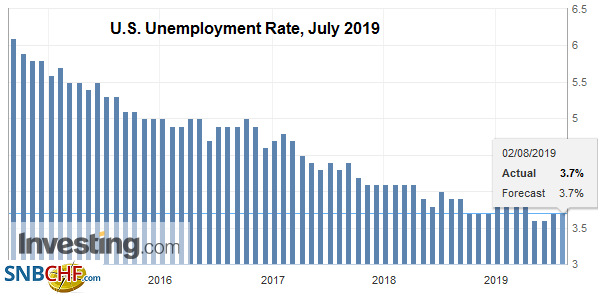

| The unemployment rate is expected to tick back down to the cyclical low seen in April of 3.6%.

The US also reports June trade figures and factory goods orders. They may draw economists attention for implications of revisions to Q2 GDP, but they will be overshadowed by the July employment data. |

U.S. Unemployment Rate, July 2019(see more posts on U.S. Unemployment Rate=, ) Source: investing.com - Click to enlarge |

The US dollar is edging higher against the Canadian dollar for the third consecutive session. It is flirting with the upper end of the band of resistance we noted that extended to the CAD1.3220 area. The next important chart point is near CAD1.33. The stabilization of oil prices after yesterday’s slide and the narrowing of the US two-year rate premium may lend some support to the Canadian dollar, the weakening risk appetite reflected in the heavy tone of the S&P 500 may be crucial offset. We have been anticipating the gap created by the higher opening on July 1 in the S&P 500 to be filled (extends to 2944). We suspect there is potential to the gap from the middle of June (2897-2905) in the days ahead. The dollar is strengthening against the Mexican peso, and the July high near MXN19.35 is coming into view. Above there, the next important level is around 1% high by MXN19.55.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,$TRY,Brexit,Eurozone Producer Price Index,Eurozone Retail Sales,Featured,newsletter,Trade,U.S. Nonfarm Payrolls