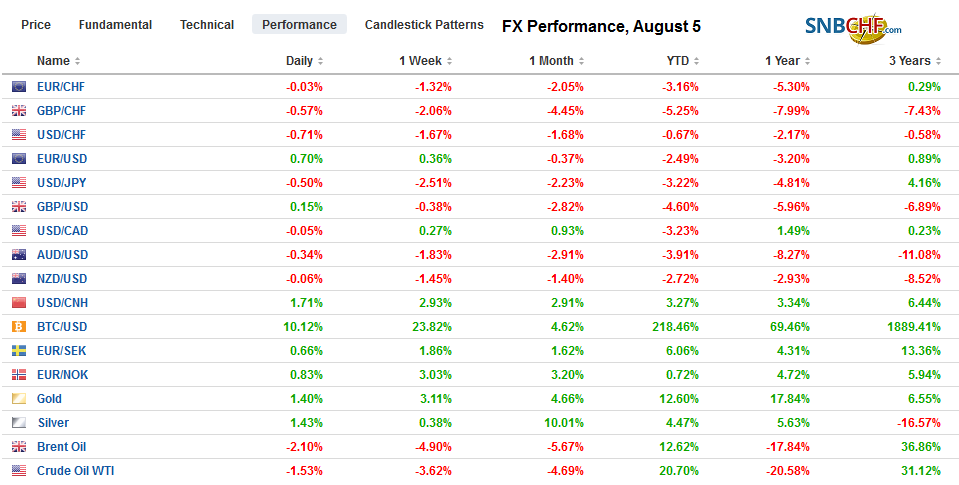

Swiss Franc The Euro has fallen by 0.13% to 1.0893 EUR/CHF and USD/CHF, August 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Chinese officials took the US tariff hike quietly last week but struck back today. The PBOC fixed the dollar higher (CNY6.90), which it has not done, and will halt imports of US agriculture. The dollar shot through CNY7.0 to finish the mainland session a little above CNY7.03 and CNH7.07 for the offshore yuan. This has sent ripple effects through the global equities, which were already on the defensive at the end of last week. Most markets in the Asia Pacific region were off 1%-2%, which the Hang Seng down among the most (~-2.8%).

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, CHF, Currency Movements, Featured, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.13% to 1.0893 |

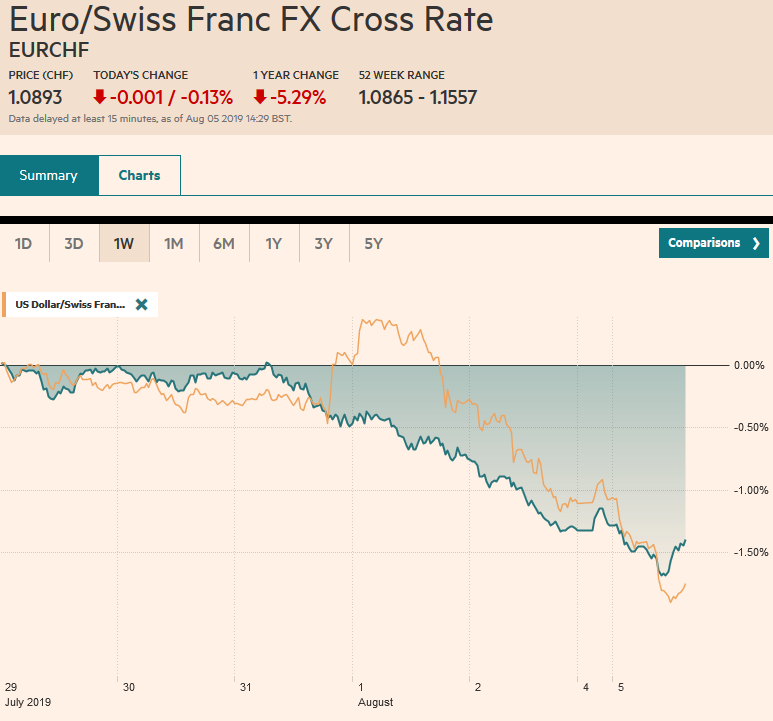

EUR/CHF and USD/CHF, August 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Chinese officials took the US tariff hike quietly last week but struck back today. The PBOC fixed the dollar higher (CNY6.90), which it has not done, and will halt imports of US agriculture. The dollar shot through CNY7.0 to finish the mainland session a little above CNY7.03 and CNH7.07 for the offshore yuan. This has sent ripple effects through the global equities, which were already on the defensive at the end of last week. Most markets in the Asia Pacific region were off 1%-2%, which the Hang Seng down among the most (~-2.8%). Korea’s NASDAQ equivalent plummeted almost 8%, helping to send the Korean won down 1.4%, the most among the emerging market currencies. European shares are following suit and the Dow Jones Stoxx 600 gapped lower and is off around 1.5% in mid-morning dealings after shedding nearly 2.5% before the weekend. The prospects of a full-blown currency and trade war also are seeing yields tumble. European bond yields are two-three basis points lower, while the 10-year US Treasury yield is off nearly eight basis points to 1.77%. The yen and Swiss franc are the strongest of the major currencies, while the dollar-bloc, Scandis, and sterling are on their back foot. Gold is a big beneficiary of the turmoil and is trading a little above $1455, new six-year highs. Oil has given back about half of its pre-weekend gains, leaving September WTI straddling the $55-level. |

FX Performance, August 5 |

Asia Pacific

Over the weekend, the Nikkei reported that the US and Japan will seek to strike a trade agreement by the end of next month. As we have noted, Japan’s free trade agreements (TPP and with the EU) have put US producers at a disadvantage. The US is pressing to be given the best terms that Japan has struck with others in agriculture. Japan reportedly is pushing for the US to remove tariffs on industrial goods, including car parts. There will be two opportunities for Trump and Abe to meet directly. August 24 is the G7 summit in France and September 17 the opening of the UN General Assembly.

The demonstrations in Hong Kong are escalating and is drawing in more of the public than the Umbrella Movement, and the protesters have developed new tactics. Top party officials are meeting in their annual conclave, and their restraint is like limited. In response, the risk is that people and capital leave Hong Kong. The Hang Seng fell 5.2% last week and finished more than three standard deviations below the 20-day moving average (Bollinger Band is set at two standard deviations). Today, it saw among the sharpest losses in the region with a 2.8% drop. The economy is being squeezed. The July manufacturing PMI fell to 43.8 from 47.9. Output fell to 40.5, the lowest since March 2009.

Japan’s composite PMI for July was confirmed at 51.2, up from 50.8. China’s Caixin composite PMI edged to 50.9 from 50.6. The price action in the foreign exchange market paid little notice. The dollar, which had briefly traded above JPY109 in the middle of last week, is being pushed through JPY106 today. The flash crash low at the start of the year saw the dollar trade to almost JPY104.80. Below there, and the JPY100 looms. The strength of the yen and the weakness of the yuan conspired to send the Australian dollar sharply lower. Recall that before the weekend, the Aussie posted the most minor of gains to snap a 10-day slide. The slide resumed today as it was sold a little through $0.6750. Its flash crash low was closer to $0.6740, which it has not traded below since 2009. Chinese officials offered a small olive branch. It noted that the CNY7.0 level “was not like an age that when passed, cannot return.”

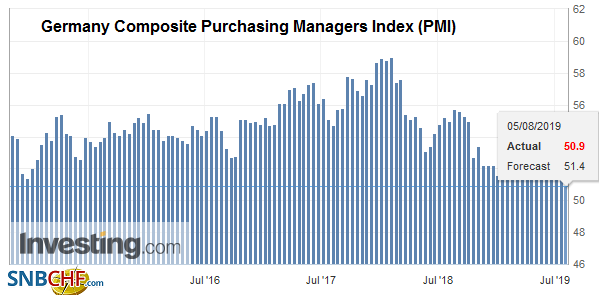

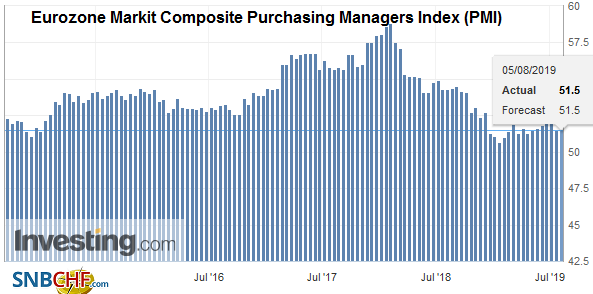

EuropeThe escalation of the US-Chinese trade conflict will not do Europe any favors. It comes as the eurozone is struggling. Germany’s July composite PMI fell to 50.9 from the flash reading of 51.4 and 52.6 in June. France ticked up to 51.9 from 51.7 flash report but is still off from June’s 52.7 results. Spain disappointed with its composite falling to 51.7 from 52.1. Italy offered a rare and pleasant upside surprise. Its composite rose to 51.0 from 50.1. The UK composite PMI popped back above the 50 boom/bust level reaching 50.7. It had fallen to 49.7 in June. |

Germany Composite Purchasing Managers Index (PMI), July 2019(see more posts on Germany Composite PMI, ) Source: investing.com - Click to enlarge |

| The euro traded at new year lows against the Swiss franc to almost CHF1.09 at the end of last week. It has fallen steadily for three months, having peaked in April near CHF1.1480. What is happening in the eurozone helps explain the franc’s resilience against the dollar. It is flat, essentially flat this year. The dollar was turned back from its 200-day moving average last week (~CHF0.9980). A broader correction in the US dollar, spurred by the US rates cuts the market thinks will be necessary given the end of the tariff truce, could aggravate the challenges Swiss officials face. The SNB does not meet until September 23. |

Eurozone Markit Composite Purchasing Managers Index (PMI), July 2019(see more posts on Eurozone Markit Composite PMI, ) Source: markets.ft.com - Click to enlarge |

The market expects the ECB and FOMC (September 12 and 18 respectively) to ease policy. The policy rate is minus 75 bp. However, the entire two-year through 10-year curve is below it (two-year finished last week at minus 114 bp, and the 10-year was minus 88 bp). It is expected to match the ECB’s rate cut. Swiss inflation is less than 0.5% year-over-year in both the headline and core rates. After expanding by 0.6% in Q1 19, the Swiss economy is expected to have slowed to around 0.2% in Q2 and stabilize near 0.3% in H2. It appears, judging from the sight deposits, that the SNB may have intervened to slow the franc’s appreciation around the time of the ECB meeting last month. Heavy intervention risks the US ire, where the Treasury Department recently took it off the watch-list. Initial support near CHF0.9800 area has yielded, and the near-term risk extends to the January and June low near CHF0.9700. The skew between three-month dollar calls and puts (25-delta risk-reversals) has favored puts for around 3.5 years. It is approaching minus 1%, which it rarely has traded through. Implied volatility (6.6%) is at the upper end of where it has traded over the past six months. These indications are consistent with the purchases of USD dollar puts.

The euro has bounced smartly off last week lows near $1.1025. It approached $1.1140 in the European morning. The next hurdle looks to be in the $1.1160-$1.1180 range. Establishing a foothold above $1.12 would give some hope of a durable bottom. The Sino-American conflict may take some pressure off Europe, which had appeared headed for a clash with the US over a range of issues. Before the weekend, the US made much fanfare over an opening of the European beef market to American producers, which had already been in the cards. Brexit, and in particular the prospects of a no-deal exit overwhelm other considerations, but a world that is less open to trade does not seem particularly conducive for the UK to strike out on its own. Sterling was turned back after briefly taking out the pre-weekend high (~$1.2170). Last week’s low was $1.2080, but it does not appear set to hold very long. Sterling has traded below $1.20 only on two occasions since the mid-1980. One was the flash crash low from October 2016 that Bloomberg has near $1.1840. The other was January 2017, and the penetration was minor and brief.

America

President Trump has been haranguing for lower interest rates, and he is set to get them. The trade conflict can be walked back, but this does not seem like the most likely scenario at the moment. China appears to have all but given up on the ability to strike a deal with the US, even though economists mostly argue that the trade surplus country will be hurt more than the trade deficit country in such a dispute. The Sword of Damocles that hangs over the investment climate is how the US responds.

Overshadowed by the FOMC and the end of the tariff truce, two Senators (Baldwin D-WI and Hawley R-MO) submitted a bill that would give the Fed another mandate–a balanced current account in medium-term (five years). The proposal would entail the levying a market access charge on foreign purchases of US assets, including stocks, bonds, and real estate. If this became law, it would be a significant blow to globalization and signal a disengagement by the US. While it is unlikely to pass, there are two takeaways. First, the economic nationalism extends beyond the White House and is bipartisan. Second, there are other proposals, including Elizabeth Warren’s, that would more directly manage the dollar.

The US dollar briefly traded below CAD1.3200 and tested CAD1.3240 in both Asia and Europe, we suspect that it can steady in the North American session. The Canadian economy is among the strongest of the high-income countries. It is one of the few not considering easier monetary policy. It has already absorbed a shock from antagonizing China. The Canadian dollar may offer an alternative to those international investors seeking to diversify away from the US dollar. That said, risk extends toward CAD1.3300, near where a retracement objective and the 200-day moving average can be found. The weakness in the Mexican peso seems more a function of unwinding carry trades (against the yen, Swiss franc, and euro) and the broader risk-off move than domestically driven. The dollar has shot up to almost MXN19.60, the highest level since the US tariff threat two months ago. Above there are those highs which extend to MXN19.88.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CHF,$CNY,Currency Movements,Featured,newsletter